Change Registered Address For Eori Number

Description

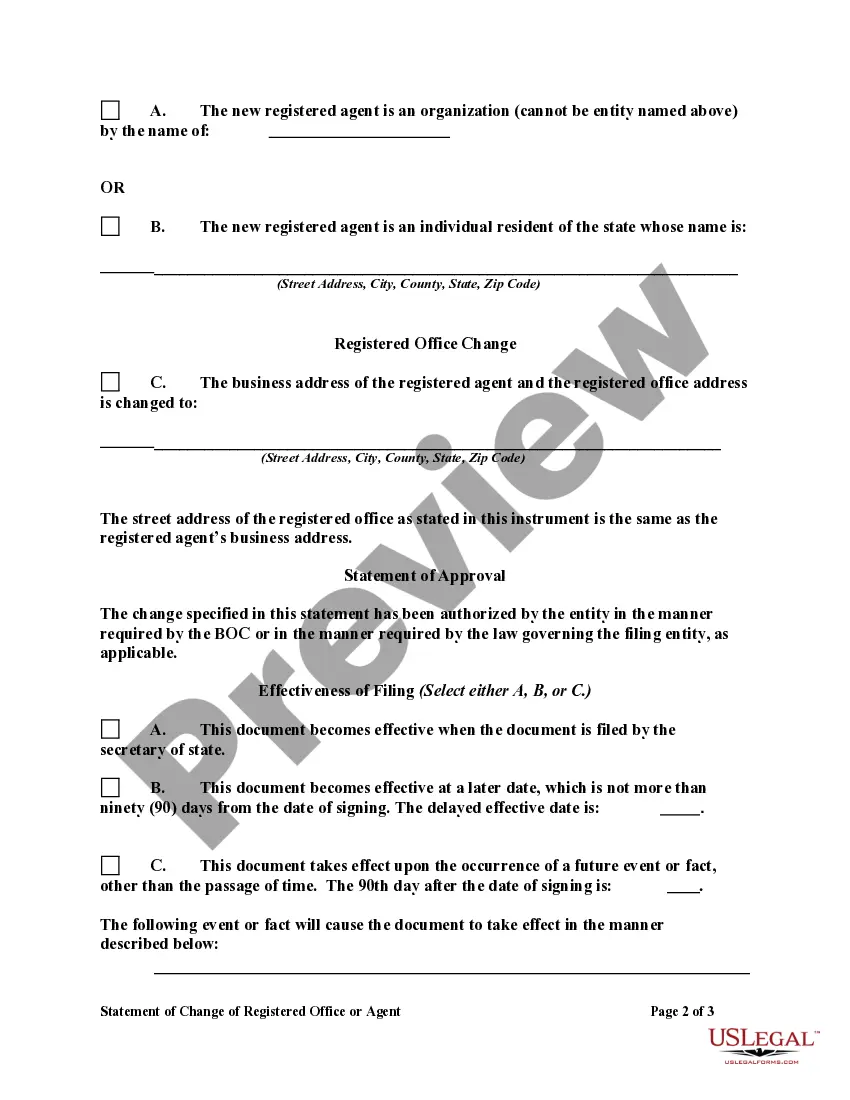

How to fill out Statement Of Change Of Registered Office Or Agent?

The Altered Registered Address For Eori Number you observe on this page is a versatile official template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and lawyers with more than 85,000 validated, state-specific forms for various business and personal circumstances. It’s the quickest, easiest, and most dependable method to acquire the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms. Register for US Legal Forms to have verified legal templates for all of life’s situations at your command.

- Search for the document you require and examine it.

- Review the sample you found and preview it or verify the form description to ensure it meets your needs. If it doesn't, use the search bar to locate the suitable one. Click Buy Now when you have found the template you need.

- Choose a pricing plan that works for you and set up an account. Utilize PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Select the format you desire for your Altered Registered Address For Eori Number (PDF, DOCX, RTF) and download the sample to your device.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with validity.

Form popularity

FAQ

How To Apply for an EORI Number. An EORI number can be obtained through the customs authorities (source: taxation-customs.ec.europa.eu ) of the Member State where the company will first be exporting. Applying* for an EORI number is done online and is free of charge.

A U.S. business will have a US-issued Employer ID number. This is a U.S. number. A business in the EU will have an EU-issued EORI. An EORI is required by a recipient business in the.

Do I need an EORI number? The EORI number is necessary if you want to export and/or import to/from a territory in which one of the parties is the customs territory of the European Union and the other party has a different tax system.

You can contact the EORI team by filling out an online form. Alternatively, You can contact the EORI team by phone on 0300 322 7067 Monday to Friday, 8am to 6pm (closed bank holidays). Call charges apply. For more information about EORI numbers visit government website GOV.UK.

Imports into the European Union require an EU Importer of Record, EORI number, and a VAT.