Agreement Unmarried Couples With Child Rights

Description

How to fill out Cohabitation Agreement For Unmarried Couples?

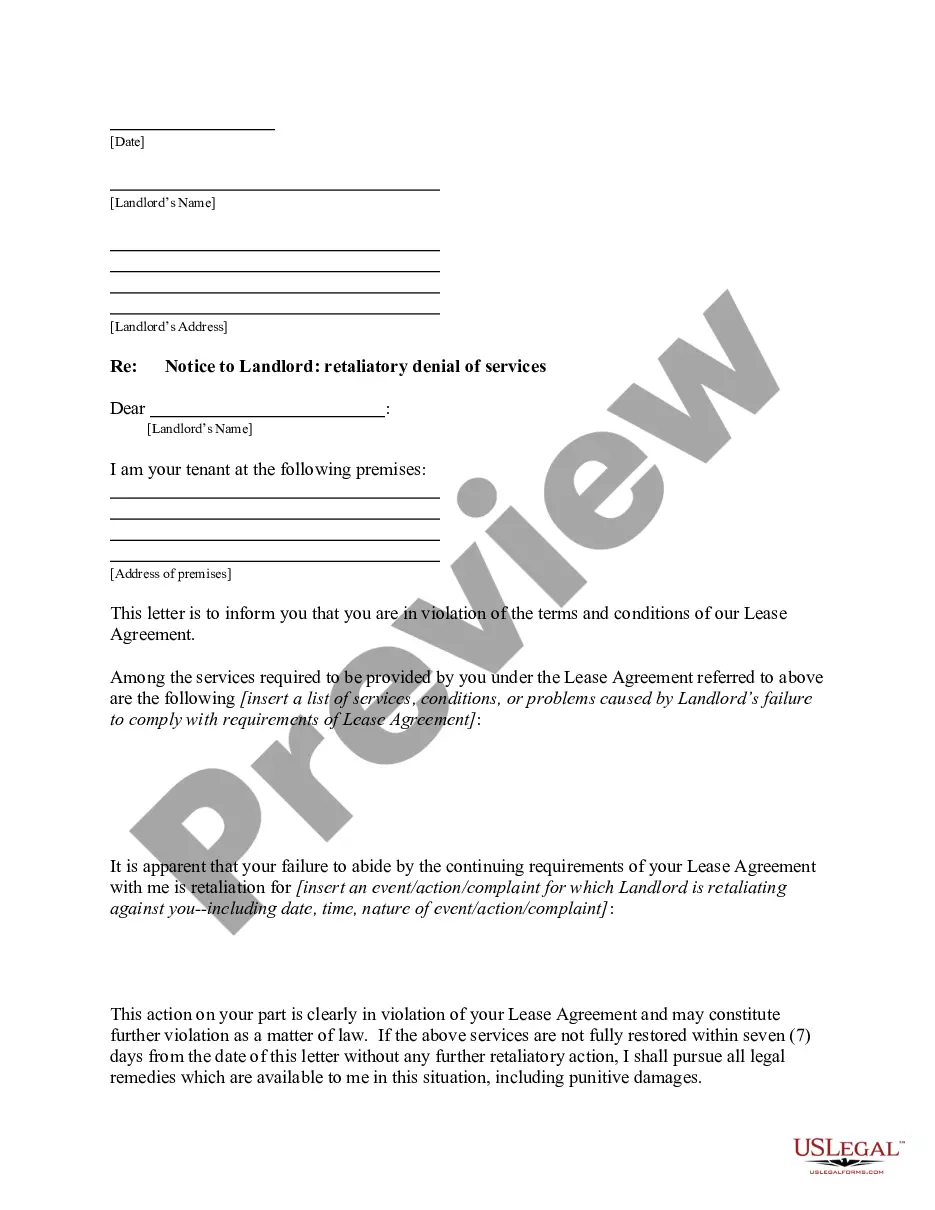

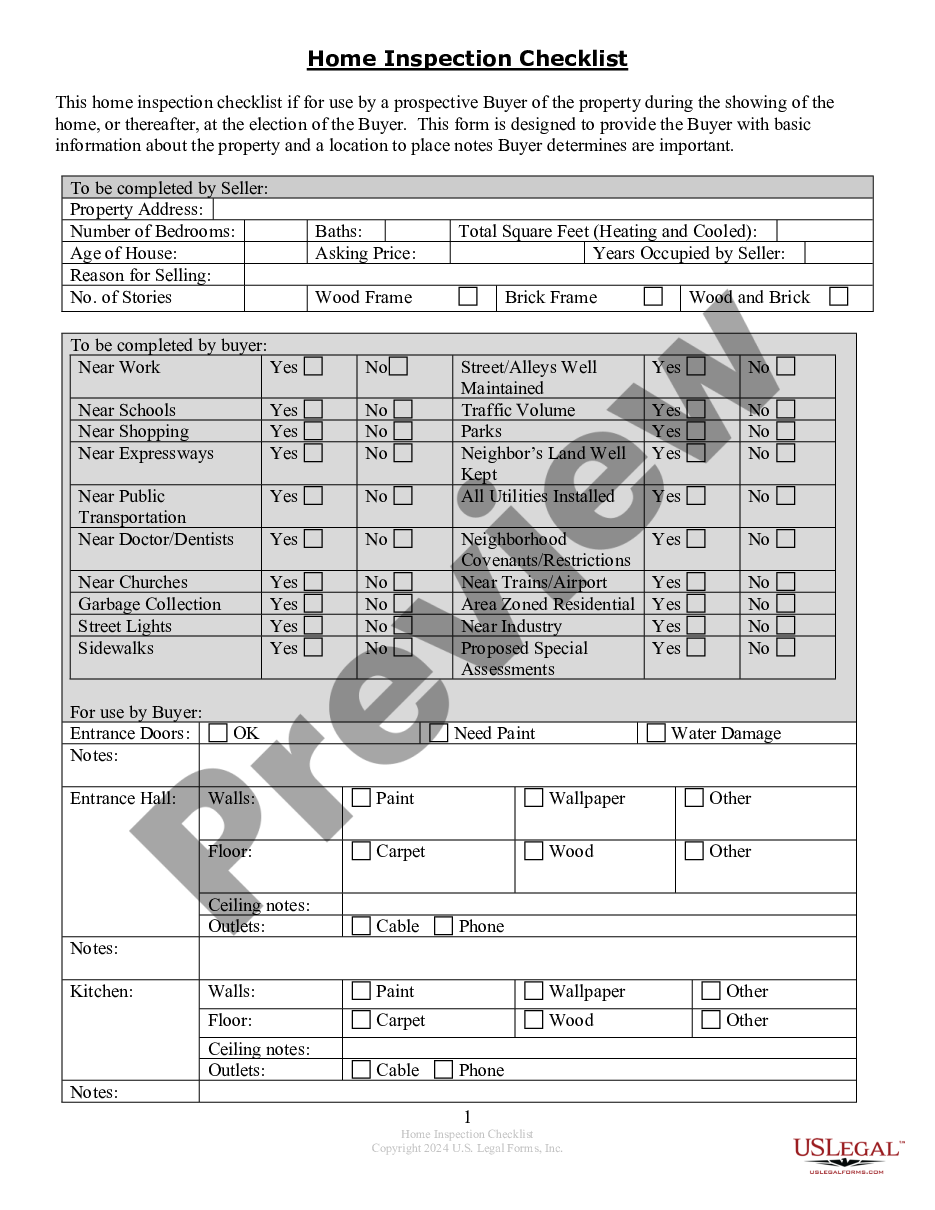

When you need to complete the Agreement Unmarried Couples With Child Rights following your local state's statutes, there may be various options to select from.

There's no requirement to inspect every document to ensure it meets all the legal prerequisites if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Utilizing expertly crafted formal documentation becomes easy with US Legal Forms. Moreover, Premium users can also take advantage of the advanced integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Consequently, when retrieving the Agreement Unmarried Couples With Child Rights from our platform, you can be assured that you possess a legitimate and current document.

- Acquiring the necessary sample from our site is quite simple.

- If you already have an account, just Log In to the platform, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents section in your profile and keep access to the Agreement Unmarried Couples With Child Rights at any time.

- If it's your first time using our library, please follow the instructions below.

- Browse the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

Claiming Children on Tax FormsOnly one parent can claim the children as dependents on their taxes if the parents are unmarried. Either unmarried parent is entitled to the exemption, so long as they support the child.

If a father is not named on the birth certificate, they have no legal rights regarding their child. However, the father can enter into a Parental Responsibility Agreement with the mother, which would give the father the same rights as the mother, or the father can apply to court for a Parental Responsibility Order.

The general rule in England and Wales is that it is the child's right to have access to both parents. Both the mother and the father have a right to care for the welfare of their child as well being responsible for their upbringing their child by providing them with food, shelter and clothes.

According to family law, the mother automatically gains custody of the child if she is unwed to the father. There is no need for unwed mothers to take legal actions to fight for the child's custodial rights, even the decision to determine the father's role in their child's life.

Under CA law, unmarried couples are fully separate individuals with separate finances. No new resources or assets are automatically considered jointly-owned, unless the parties choose to share income/assets. In the case of a split, these assets are equally divided.