Collection Notice Template Formal

Description

How to fill out Sample Letter For Collection Notice For Unpaid Bill?

Legal document management might be overpowering, even for the most knowledgeable specialists. When you are interested in a Collection Notice Template Formal and do not get the a chance to devote in search of the correct and updated version, the operations might be demanding. A robust web form catalogue might be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you may:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you might have, from personal to enterprise paperwork, all in one location.

- Employ innovative tools to accomplish and handle your Collection Notice Template Formal

- Access a useful resource base of articles, tutorials and handbooks and resources relevant to your situation and needs

Save time and effort in search of the paperwork you need, and use US Legal Forms’ advanced search and Review tool to locate Collection Notice Template Formal and get it. In case you have a subscription, log in to your US Legal Forms profile, look for the form, and get it. Take a look at My Forms tab to view the paperwork you previously saved as well as handle your folders as you see fit.

Should it be your first time with US Legal Forms, create an account and acquire unrestricted usage of all advantages of the platform. Here are the steps to take after getting the form you want:

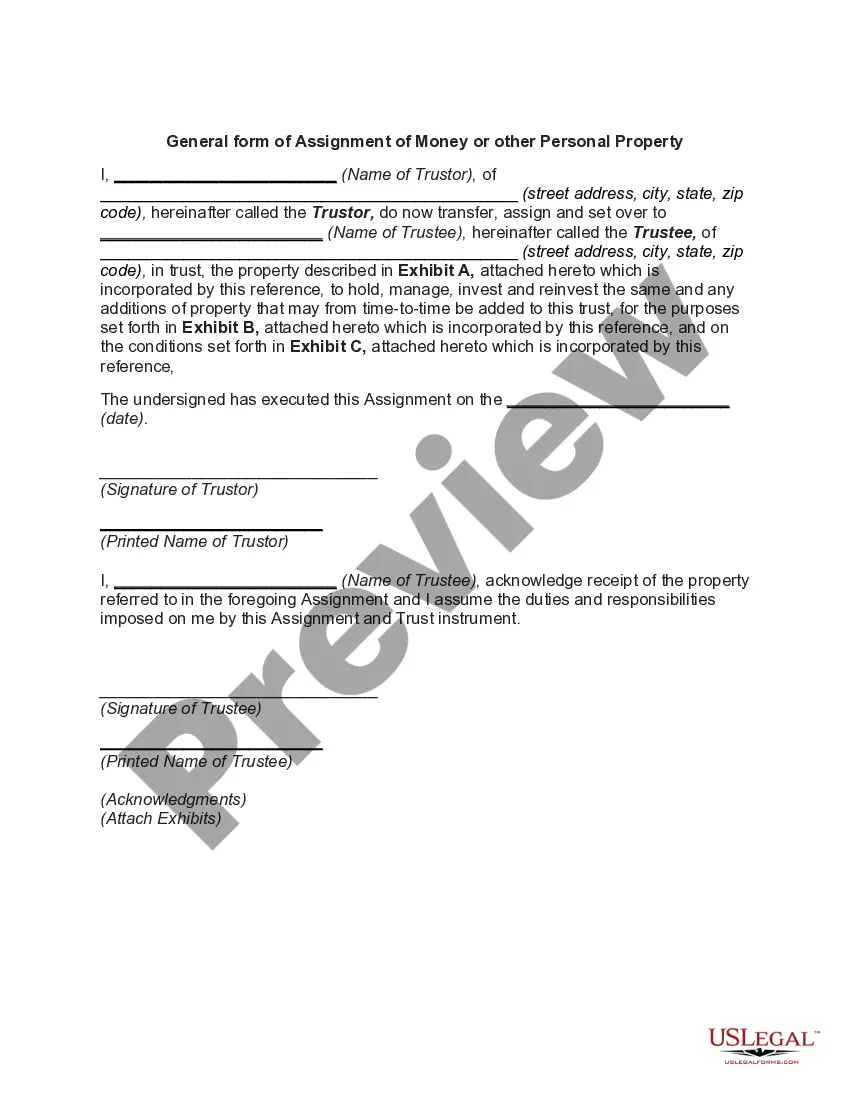

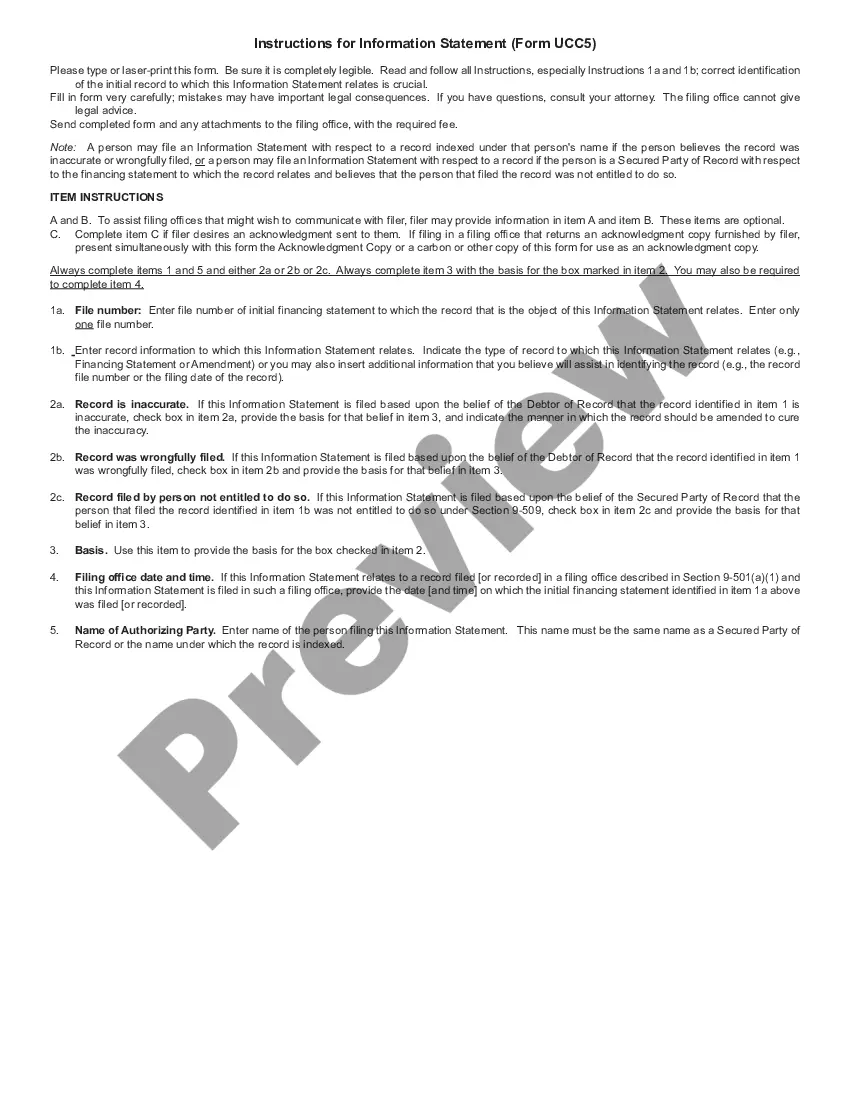

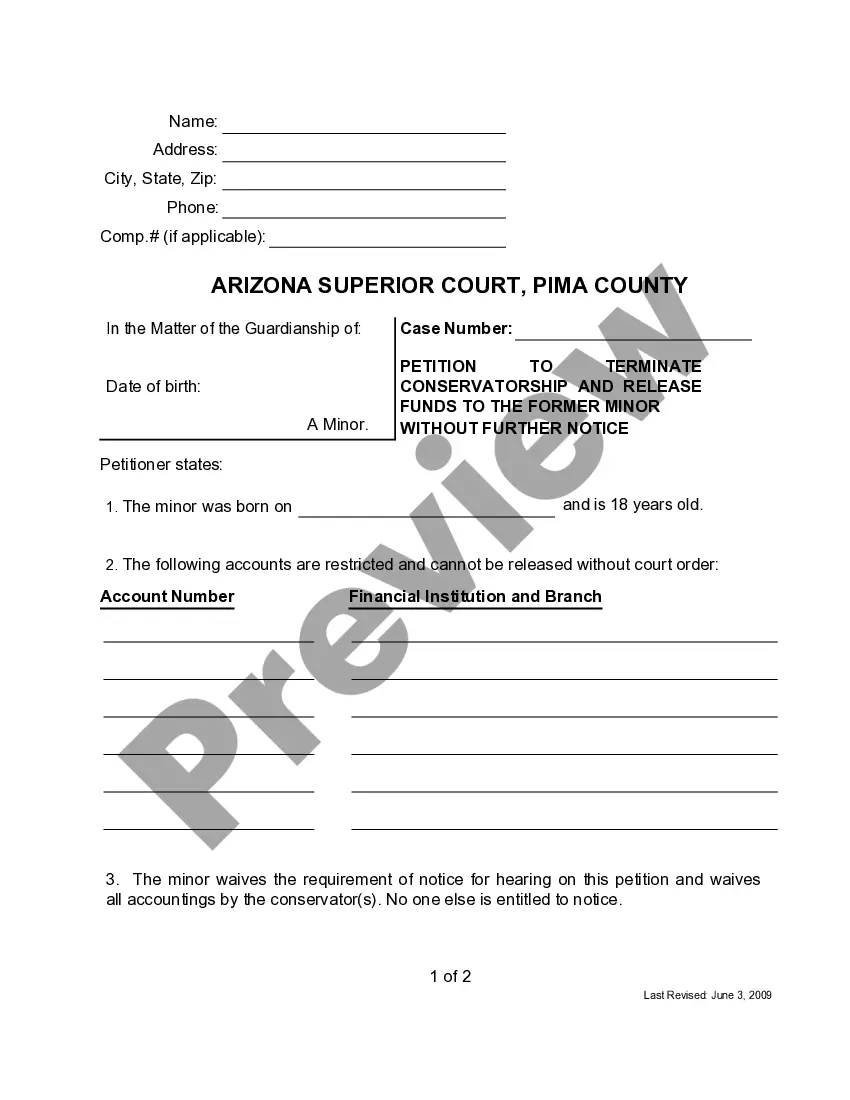

- Confirm this is the right form by previewing it and reading its information.

- Be sure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Pick the format you want, and Download, complete, eSign, print out and send out your papers.

Enjoy the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Change your day-to-day papers administration in to a smooth and intuitive process right now.

Form popularity

FAQ

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

Summary: A "creditor" is not required to inform their clients before passing an account to collections. A debt collection agency is responsible for sending an initial demand letter, also known as a ?validation notice,? to notify your debtor about their account being assigned to the agency.

Characteristics of Collection Letter The reason or the objective of writing a collection letter. Reference of the previous letters (if any). Name of the creditor or the company issuing loans. Name of the lender. Full debt amount. Additional costs or terms. Last deadline for the payment of the debt.

A debt collection letter is a written communication from a business to a customer that notifies them of an outstanding debt and demands payment of that debt. The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);