Workplace Drug Test Policy Without Notice

Description

How to fill out Alcohol And Drug Free Workplace Policy?

Regardless of whether for corporate needs or individual matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal documentation necessitates meticulous care, beginning with choosing the proper form model.

After downloading, you can fill in the form using editing software or print it out and complete it manually.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it aligns with your situation, jurisdiction, and area.

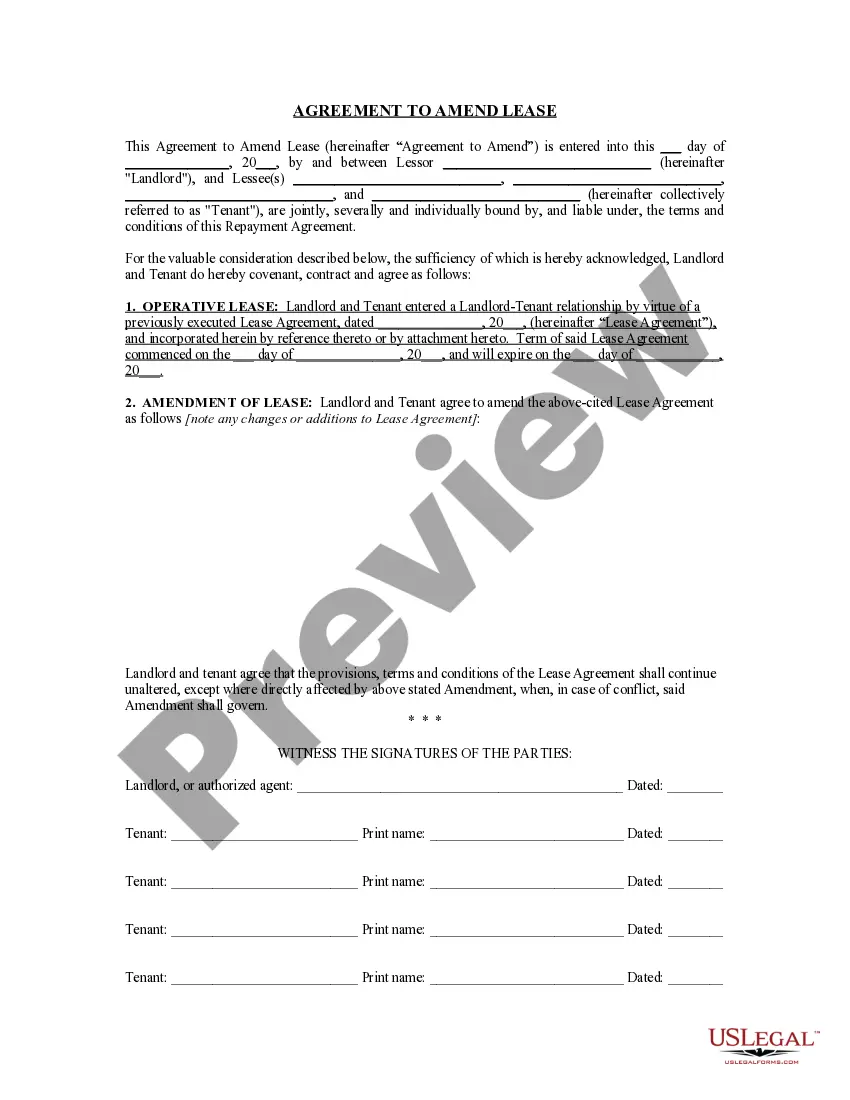

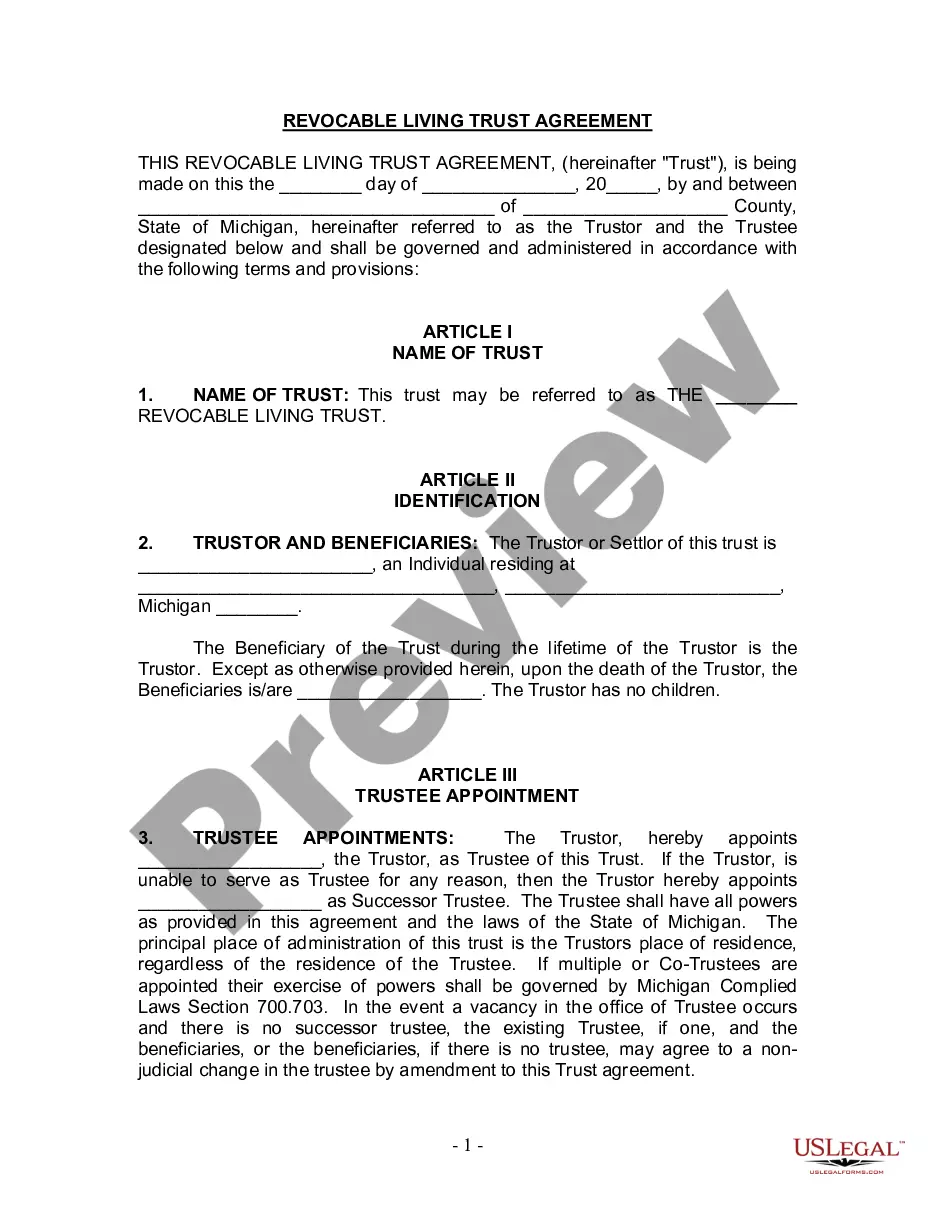

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search tool to find the Workplace Drug Test Policy Without Notice sample you need.

- Obtain the template if it meets your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you haven't established an account yet, you can download the form by clicking Buy now.

- Select the appropriate payment option.

- Fill out the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Workplace Drug Test Policy Without Notice.

Form popularity

FAQ

Wisconsin's Small Estate Affidavit statute allows estates under $50,000 to avoid probate and instead be transferred via affidavit. See Wis Stat. §867.03. It can be used by an heir, a trustee of a revocable trust, a person named in the decedent's will, or a guardian after the passing of the decedent.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin.

Form PR-1831 - Transfer By Affidavit ($50,000 And Under) is a probate form in Wisconsin. To transfer decedent's assets not exceeding $50,000 (gross) to an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of the decedent's death for distribution.

Currently, if the value of the Wisconsin Decedent's estate is less than $50,000.00 then it may be considered a small estate. If it is greater than fifty thousand dollars then such a value will disqualify the estate from this status.

All claims under $50,000 require a Transfer by Affidavit unless they are being claimed by an active trust or an open estate. The Transfer by Affidavit can be found on the State Bar of Wisconsin website.

Pursuant to Wisconsin State Statute Section 867.03, Transfer by Affidavit is used for solely owned property within this state valued under $50,000. Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate.

In Wisconsin, Small Estate Affidavits are commonly referred to as Transfer Affidavits. If you are dealing with someone's estate after they have passed, and there is $50,000 or less in probate assets, a transfer affidavit may be a good way to avoid probate, save time, and make the whole process easier for you.

Collecting Property With a Small Estate Affidavit To qualify, the gross value of all of the deceased person's property that's subject to probate can't exceed $50,000. (Wis. Stat. Ann.