Fictitious Business Name Statement Filed With The Orange County Clerk

Description

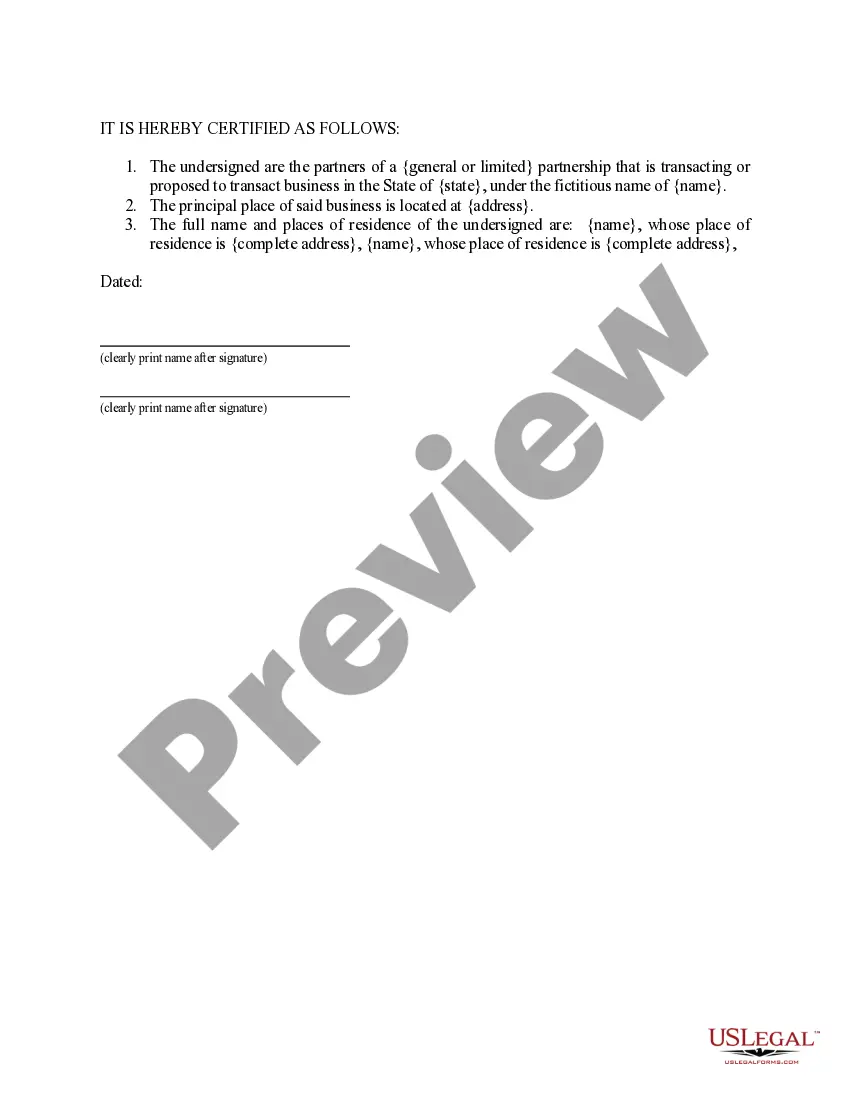

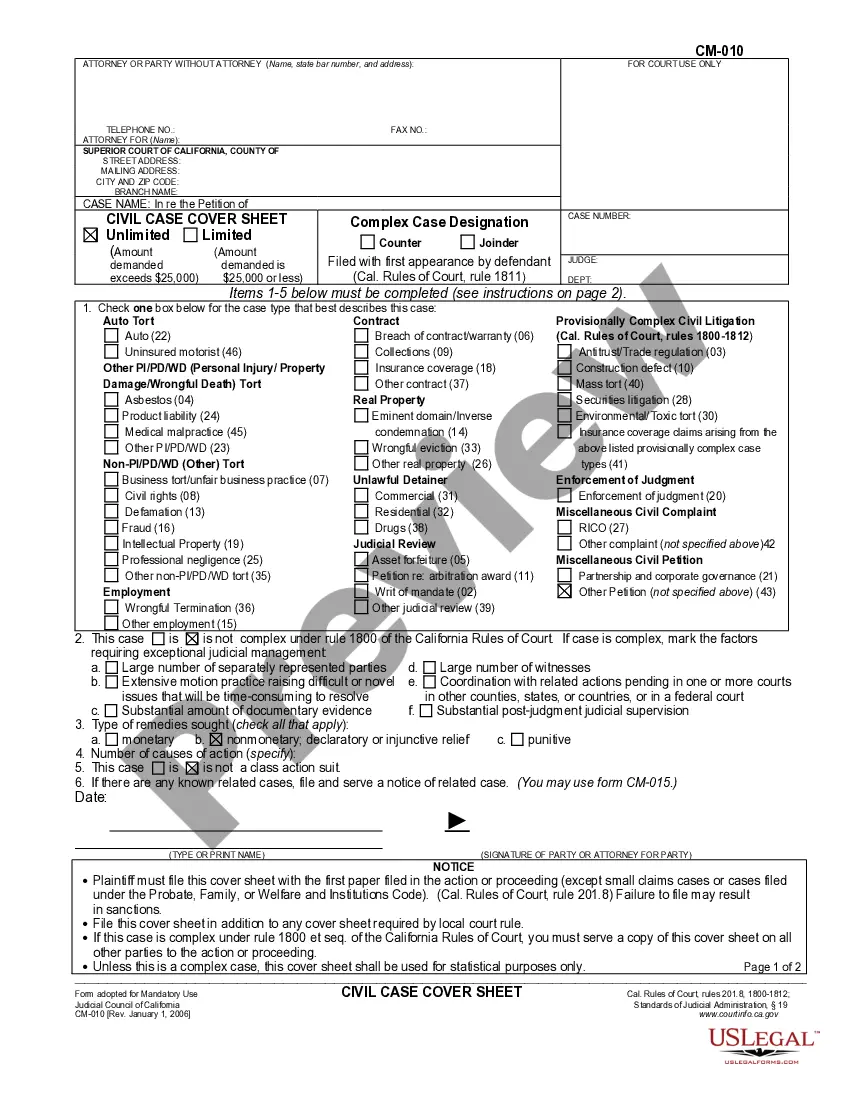

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

It’s well-known that you cannot become a legal authority instantly, nor can you understand how to swiftly prepare a Fictitious Business Name Statement filed with the Orange County Clerk without specialized expertise.

Compiling legal documents is a labor-intensive process that necessitates specific education and abilities. Therefore, why not entrust the creation of the Fictitious Business Name Statement filed with the Orange County Clerk to the experts.

With US Legal Forms, featuring one of the broadest collections of legal templates, you can find everything from court documents to templates for internal business communication. We recognize the importance of compliance with federal and local laws and regulations. That’s why all templates on our platform are location-specific and current.

Click Buy now. Once your payment is processed, you’ll receive the Fictitious Business Name Statement filed with the Orange County Clerk, allowing you to complete it, print it, and send or post it to the designated individuals or organizations.

You can access your documents again via the My documents tab at any time. If you are a returning customer, simply Log In to find and download the template from the same tab.

- Start by visiting our website to obtain the form you require in just minutes.

- Utilize the search bar at the top of the page to find the document you need.

- If available, preview it and review the accompanying description to see if the Fictitious Business Name Statement filed with the Orange County Clerk meets your needs.

- If you require a different form, initiate your search again.

- Create a free account and select a subscription plan to acquire the form.

Form popularity

FAQ

Who Pays Workers' Comp? Regardless of the state you're in, employers pay for workers' compensation insurance. Your cost for workers' compensation is a percentage of your payroll. Unlike health insurance, there are no employee payroll deductions for workers' compensation insurance.

The percentage of worker's wage paid is 66 2/3. For weekly payments, the minimum is $36 or actual wage if less, and the maximum is $699.01, 100% of SAWW. The maximum period of payments is the lifetime of the injured worker.

Workers' compensation provides workers with: Payments for a worker who has a permanent impairment or is permanently totally disabled. Payments for temporary indemnity benefits if an injured worker is unable to work and earn a paycheck. Survivor benefits for survivors of those killed on the job.

The employer must obtain a workers' compensation insurance policy. The fee for the employer is $2.30 times the number of covered employees working on the last day of the quarter. The fee for covered employees working on the last day of the quarter is $2.00.

Workers' compensation provides workers with: Payment for medical care resulting from a work-related injury or illness. Payments for a worker who is permanently partially disabled once maximum medical improvement is reached. Payments for a worker who has a permanent impairment or is permanently totally disabled.

Only real estate sales people and private domestic servants are exempt. Employers who fall under the New Mexico Workers' Compensation Act are required to pay a quarterly fee to the Taxation and Revenue Department. The fee is $4.30 per employee per quarter, $2 of which is paid by the worker.