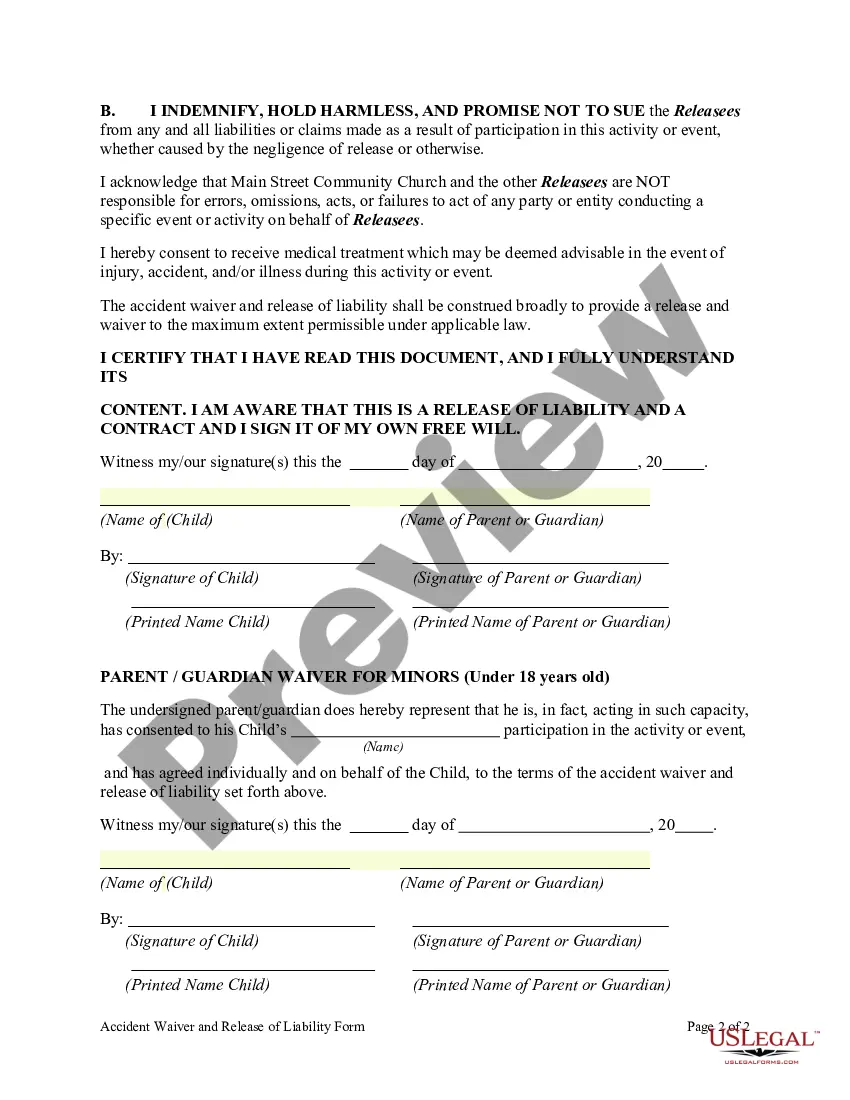

A waiver or release is the intentional and voluntary act of relinquishing something, such as a known right to sue a person or organization for an injury. The term waiver is sometimes used to refer a document that is signed before any damages actually occur. A release is sometimes used to refer a document that is executed after an injury has occurred. Courts to not always uphold waivers and releases. Courts vary in their approach to releases depending on the particular facts of each case, the releases’ effect on other statutes and laws, and the courts’ views of the benefits of releases as a matter of public policy.

Accident forgiveness is a valuable feature offered by Progressive Insurance that can protect drivers from facing increased insurance rates after being involved in an accident. This unique program is designed to mitigate the financial consequences of an accident by ensuring drivers do not experience a rate hike due to their first at-fault accident. With Progressive’s Accident Forgiveness program, policyholders are granted leniency for their first at-fault accident, meaning they can avoid the usual spikes in insurance premiums. This benefit is especially advantageous for responsible drivers who have maintained a clean driving record and suddenly find themselves facing an unexpected accident. Progressive understands that accidents can occur to even the most careful drivers, so they introduced this feature to support their customers during challenging times. Accident forgiveness allows policyholders to retain their current premium rates rather than experiencing a hike in their insurance costs, which can save them a significant amount of money in the long run. It is important to note that Accident Forgiveness is not automatically included in all Progressive policies. Instead, it is offered as an optional add-on that policyholders can choose to include in their coverage. By adding this feature, drivers can have peace of mind, knowing that they will not be penalized for their first at-fault accident. Apart from the standard Accident Forgiveness, Progressive offers additional variations of this coverage, such as Small Accident Forgiveness and Large Accident Forgiveness. These options cater to different driving circumstances and provide even more flexibility for policyholders. Small Accident Forgiveness is a type of Accident Forgiveness coverage designed specifically for minor accidents. With this add-on, policyholders can keep their premiums from increasing after a small accident, regardless of who was at fault. This is particularly beneficial for drivers who frequently navigate busy areas and are more prone to minor fender-benders. On the other hand, Large Accident Forgiveness is perfect for drivers who want to be protected against the financial consequences of a major accident. This coverage applies to significant accidents that may involve substantial damages or medical expenses. With Large Accident Forgiveness, policyholders can ensure their insurance rates won't skyrocket after an unfortunate accident, allowing them to focus on recovery without the added stress of increased premiums. In conclusion, Accident Forgiveness is a program provided by Progressive Insurance that grants leniency to policyholders involved in their first at-fault accident. With this feature, drivers can avoid the typical premium increases following an accident and maintain their current insurance rates. Progressive also offers additional variations of Accident Forgiveness, including Small Accident Forgiveness for minor accidents and Large Accident Forgiveness for major accidents, providing tailored options to meet individual needs.