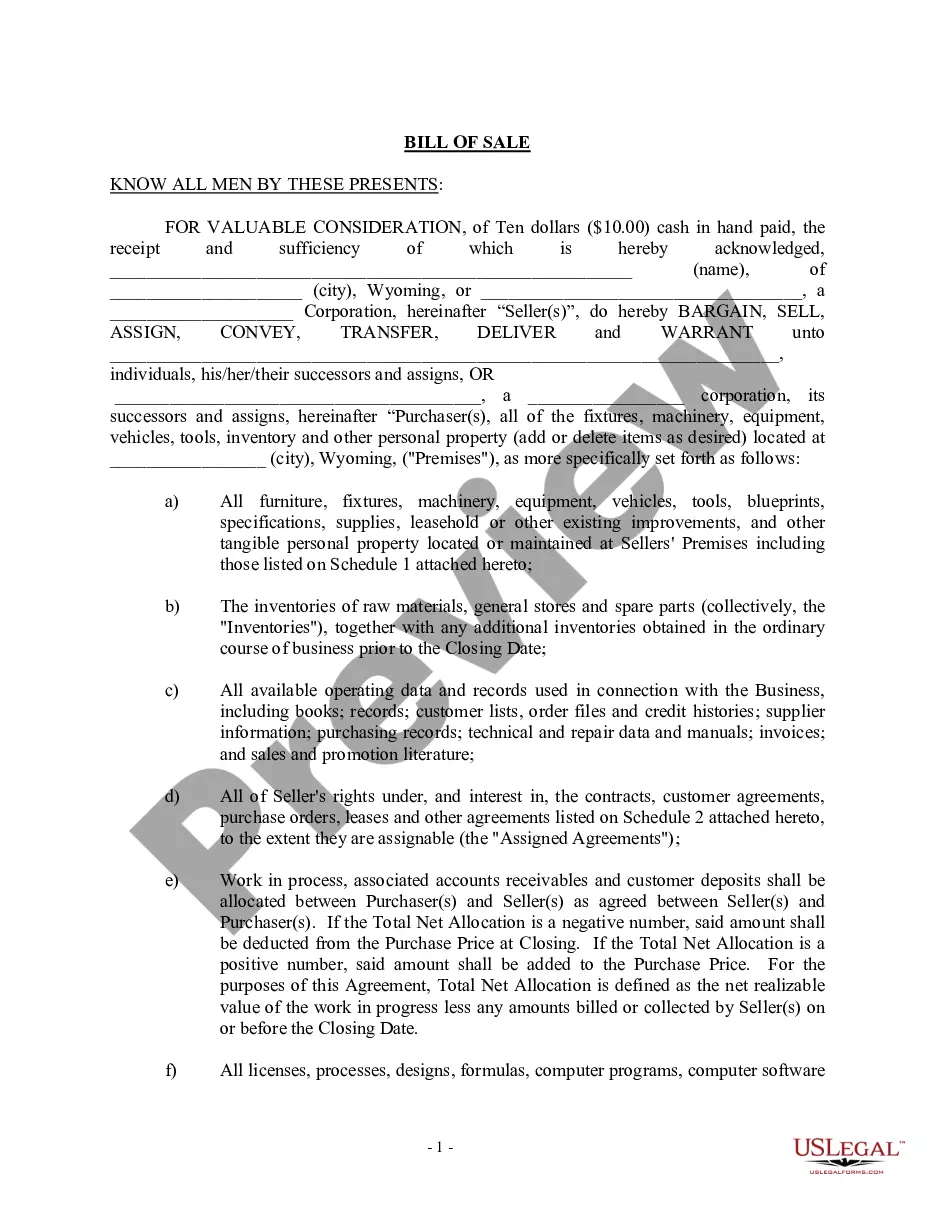

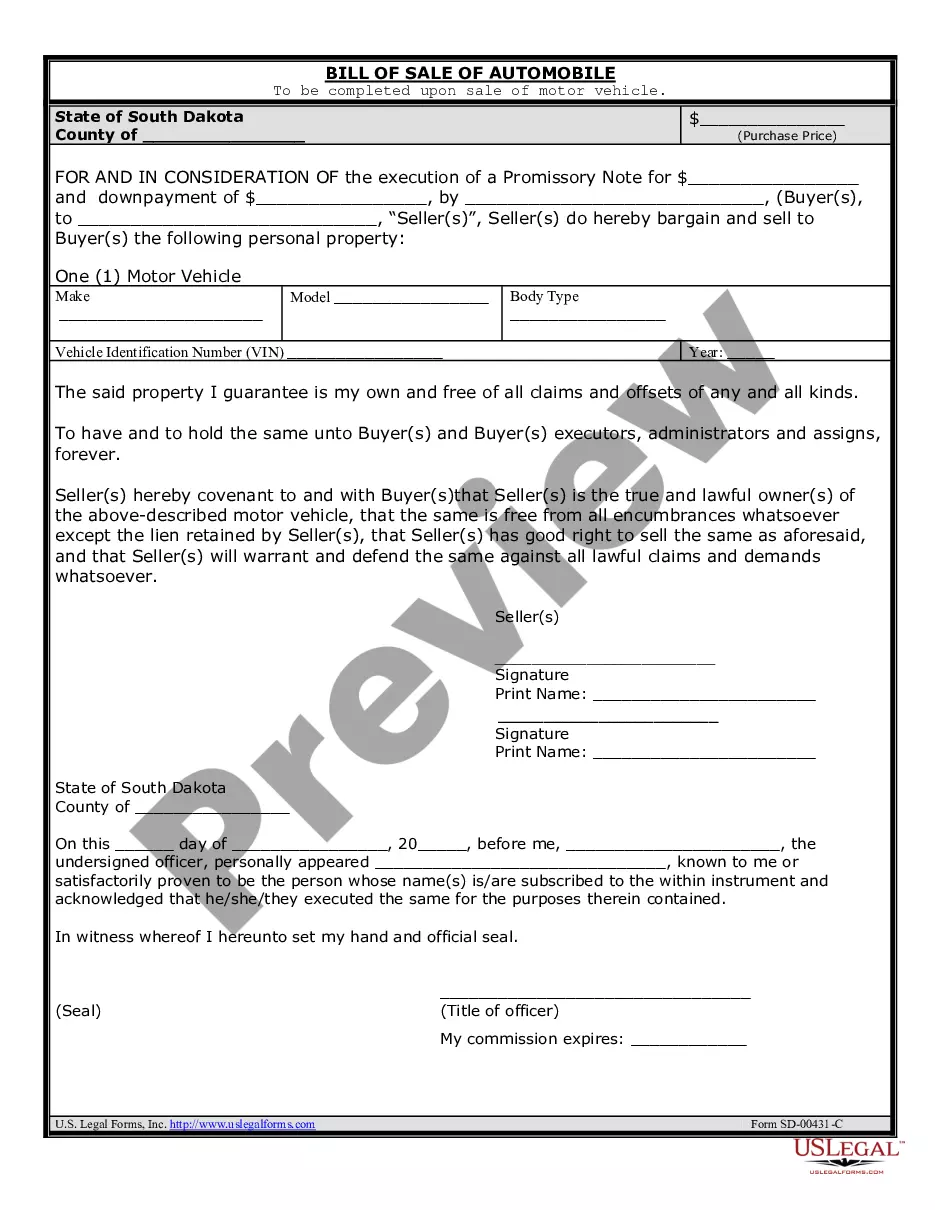

Promissory Note Demand Letter Withdrawal

Description

How to fill out Demand Letter - Repayment Of Promissory Note?

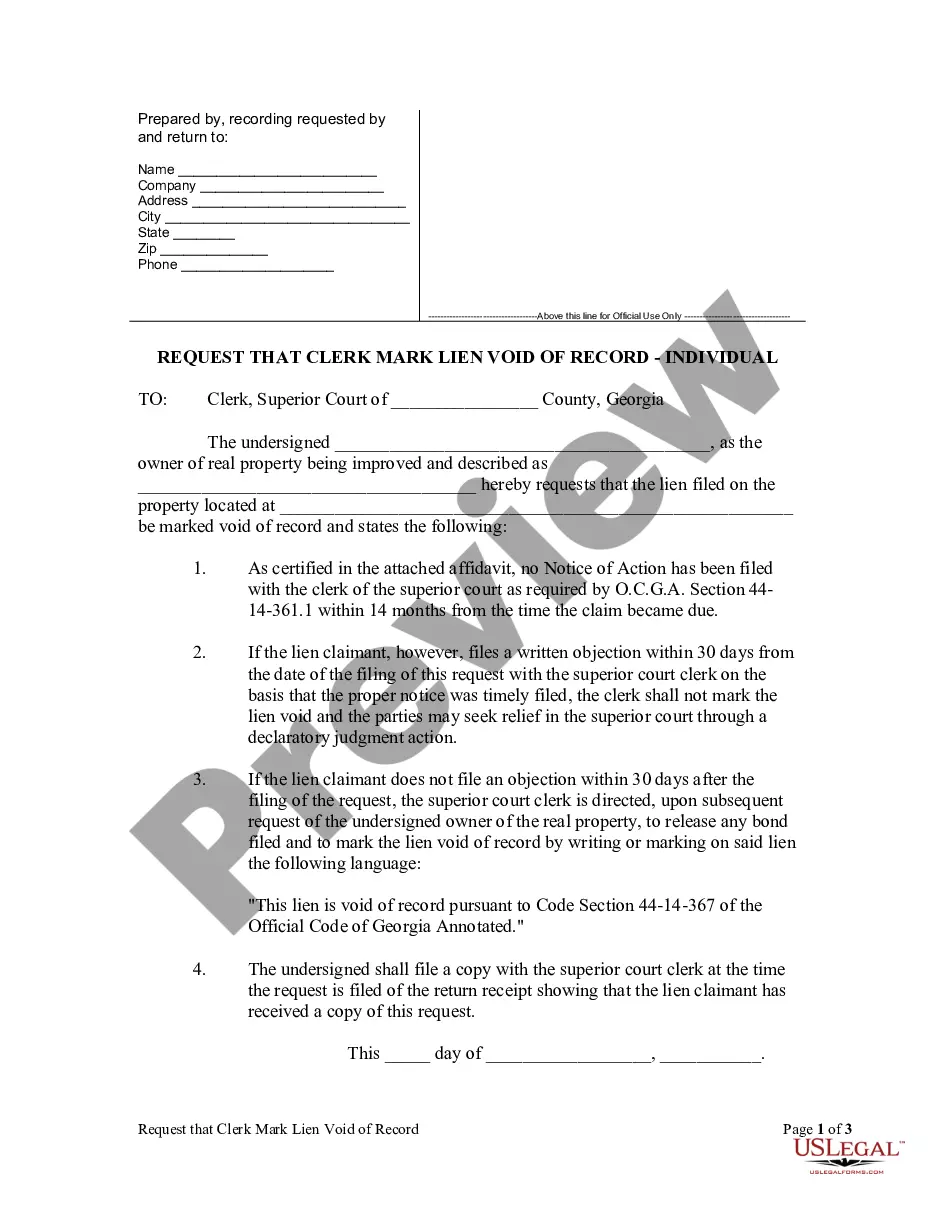

Navigating through the red tape of official documents and templates can be challenging, particularly when one is not engaged in such tasks professionally.

Locating the appropriate template for a Promissory Note Demand Letter Withdrawal can also be labor-intensive, as it must be legitimate and precise down to the last number.

However, you will need to spend considerably less time selecting an appropriate template from a source you can trust.

Acquire the correct form in just a few straightforward steps.

- US Legal Forms is a platform that streamlines the process of finding the correct forms online.

- US Legal Forms is a single destination where you can discover the most recent document samples, verify their usage, and download these samples to complete them.

- It is a repository containing over 85K forms applicable in various sectors.

- When looking for a Promissory Note Demand Letter Withdrawal, you won’t have to doubt its relevance as all forms are validated.

- Creating an account at US Legal Forms guarantees you have all the essential samples at your fingertips.

- You can save them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by simply clicking Log In at the library site.

- If you lack an account, you can always search again for the template you require.

Form popularity

FAQ

Write in the identifying information about the promissory note, including the original amount and its effective date. If there is only one noteholder signing the release, delete all references to we or to more than one noteholder. Enter an address for each party in the blanks provided.

This demand letter should include the following:The date of the letter.The names of the borrower and lender.The original amount of the loan.The date of the promissory note and any reference number or account number it contains.The payment schedule that was agreed upon.More items...?

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

When payment is requested, a time period will be given for repayment. A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date. A demand note is not required to show cause notice to be given to a borrower who is delinquent, unlike a mortgage loan.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.