Sample Request Letter With Thru

Description

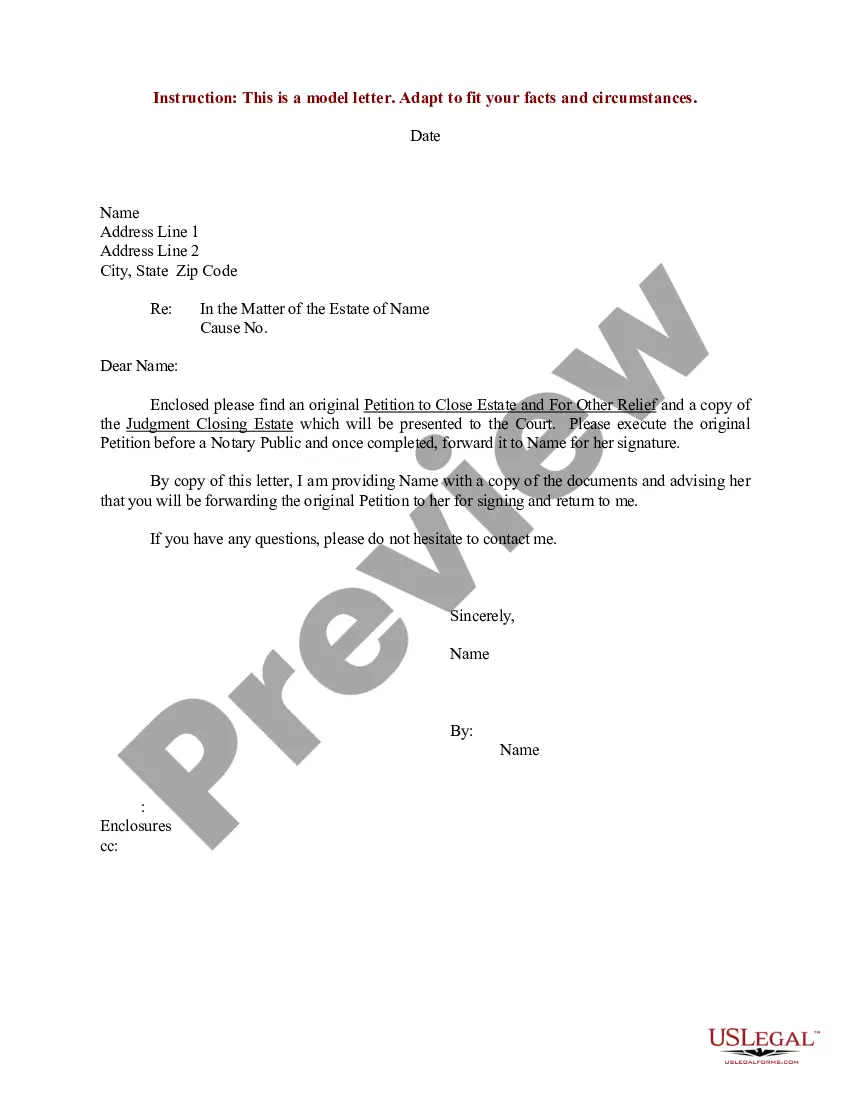

How to fill out Sample Letter For Execution Of Petition To Close Estate And For Other Relief?

Acquiring legal document samples that comply with federal and state laws is essential, and the internet presents numerous alternatives to select from.

However, what's the advantage of spending time looking for the suitable Sample Request Letter With Thru template online when the US Legal Forms digital library has already compiled such documents in one location.

US Legal Forms stands as the largest online legal directory with more than 85,000 fillable templates created by attorneys for various professional and personal situations.

All templates found through US Legal Forms are reusable. To re-download and complete previously bought forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- These are easy to navigate with all forms organized by state and intended use.

- Our professionals stay updated with legislative changes, ensuring your document is current and compliant when acquiring a Sample Request Letter With Thru from our site.

- Getting a Sample Request Letter With Thru is quick and straightforward for both returning and new users.

- If you currently hold an account with an active subscription, Log In and download the document sample you need in the preferred format.

- If you're a newcomer to our platform, follow the steps outlined below.

Form popularity

FAQ

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.

An Example of a UCC Lien Filing If you secure equipment financing, the lender will file a UCC lien to state that if the debt for the espresso machine is not repaid, the lender has the right to repossess the espresso machine or seize other assets from your business.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

Remember: as long as an asset has a UCC lien filed against it, you're not allowed to transfer, sell, or use it as collateral for any other loan.

A UCC lien filing remains on your business credit report for 5 years. This has no negative effect on your credit score, however, when someone checks your credit report it is visible and that can play a factor in your ability to be approved for things other than just business funding.

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.