The bylaws of a corporation are the internal rules and guidelines for the day-to-day operation of a corporation, such as when and where the corporation will hold directors' and shareholders' meetings and what the shareholders' and directors' voting requirements are. Typically, the bylaws are adopted by the corporation's directors at their first board meeting. They may specify the rights and duties of the officers, shareholders and directors, and may deal, for example, with how the company may enter into contracts, transfer shares, hold meetings, pay dividends and make amendments to corporate documents. They generally will identify a fiscal year for the corporation.

Non Profit Corporation Form With Two Points

Description

How to fill out Bi-Laws Of A Non-Profit Church Corporation?

It’s no secret that you can’t become a law professional immediately, nor can you grasp how to quickly prepare Non Profit Corporation Form With Two Points without the need of a specialized set of skills. Putting together legal forms is a time-consuming process requiring a specific training and skills. So why not leave the preparation of the Non Profit Corporation Form With Two Points to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and obtain the form you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

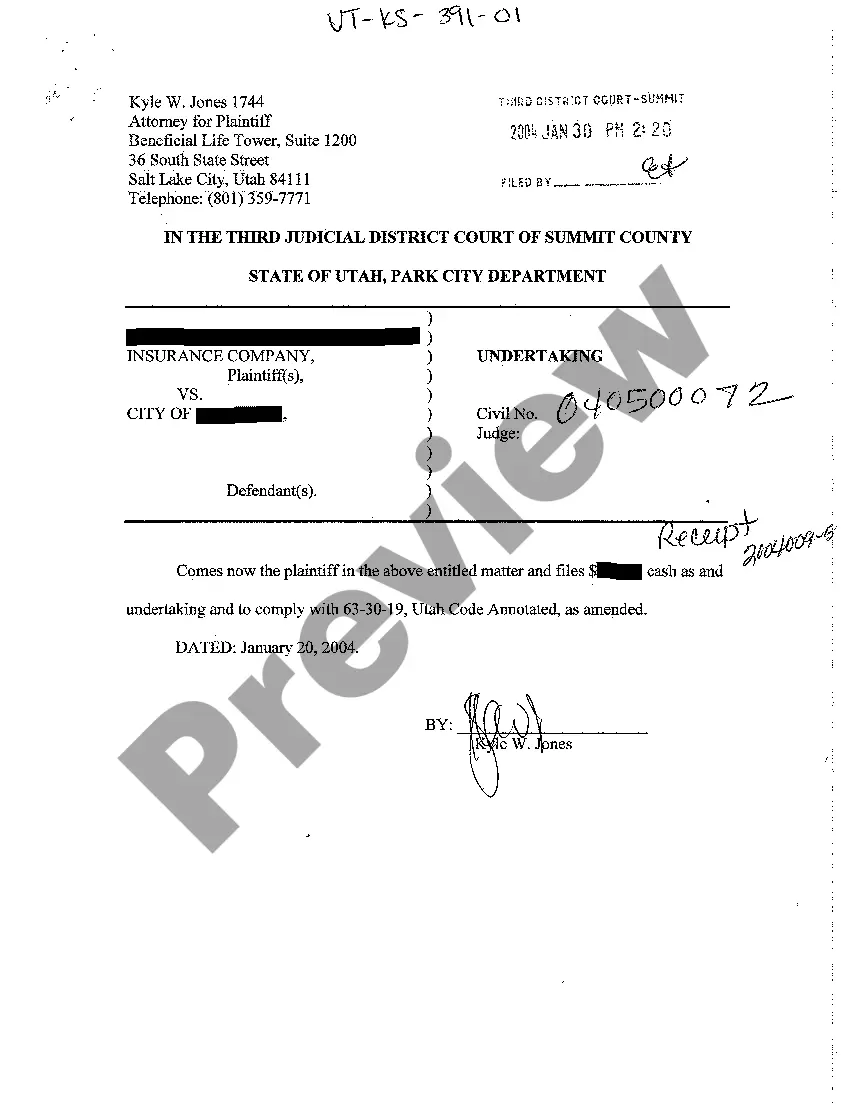

- Preview it (if this option available) and read the supporting description to figure out whether Non Profit Corporation Form With Two Points is what you’re looking for.

- Start your search again if you need a different form.

- Register for a free account and select a subscription plan to purchase the form.

- Pick Buy now. Once the transaction is through, you can download the Non Profit Corporation Form With Two Points, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Non-profit organizations include churches, public schools, public charities, public clinics and hospitals, amateur sports organizations, political organizations, legal aid societies, volunteer services, organizations, labor unions, professional associations, research institutes, museums, and some governmental agencies.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

When speaking about NPO's the public spells them many ways. This includes nonprofit, non-profit and also non profit. While it is acceptable to use any of these versions the most widely accepted spelling is nonprofit all one word.

Non-profit or Nonprofit: Failing to Reach Consensus Practically speaking, the many organizations and businesses that use the term do so interchangeably, which indicates there is no real difference.

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.