Record Receipt Form For Estate Distribution

Description

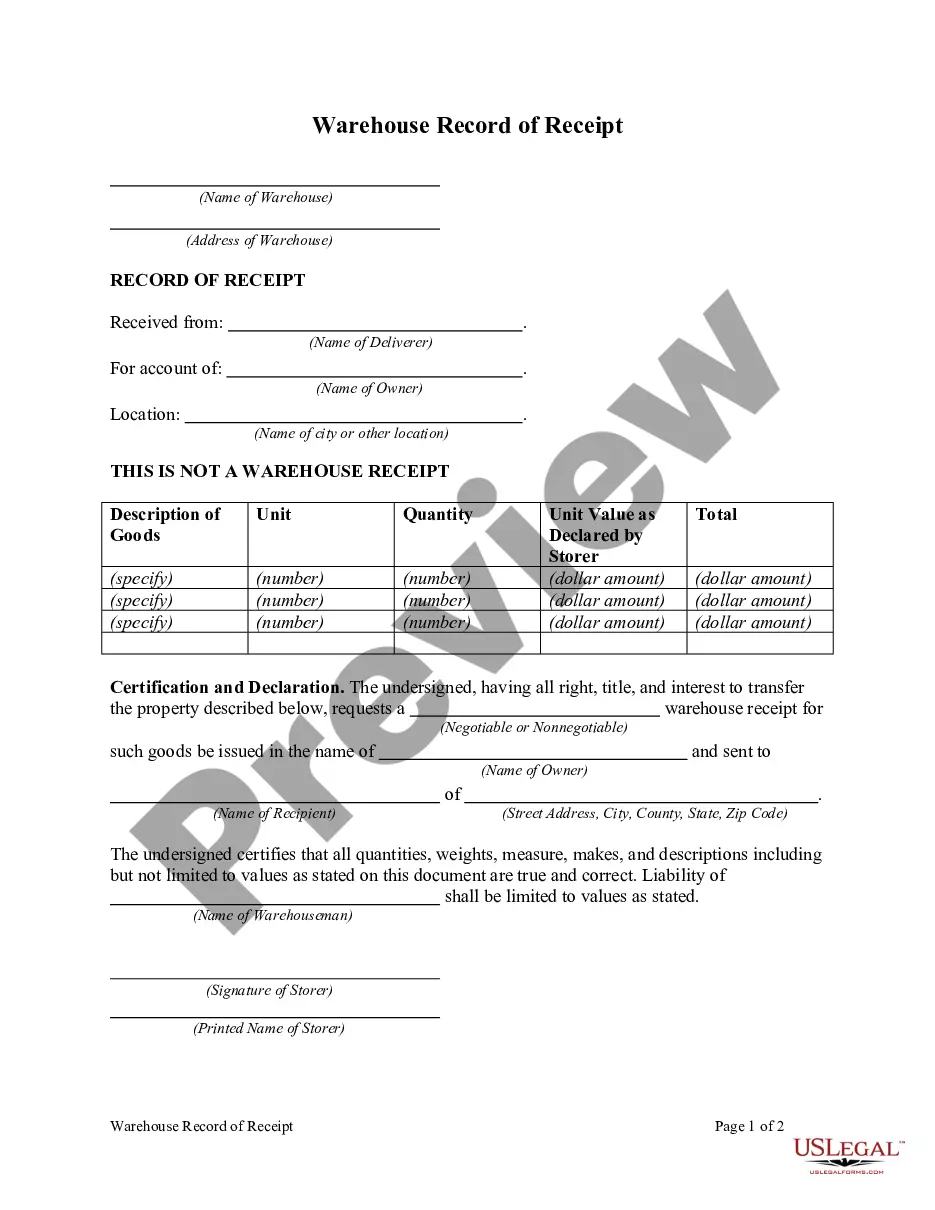

How to fill out Warehouse Record Of Receipt?

When you are required to finalize the Record Receipt Form for Estate Distribution in line with the regulations of your local state, there may be various options to select from.

There's no requirement to scrutinize every form to ensure it meets all the legal criteria if you are a subscriber to US Legal Forms.

It is a reliable source that can assist you in obtaining a reusable and current template on any topic.

Utilize the Preview mode and review the form description if accessible.

- US Legal Forms is the most extensive online repository with an archive of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are verified to adhere to the laws and regulations of each state.

- Thus, when you download the Record Receipt Form for Estate Distribution from our website, you can be assured that you possess a valid and current document.

- Obtaining the necessary template from our platform is exceptionally simple.

- If you already have an account, simply Log In to the system, confirm your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the Record Receipt Form for Estate Distribution whenever you need.

- If this is your first encounter with our website, kindly follow the directions below.

- Visit the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

The 3-year rule generally refers to the timeframe in which any inheritance or asset distribution must be reported for tax purposes, usually starting from the date of the individual’s death. This period helps ensure all tax obligations are met promptly, preventing complications. By keeping proper documentation, such as a record receipt form for estate distribution, you can stay organized and comply with necessary regulations.

An estate can help organize and manage vital matters during and after life, potentially avoiding the lengthy probate process associated with a will. An estate allows for faster distribution of assets, which can be crucial during challenging times. Additionally, employing a record receipt form for estate distribution offers clarity and helps manage the asset transfer effectively.

Filling out an estate document involves gathering necessary information such as names, dates, and asset descriptions. Take your time to ensure accuracy, and seek help if you encounter challenges. Using a record receipt form for estate distribution can guide you through this process, ensuring you capture all details correctly and simplify future distributions.

Estate distribution refers to the process of transferring assets from the deceased to their heirs. For example, if a homeowner passes away and leaves their house to their children, this transfer typically occurs through the estate distribution process. To simplify this process, using a record receipt form for estate distribution can help keep a definitive record of the transactions.

Income for an estate includes any revenue generated after a person's death. This can include rental income from real estate, interest earned on bank accounts, and income from stocks or investments. Accurately tracking this income is essential, and utilizing a record receipt form for estate distribution can help ensure everything is documented properly.

Certain assets do not go through probate, such as life insurance policies, retirement accounts, and properties held in joint tenancy. These assets typically transfer directly to the named beneficiaries, making the process more efficient. By using a record receipt form for estate distribution, you can record these transactions clearly and reduce confusion among heirs.

A receipt of inheritance is a crucial document that confirms the distribution of assets to heirs after someone's passing. This document serves as a formal acknowledgment of the received inheritance and often requires a Record receipt form for estate distribution to ensure transparency and legality. By utilizing this form, you can clearly outline what you have inherited, thus preventing future disputes. It is essential for both beneficiaries and estate administrators to properly document the distribution process.

A disbursement receipt is a record that verifies the payment or distribution of funds to beneficiaries from an estate. This documentation is essential to maintain transparency and prevent disputes among beneficiaries. To ensure proper recordkeeping, consider using a Record receipt form for estate distribution from uslegalforms to create organized, professional disbursement receipts.

Distributing items from an estate involves following the guidelines set forth in the will or state law if no will exists. Executors should list the assets, obtain appraisals, and communicate clearly with beneficiaries. Utilizing a Record receipt form for estate distribution can help document each item's distribution accurately and maintain clarity throughout the process.

A distribution receipt is a document that confirms the receipt of an asset or payment by a beneficiary from an estate. This receipt serves as evidence of the distribution and protects both the executor and the beneficiary. To streamline this documentation, you can use a Record receipt form for estate distribution available on uslegalforms.