Assets Distributed Estate With A Will

Description

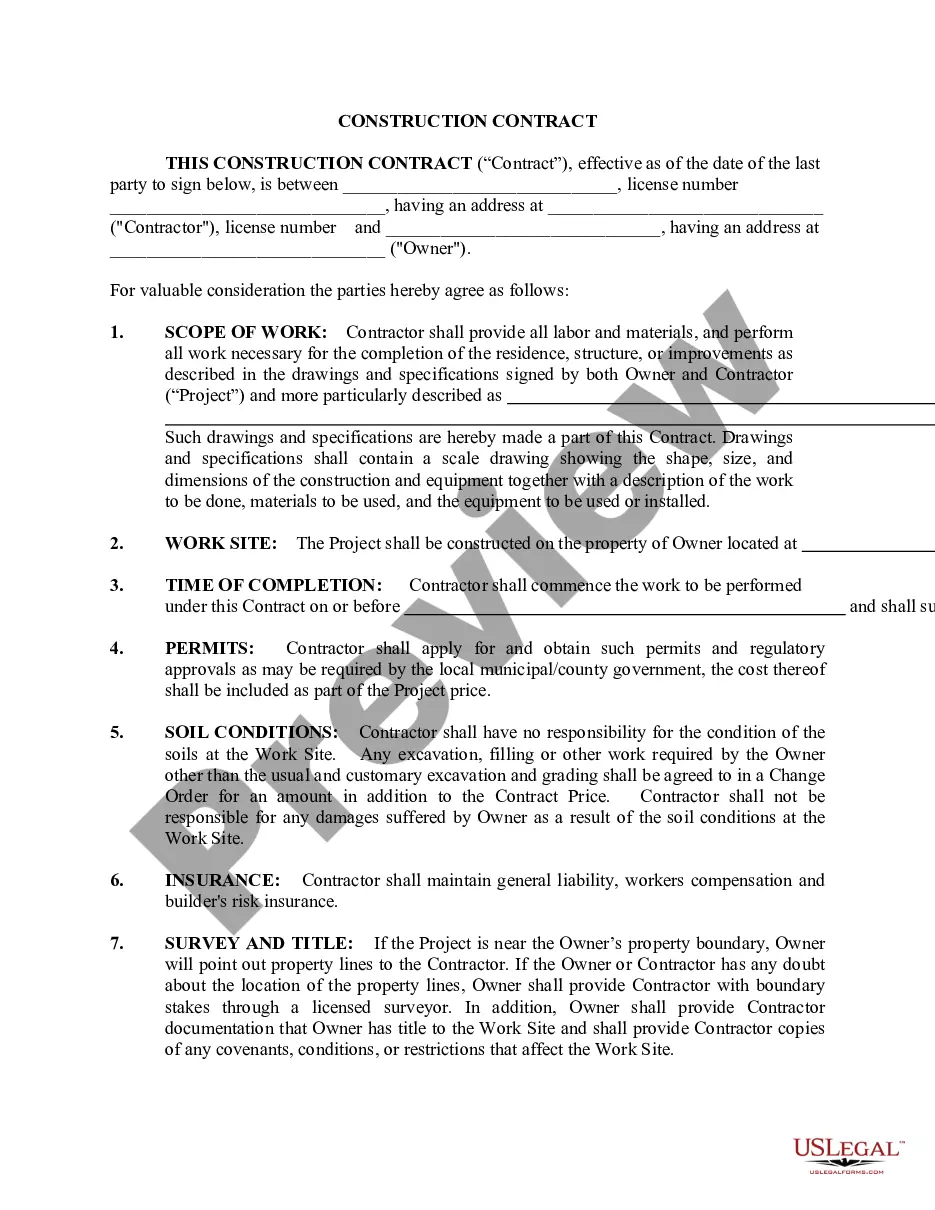

How to fill out Sample Letter For Distribution Of Estate Assets?

Legal administration can be exasperating, even for the most skilled professionals.

If you are seeking an Assets Distributed Estate With A Will and lack the time to spend on finding the correct and current version, the processes can be stressful. A comprehensive online form repository could be a pivotal improvement for those wishing to handle these matters effectively.

Access a valuable resource library of articles, guides, handbooks, and materials pertinent to your circumstances and needs.

Conserve time and energy searching for the documents you require, and take advantage of US Legal Forms' sophisticated search and Preview feature to find Assets Distributed Estate With A Will and obtain it.

Appreciate the US Legal Forms online catalog, supported by 25 years of experience and reliability. Revamp your daily document management into a seamless and user-friendly process today.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents section to view the documents you have previously saved and manage your folders as desired.

- If this is your first time using US Legal Forms, register for an account to gain unlimited access to all the platform's advantages.

- Here are the steps to follow after obtaining the necessary form.

- Verify it is the correct form by previewing it and examining its details.

- Make sure the specimen is sanctioned in your state or county.

- Select Buy Now when you are prepared.

- Choose a subscription option.

- Select the desired file format, then Download, fill out, sign, print, and distribute your documents.

- Obtain state- or county-specific legal and business documents.

- US Legal Forms includes all the necessities you may require, from personal to corporate documentation, all in one location.

- Utilize advanced tools to complete and manage your Assets Distributed Estate With A Will.

Form popularity

FAQ

Assets such as payable-on-death accounts and living trusts do not undergo probate. These assets provide immediate access to beneficiaries and facilitate a quicker distribution process. Understanding which assets fit this model is essential, especially when aiming to minimize the complexities surrounding the transfer of assets in an estate with a will. Consider using comprehensive estate planning tools available at US Legal Forms to streamline your approach.

Assets such as real estate solely owned by a deceased individual typically pass through probate. This ensures that the asset is legally transferred to the beneficiaries according to the terms of the will. Knowing which assets fall into this category helps in planning an estate that balances timely distribution with legal compliance. Leveraging resources like US Legal Forms can simplify managing such details effectively.

An example of non-probate property is a joint bank account with rights of survivorship. When one account holder passes away, the remaining holder automatically inherits the account, bypassing the probate process altogether. This feature is crucial for efficient asset distribution in an estate with a will. Familiarizing yourself with non-probate properties can significantly benefit your estate planning strategy.

One effective method to avoid probate is to establish a living trust. By transferring assets into a trust, you can designate a trustee to manage them after your death, allowing assets to be distributed directly to beneficiaries without probate delays. Additionally, an estate plan that includes a will ensures that your assets are distributed according to your wishes. Using platforms like US Legal Forms can help you set up these legal arrangements smoothly.

Certain assets do not go through probate, which can simplify the process of asset distribution after death. Examples include life insurance policies with a designated beneficiary, retirement accounts like IRAs, and trusts. When assets are distributed through a will, they may not need to enter probate if they fall into these categories. Consider planning your estate effectively to utilize non-probate options, ensuring your loved ones receive their inheritance promptly.

Allocating assets in a will involves specifying who receives which asset in clear terms. It is essential to be explicit to avoid potential conflicts between beneficiaries. You may categorize assets by family heirlooms, personal belongings, or financial accounts, ensuring that each allocation aligns with your wishes. To make the allocation process smooth, consider using reliable services like US Legal Forms to draft your will accurately, ensuring your assets are distributed from the estate with a will seamlessly.

You can transfer assets out of your estate through processes like gifting or establishing trusts prior to death. However, if you want to ensure assets are distributed from the estate with a will, this can also be accomplished by clearly outlining these transfers in your will while following legal guidelines. It is advisable to consult a legal expert to ensure these actions are compliant with state laws.

To divide assets in a will, first, identify all the assets and their respective values. Next, you need to clearly indicate in the will how each asset will be allocated to the beneficiaries. This clarity prevents confusion or disputes between beneficiaries later. Utilizing tools like US Legal Forms can help you create a well-structured will, ensuring that your assets are distributed from the estate with a will as you desire.

An executor can distribute assets to beneficiaries after the will has been validated and all debts and taxes of the estate have been settled. It is important to ensure that the executor has followed the necessary legal procedures to protect the estate’s integrity. By ensuring these steps are completed, the executor can distribute assets efficiently and fairly, making sure assets are distributed from the estate with a will as intended.

The golden rule when making a will is to ensure clarity and precision in your instructions. Clearly outline how you want your assets distributed, and avoid vague language that could lead to disputes. Utilizing resources like US Legal Forms can provide the guidance needed for a well-structured estate plan.