What Is An Asset Protection Agreement

Description

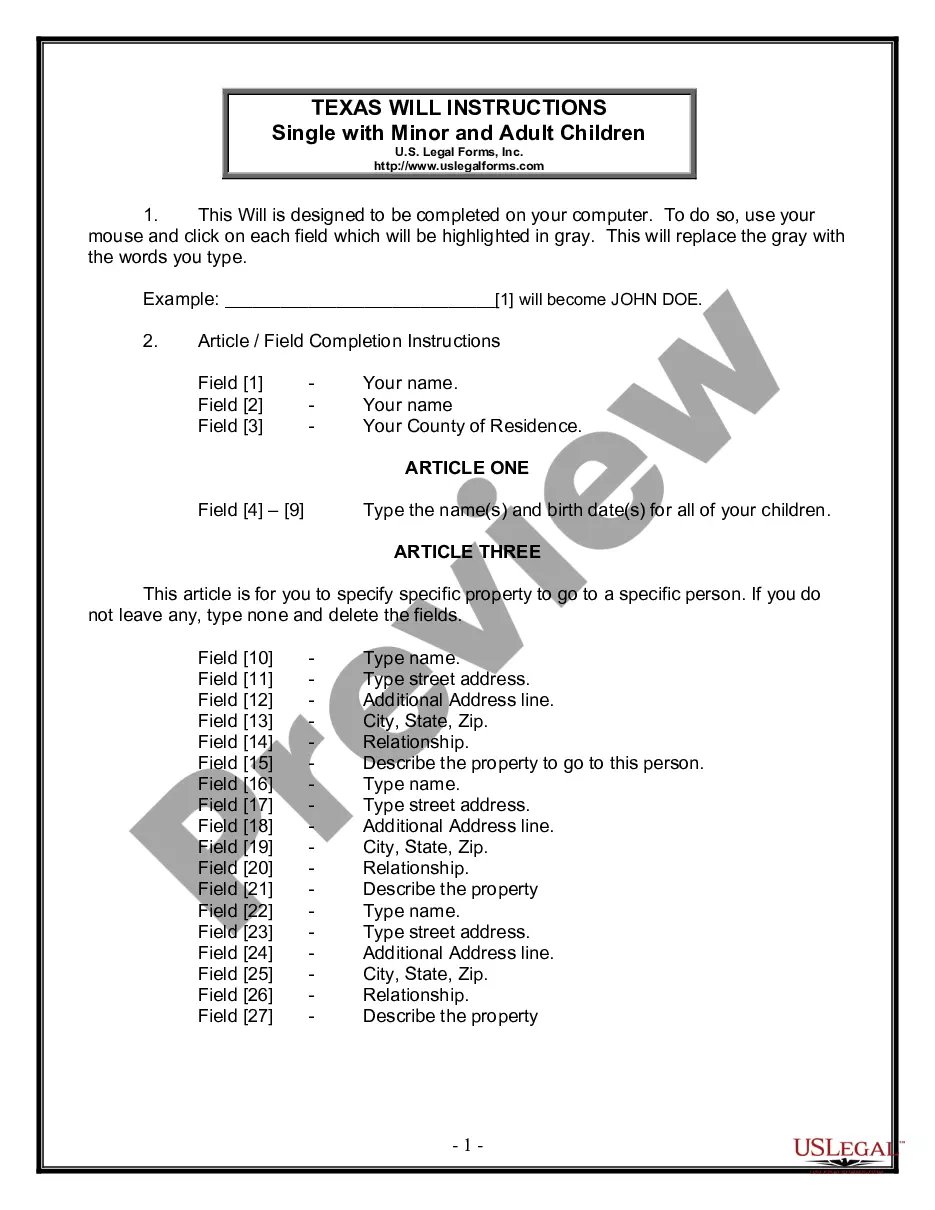

How to fill out Asset Sale Agreement?

- If you're a returning user, log in to your existing account, ensuring your subscription is active. Download the needed form template easily by clicking the Download button.

- For first-time users, start by examining the Preview mode and the form description. Verify that you have selected the correct form that aligns with your local jurisdiction requirements.

- If the selected template does not meet your needs, utilize the Search feature above to find a more suitable document.

- Once you've found the correct form, proceed to purchase it by clicking the Buy Now button. Select your preferred subscription plan and register for an account to gain access to the resource library.

- Complete your transaction by entering payment details or using PayPal for a seamless checkout.

- Finally, download your form template to your device. You can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms offers an efficient way to access legal documents while ensuring your agreements are correctly tailored to your needs. Their extensive library, rich in over 85,000 editable forms, grants users immediate access to premium resources.

Ready to simplify your legal documentation process? Explore US Legal Forms today!

Form popularity

FAQ

Setting up asset protection involves creating legal structures that safeguard your assets. One common method is to draft an asset protection agreement, which outlines how your assets will be organized and protected. It’s essential to consult legal professionals or utilize platforms like US Legal Forms to help tailor an agreement to suit your specific needs.

Using an LLC for asset protection is an effective strategy. An LLC, or limited liability company, separates your personal assets from your business assets. This separation helps shield your personal assets from business debts and legal claims. To create an effective asset protection strategy, consult resources that explain what an asset protection agreement entails.

Asset protection works by legally redefining the ownership and control of your assets to limit exposure to risk. This process often involves creating entities like LLCs and trusts to hold assets, distancing your personal wealth from potential claims. Understanding what is an asset protection agreement is key to implementing effective strategies that safeguard your financial future.

Asset protection insurance typically covers liability claims, legal fees, and financial losses associated with lawsuits. This type of insurance acts as a safety net, ensuring your assets are safeguarded in case of unforeseen events. Knowing what is an asset protection agreement can complement your insurance strategy, providing a more robust defense for your wealth.

While asset protection trusts offer benefits, they also have some disadvantages worth considering. For example, transferring assets into a trust may result in loss of control over those assets. Additionally, certain types of asset protection trusts can incur legal fees and complexity during setup—understanding these aspects can help you make informed choices.

The basics of asset protection include understanding how to identify and structure your assets to minimize risks. This can involve utilizing trusts, LLCs, and various legal entities to separate personal and business assets. Ultimately, knowing what is an asset protection agreement helps you implement effective strategies to keep your wealth secure.

A basic asset protection agreement outlines the terms under which your assets are legally shielded from claims by creditors. Essentially, this agreement details how assets are handled and what legal measures are taken to ensure protection. By using a platform like USLegalForms, you can create a tailored asset protection agreement that meets your specific needs.

Asset protection aims to safeguard your wealth from potential creditors, lawsuits, or unforeseen liabilities. By implementing strategies like an asset protection agreement, you effectively reduce the risk of losing your assets. This proactive approach gives you peace of mind, ensuring your hard-earned investments remain secure.

To obtain asset protection, start by assessing your assets and understanding potential risks. Consulting with legal professionals and exploring options like LLC formation or trust creation can provide valuable insights. Knowing what an asset protection agreement entails also empowers you as you implement strategies designed to protect your wealth.

The strongest asset protection typically involves various legal tools, including offshore accounts and irrevocable trusts. These strategies offer significant barriers to creditors attempting to seize your assets. By understanding what an asset protection agreement includes, you can better evaluate which options best safeguard your financial future.