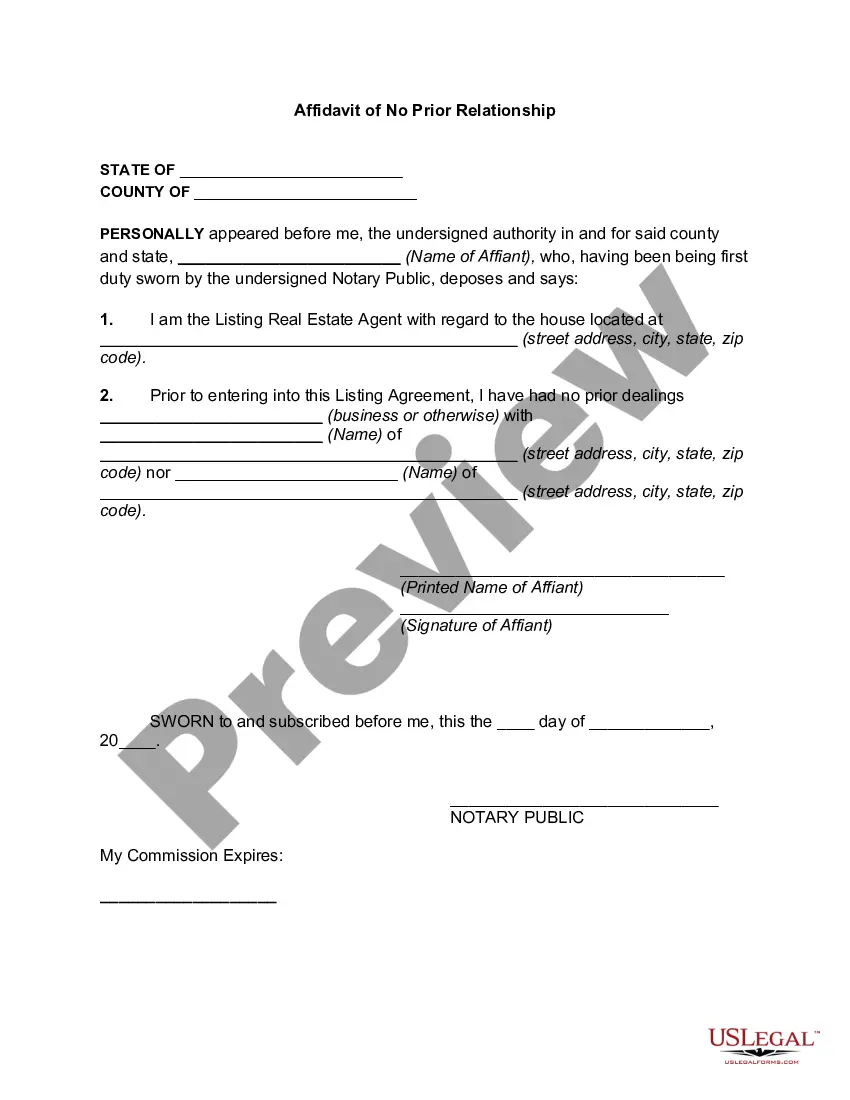

Affidavit Format For Declaration

Description

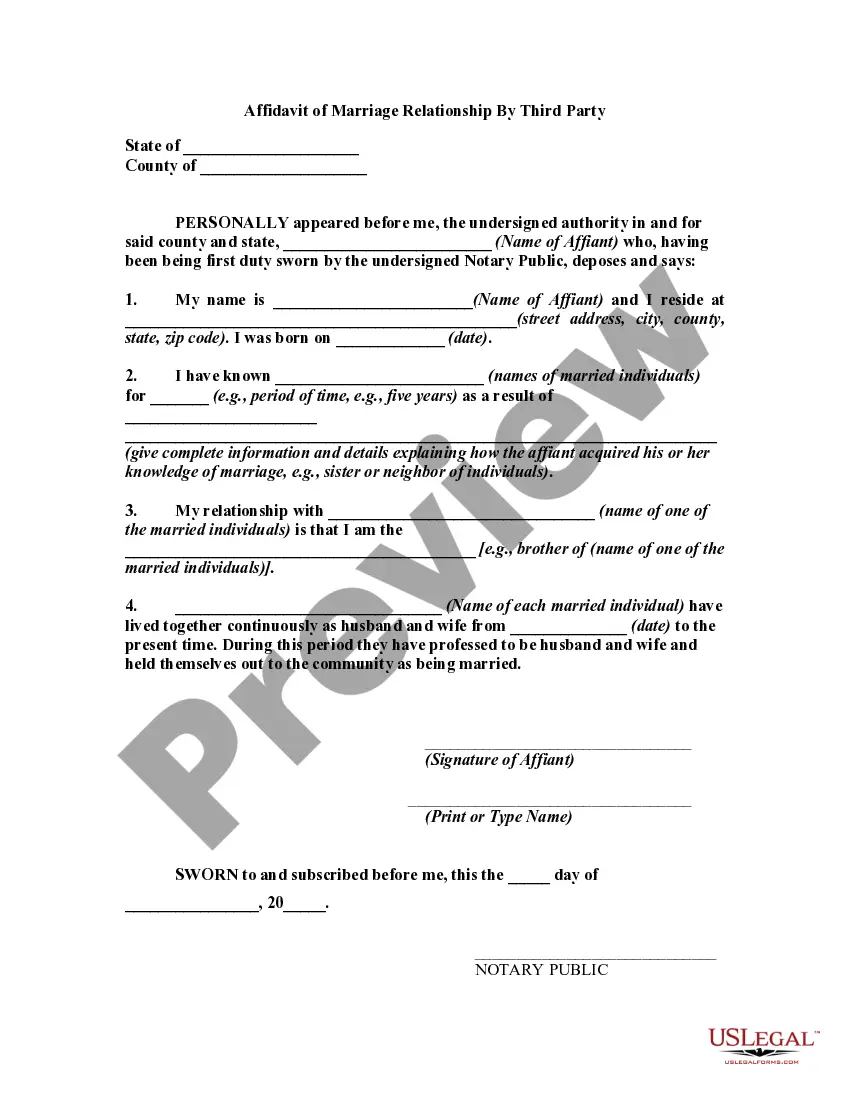

How to fill out Affidavit Of No Prior Relationship?

Regardless of whether it is for commercial reasons or personal issues, everyone eventually needs to handle legal matters at some stage in their lifetime.

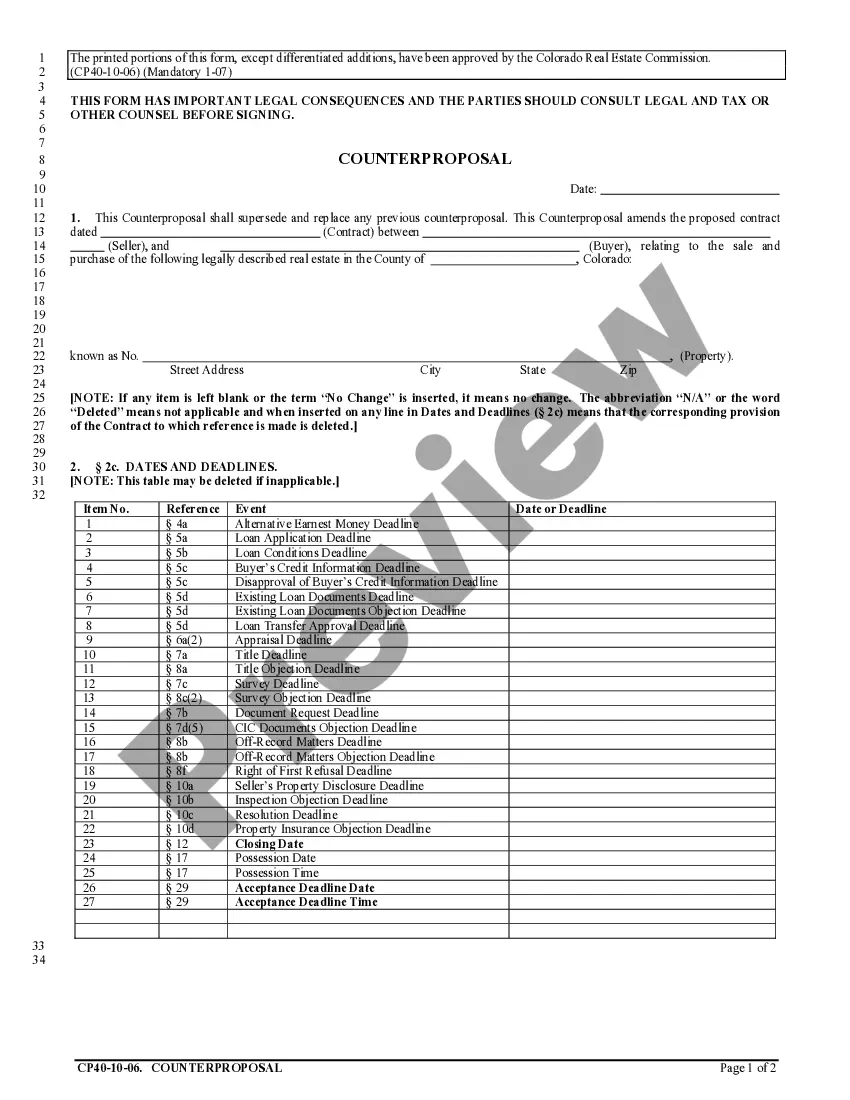

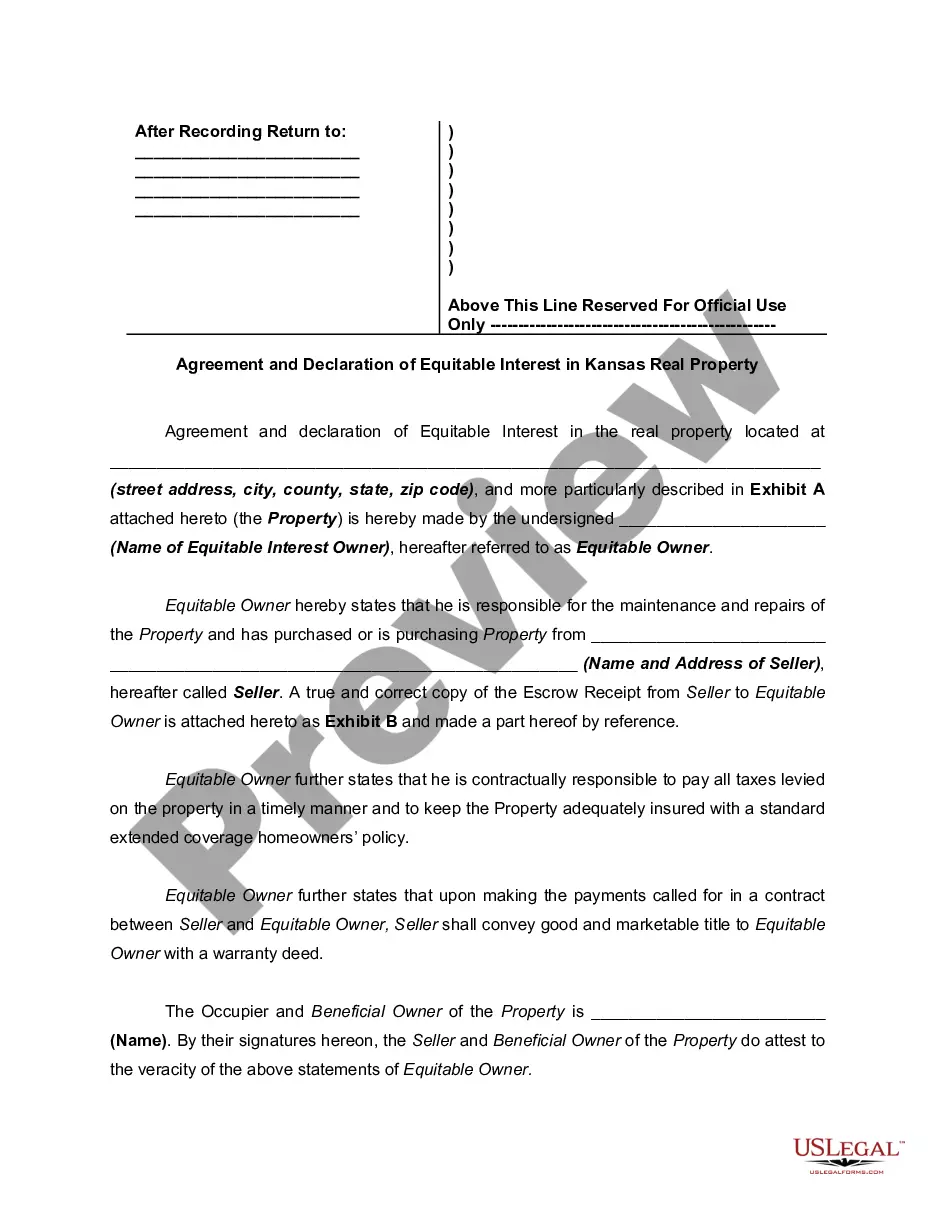

Filling out legal documents necessitates meticulous care, beginning with choosing the correct template sample. For example, if you select an incorrect version of an Affidavit Format For Declaration, it will be turned down upon submission.

With a comprehensive US Legal Forms collection at your disposal, you no longer need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to discover the ideal form for any situation.

- Retrieve the template you require using the search bar or catalog browsing.

- Review the document’s description to confirm it fits your situation, jurisdiction, and area.

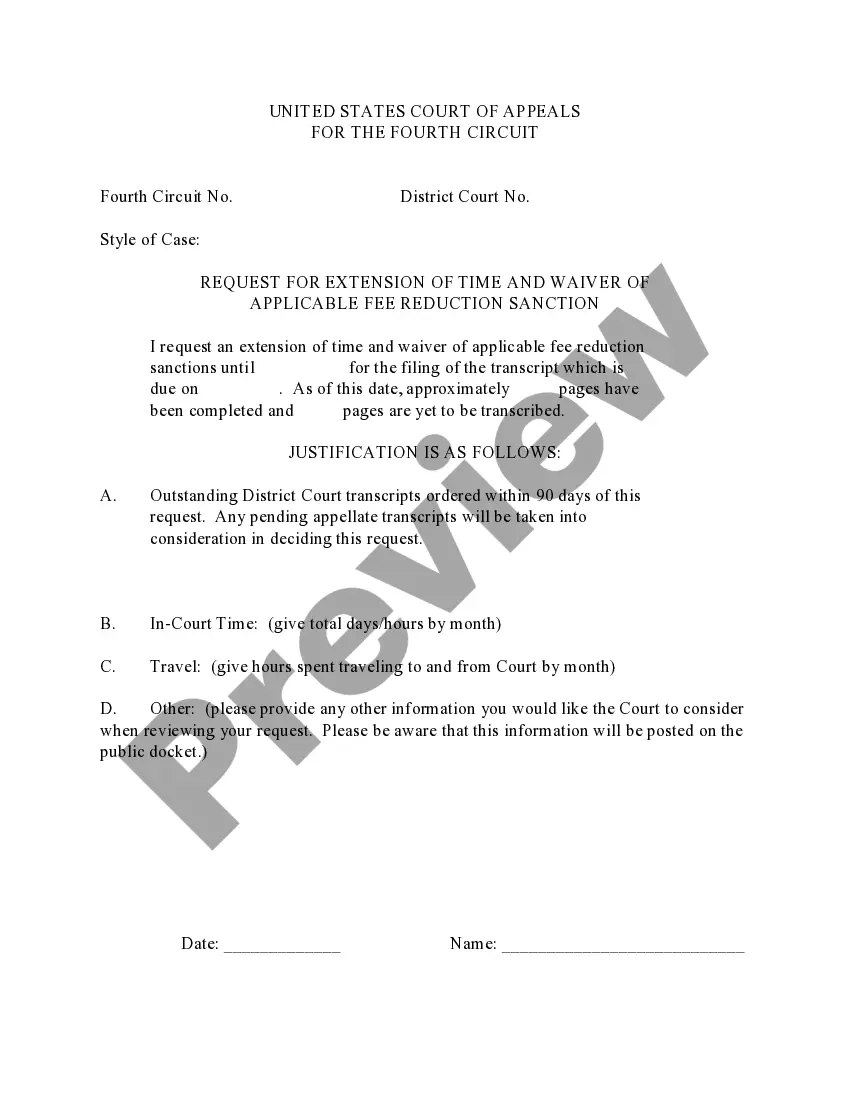

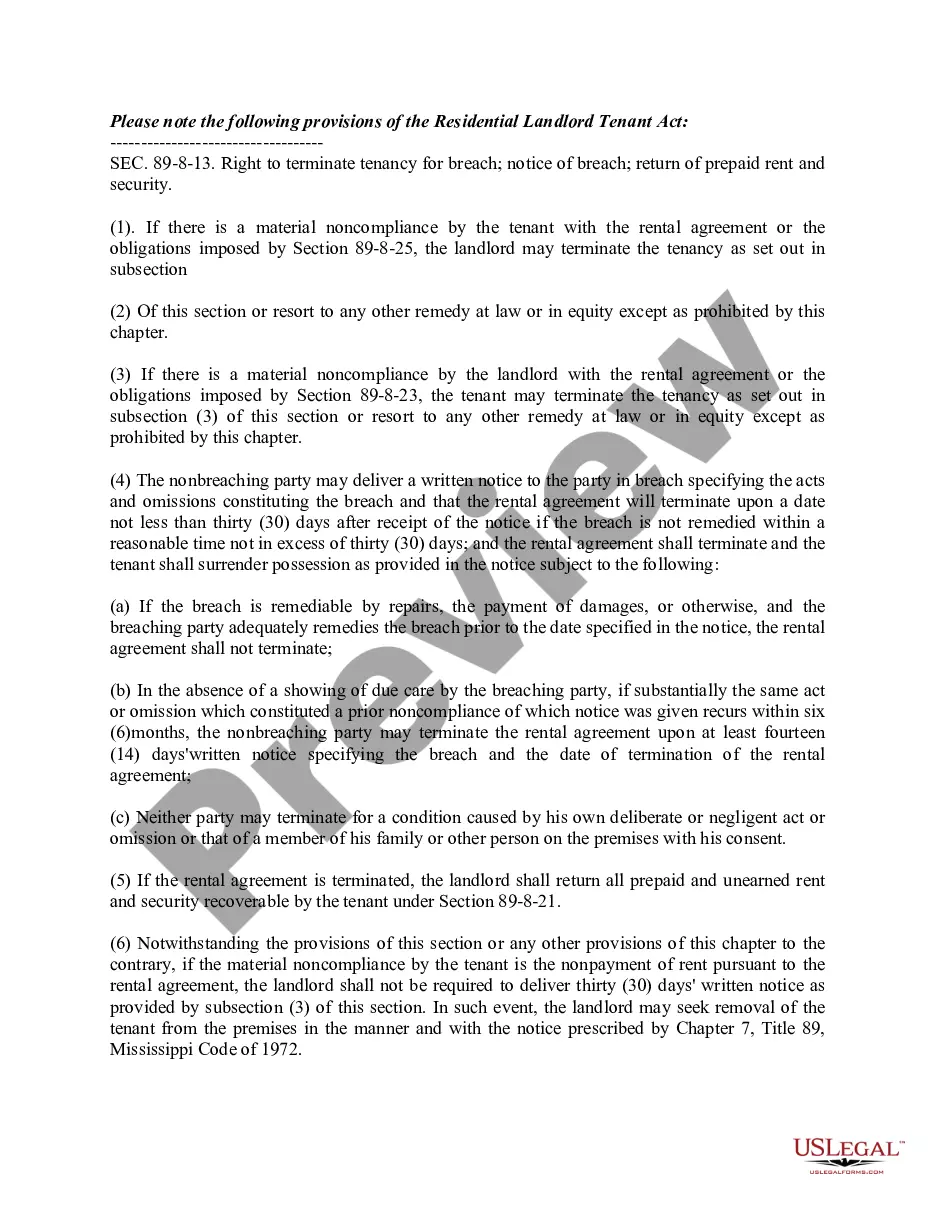

- Click on the document’s preview to inspect it.

- If it is not the correct file, return to the search feature to locate the Affidavit Format For Declaration sample you are looking for.

- Obtain the document once it meets your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the document format you prefer and download the Affidavit Format For Declaration.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

An example of a self-declaration statement can be found in personal identification situations. For instance, one might say, 'I, Your Name, declare that I reside at Your Address.' This statement should be followed by a commitment to the truthfulness of the facts. Utilizing the proper affidavit format for declaration, including a signature and date, lends credibility to this type of statement.

The seller must register with the Department and post a permit at each business location. The seller agrees to act as an agent for the State for the collection and remittance of Sales and Use Taxes to the Department as prescribed by law.

What is Exempt from Nevada Sales Tax? Prescription drugs and certain medical devices. Groceries and unprepared food items. Newspapers, magazines, and periodicals. Sales to government agencies and nonprofit organizations. Services such as legal, medical, and educational services.

Some customers are exempt from paying sales tax under Nevada law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Yes. Remote sellers registered in Nevada to collect and remit sales and use taxes are required to collect both the state and local sales or use taxes that apply to the transaction. In Nevada, the local taxes are collected and reported at the same time as the state sales tax and all are remitted to the state.

Other items that are not taxable include unprepared food, farm machinery and equipment, newspapers, and interest, finance and carrying charges on credit sales. You may write to the Department of Taxation about the taxability of a specific item.

A seller's permit can be obtained by registering through SilverFlume (State of Nevada Business Portal) or by mailing in Nevada a Business Registration Form.

In general, you need a sales tax permit in Nevada if you have physical presence or meet economic nexus requirements.

Any purchase, other than inventory, made by a retailer from a non-registered vendor, for use in the business, is subject to Use Tax and must be reported on the monthly or quarterly Sales and Use Tax return. Examples of this are supplies, forms, or equipment that is not re-sold.