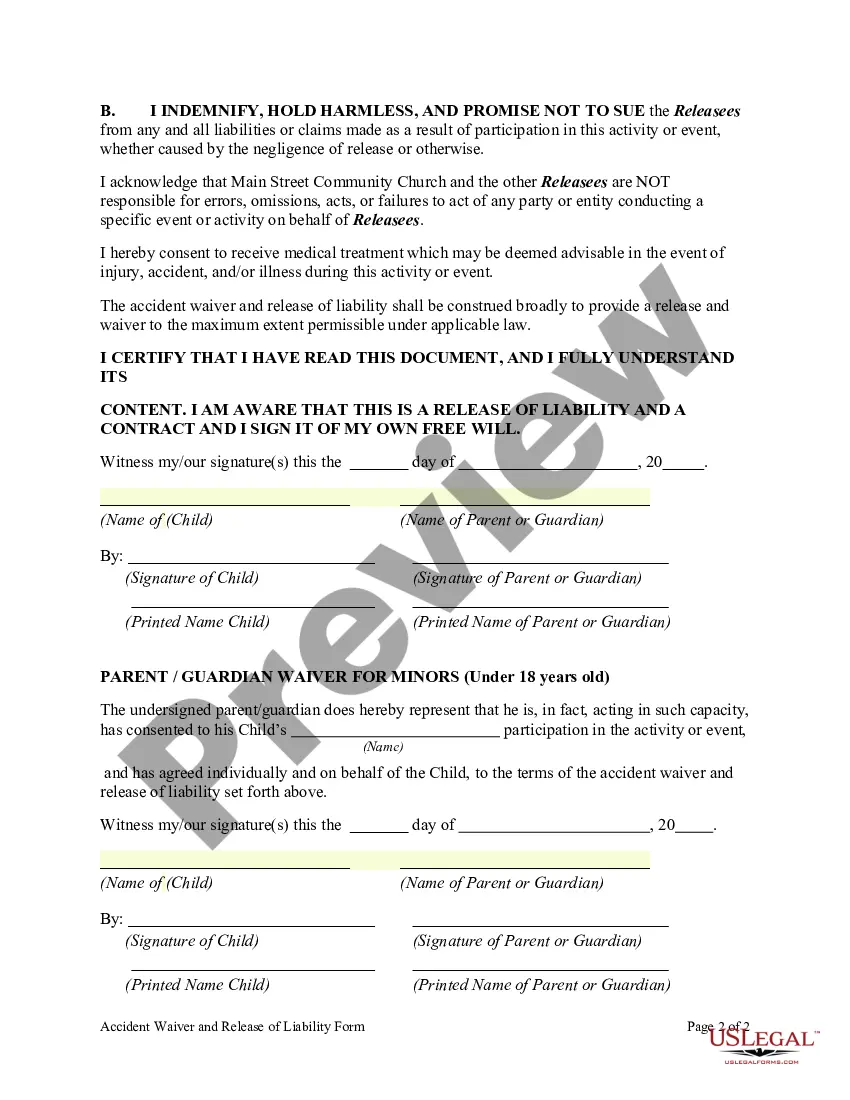

A waiver or release is the intentional and voluntary act of relinquishing something, such as a known right to sue a person or organization for an injury. The term waiver is sometimes used to refer a document that is signed before any damages actually occur. A release is sometimes used to refer a document that is executed after an injury has occurred. Courts to not always uphold waivers and releases. Courts vary in their approach to releases depending on the particular facts of each case, the releases’ effect on other statutes and laws, and the courts’ views of the benefits of releases as a matter of public policy.

Title: A Complete Guide on How to Report an Accident with State Farm — Key Steps and Different Types Explained Introduction: Being prepared for the unexpected is crucial, and reporting an accident with State Farm insurance promptly and accurately is important to ensure a smooth claims process. This comprehensive guide will walk you through the steps involved in reporting an accident with State Farm, covering different scenarios and providing essential information. Read on to discover how to report an accident with State Farm Insurance effectively. 1. Understanding the Reporting Process with State Farm: — Start by ensuring everyone's safety: The initial priority after an accident is to ensure the safety of everyone involved. Move to a safe location if possible, check for injuries, and call emergency services if needed. — Gather crucial information: Collect the necessary details, including the accident location, date, time, and the people involved. Take pictures or videos of the accident scene, property damage, and injuries. — Contact State Farm immediately: To report an accident, it's important to contact State Farm's claims department as soon as possible. You can reach State Farm's 24/7 claims service hotline at [insert hotline number]. Provide them with the gathered information, and don't forget to keep a record of the claim number and adjuster's contact details. — Cooperate with your claims adjuster: Once your claim is filed, a State Farm claims adjuster will be assigned to your case. Cooperate with them by providing any necessary documentation, answering questions truthfully, and following their instructions. 2. Different Types of Accident Reports: State Farm offers various options to report accidents, catering to different preferences and circumstances. Here are some of the main types of accident reports available with State Farm: a. Online Reporting: State Farm's website offers a convenient online reporting service, making it possible to submit accident reports quickly from anywhere with an internet connection. Simply visit State Farm's website, navigate to the claims section, and follow the instructions to file your report digitally. b. Phone Reporting: For those who prefer a more personal approach, State Farm's 24/7 claims service hotline allows you to report accidents directly by speaking with a representative. Dial the hotline number and follow the prompts to connect with a claims' agent who will guide you through the reporting process. c. Mobile App Reporting: State Farm's mobile app offers a hassle-free way to report accidents on the go. Download the State Farm mobile app from your app store, log in to your account, and navigate to the claims section. Follow the prompts to report the accident, attach any necessary pictures or documents using your phone's camera, and submit your claim. d. In-Person Reporting: For individuals who prefer face-to-face interactions, State Farm has numerous local agents located across the country. Visit a local State Farm office, and an agent will assist you in filing your accident report during regular business hours. Conclusion: Knowing how to report an accident with State Farm Insurance is essential for a stress-free claims process. Make sure to prioritize everyone's safety, gather all pertinent information, and promptly contact State Farm to initiate the claim. By understanding the various reporting options offered by State Farm, such as online, phone, mobile app, and in-person reporting, you can choose the method that suits your needs best. Remember to cooperate with your claims adjuster throughout the process to ensure a seamless resolution to your accident claim.