Secured Party Creditor For Dummies

Description

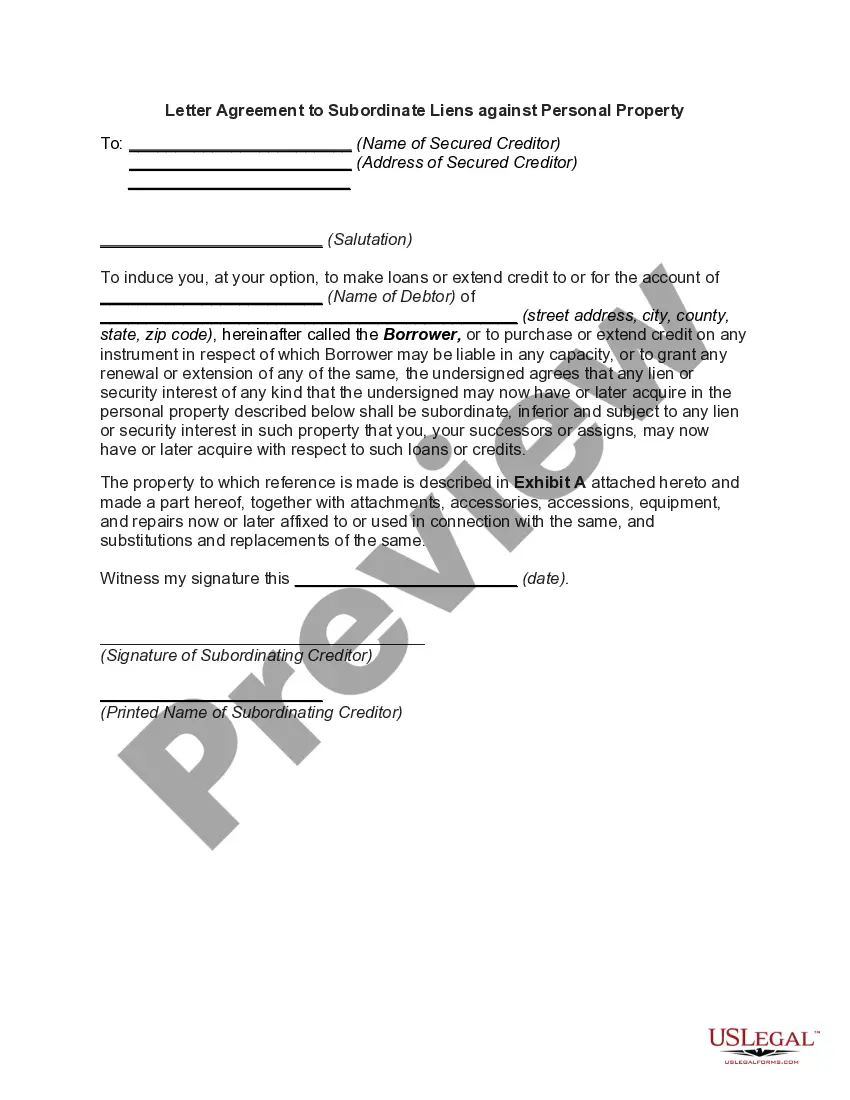

How to fill out Subordination Agreement To Include Future Indebtedness To Secured Party?

Finding a reliable source for the latest and most suitable legal documents is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it's essential to obtain samples of Secured Party Creditor For Dummies exclusively from trusted providers, such as US Legal Forms. A faulty template will squander your time and delay your situation.

Once you have the form on your device, you can edit it using the editor or print it and fill it out by hand. Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library to find legal templates, check their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search box to locate your template.

- Examine the form's details to confirm that it meets the requirements of your state and locality.

- Review the form preview, if available, to verify that the form is indeed the one you need.

- Return to the search and find the suitable template if the Secured Party Creditor For Dummies does not meet your specifications.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing option that fits your needs.

- Continue to the registration to complete your purchase.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the file type for downloading Secured Party Creditor For Dummies.

Form popularity

FAQ

The UCC, or Uniform Commercial Code, is a comprehensive statute that addresses the transactions of goods and services. For dummies, it acts as a guide, making it easier to understand the legal landscape of business dealings. This code outlines the steps for becoming a secured party creditor, helping you protect your interests in your business. By utilizing resources like uslegalforms, anyone can deepen their knowledge as a secured party creditor for dummies.

The UCC stands for the Uniform Commercial Code, a set of laws that govern commercial transactions in the United States. For dummies, it essentially simplifies procedures related to sales, leases, and secured transactions. By understanding these principles, you can grasp how businesses interact and the rights involved. Those wanting to explore being a secured party creditor for dummies will find the UCC foundational to their knowledge base.

To become a secured party creditor, start by understanding the legal requirements and associated documents. First, you'll need to file a UCC-1 financing statement to perfect your security interest. Next, identify the collateral involved and maintain accurate records to demonstrate your claim. By following these steps, anyone can navigate the journey to becoming a secured party creditor for dummies effectively.

The UCC, or Uniform Commercial Code, serves several purposes for legal and business transactions. Firstly, it standardizes laws governing commercial transactions across different states, providing clarity and consistency. Secondly, it establishes rules for secured transactions, helping creditors and debtors understand their rights and obligations. For anyone seeking to learn about becoming a secured party creditor for dummies, understanding the UCC is essential.

Secured creditors include banks, lenders, and businesses that provide loans against collateral. These parties have a legal right to the pledged assets if the borrower defaults on their obligations. Knowing who secured creditors are is essential for anyone wanting to grasp the basics of finance and the role of secured party creditors for dummies.

Filing as a secured party creditor requires completing specific forms and following state regulations. The process generally involves submitting a financing statement to the appropriate state office where the collateral is located. This might sound complicated, but with tools like US Legal Forms, you can access easy-to-use templates that guide you step by step. Understand this filing process better with resources tailored for those new to secured party creditor duties.

A secured creditor often needs to file a proof of claim in bankruptcy cases to protect their interests. By doing this, they formally assert their rights to repayment from the debtor's assets. Understanding this process is key for anyone looking to navigate secured party creditor matters effectively. If you're seeking easy guidance, consider the resources available at US Legal Forms.

The UCC, or Uniform Commercial Code, is a set of laws that standardize business transactions across the United States. It governs sales, leases, and secured transactions to ensure consistency in commerce. By simplifying these processes, the UCC provides a clear framework for creditors and debtors alike, making it easier for secured party creditors for dummies to understand.

To properly perfect a secured creditor status, you need a valid security agreement, a UCC filing to establish notice, and possession of the collateral when applicable. These elements ensure that the creditor's interest is legally recognized and prioritized in case of debtor default. Understanding these components is essential for anyone learning about being a secured party creditor for dummies.

The purpose of a UCC filing is to provide transparency and legal notice regarding secured interests in a debtor's assets. It helps assure creditors that they have priority over claims to those assets. This filing plays a crucial role in securing loans, making it vital for anyone wanting to understand the role of a secured party creditor for dummies.