Report Accident With Geico

Description

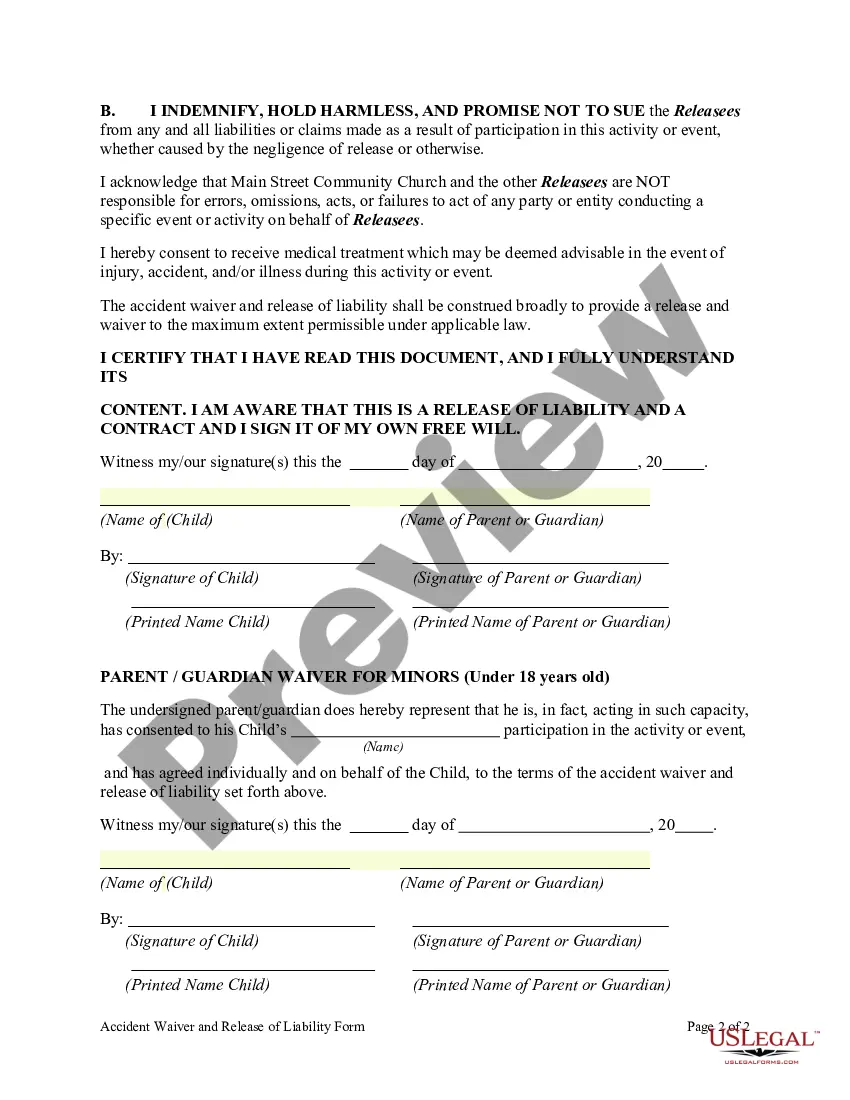

How to fill out Accident Waiver And Release Of Liability Form?

The Incident Report With Geico displayed on this page is a reusable legal document crafted by experienced attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has assisted individuals, businesses, and lawyers with more than 85,000 confirmed, state-specific documents for any commercial and personal needs. It’s the quickest, simplest, and most reliable means to acquire the forms you require, as the service ensures the utmost level of data protection and anti-virus safety.

Register with US Legal Forms to access verified legal templates for all of life’s situations.

- Search for the document you require and examine it.

- Browse the sample you looked for and preview it or review the form description to confirm it meets your needs. If it does not, utilize the search bar to find the right one. Click Buy Now when you have found the document you want.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Incident Report With Geico (PDF, Word, RTF) and download the file to your device.

- Complete and sign the document.

- Print the template to finish it by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your document with a legally-recognized electronic signature.

- Re-download your documents as needed.

- Utilize the same document again whenever necessary. Visit the My documents section in your profile to re-download any forms previously retrieved.

Form popularity

FAQ

In New Mexico, you generally need to report an accident within a reasonable time frame; ideally, this should be as soon as the accident occurs. While there are no hard and fast rules, acting quickly can improve your claim's chances of success. Therefore, if you find yourself in an accident, make sure to report it with Geico without unnecessary delay. UsLegalForms offers helpful guidance for navigating these requirements effectively.

Most states provide a specific time frame for filing an insurance claim after an accident, often ranging from one to three years. It's crucial to understand your state's laws and to report your accident with Geico as quickly as possible. If you wait too long, you may risk losing your right to claim. For clarity, consider using the resources available on UsLegalForms to outline deadlines and procedures.

You can typically make a claim after an accident with Geico as soon as you have the necessary details. While there is no strict deadline, prompt reporting is encouraged. Delaying your claim may complicate the process or affect the outcome. Always aim to report the accident with Geico soon after it happens to secure your benefits.

Yes, you have a time limit to report an accident with Geico and to make your insurance claim. Generally, it is best to report the accident as soon as possible. This helps to ensure that all necessary information is gathered while it is fresh. Remember, the sooner you report the accident with Geico, the smoother your claims process will be.

To report an accident with Geico, start by gathering all relevant details, such as the date, time, and location of the incident, along with the other party's information. Next, you can easily submit your report online through the Geico website or by using their mobile app. Alternatively, you can call Geico directly for assistance; their representatives will guide you through the reporting process. By taking these steps promptly, you ensure a smooth claims experience and get the support you need.

Filing a claim is straightforward when you report an accident with Geico through their user-friendly online platform. Simply follow the prompts for incident details, and submit photographs or documents if necessary. For added convenience, you can also chat with an agent for personalized assistance to guide you through the claim process.

The best way to report an accident with Geico is to use their mobile app or website for fast processing. You can also call their claims department directly for assistance. Providing detailed information and any supporting documentation will help streamline the process and get you the support you need.

Yes, Geico requires all accidents to be reported, regardless of the perceived severity. Reporting an accident with Geico ensures you remain compliant with your policy and helps protect your rights in case issues arise later. It’s better to report, as failing to do so might lead to complications with your coverage.

An insurance investigation is generally triggered when there are discrepancies in the information provided, such as conflicting accounts of the accident or potential fraud. For example, when you report an accident with Geico, they may scrutinize the details if the damages appear inconsistent with the claims. It's essential to provide clear and accurate information to avoid unnecessary delays.

Writing a car accident report for your insurance involves detailing the facts of the incident precisely. Start with the date, time, and location of the accident, and then describe what happened, including vehicle positions and any damages. Don't forget to include contact information for all parties involved and any witnesses. This report assists Geico in processing your claim efficiently.