Template For Unincorporated Association

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

There's no longer a necessity to squander hours looking for legal documents to satisfy your local state obligations.

US Legal Forms has assembled all of them in one location and made their accessibility more efficient.

Our platform offers over 85,000 templates for any business and personal legal scenarios categorized by state and area of application. All forms are professionally crafted and verified for authenticity, so you can be confident in obtaining an up-to-date Template For Unincorporated Association.

Make payment for your subscription using a credit card or via PayPal to continue. Choose the file format for your Template For Unincorporated Association and download it to your device. Print your form to complete it manually or upload the sample if you prefer to utilize an online editor. Creating formal paperwork under federal and state regulations is quick and straightforward with our platform. Try US Legal Forms now to keep your documentation organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is current before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time by navigating to the My documents tab in your profile.

- If you have never utilized our platform before, the process will require a few additional steps to complete.

- Here’s how new users can locate the Template For Unincorporated Association in our catalog.

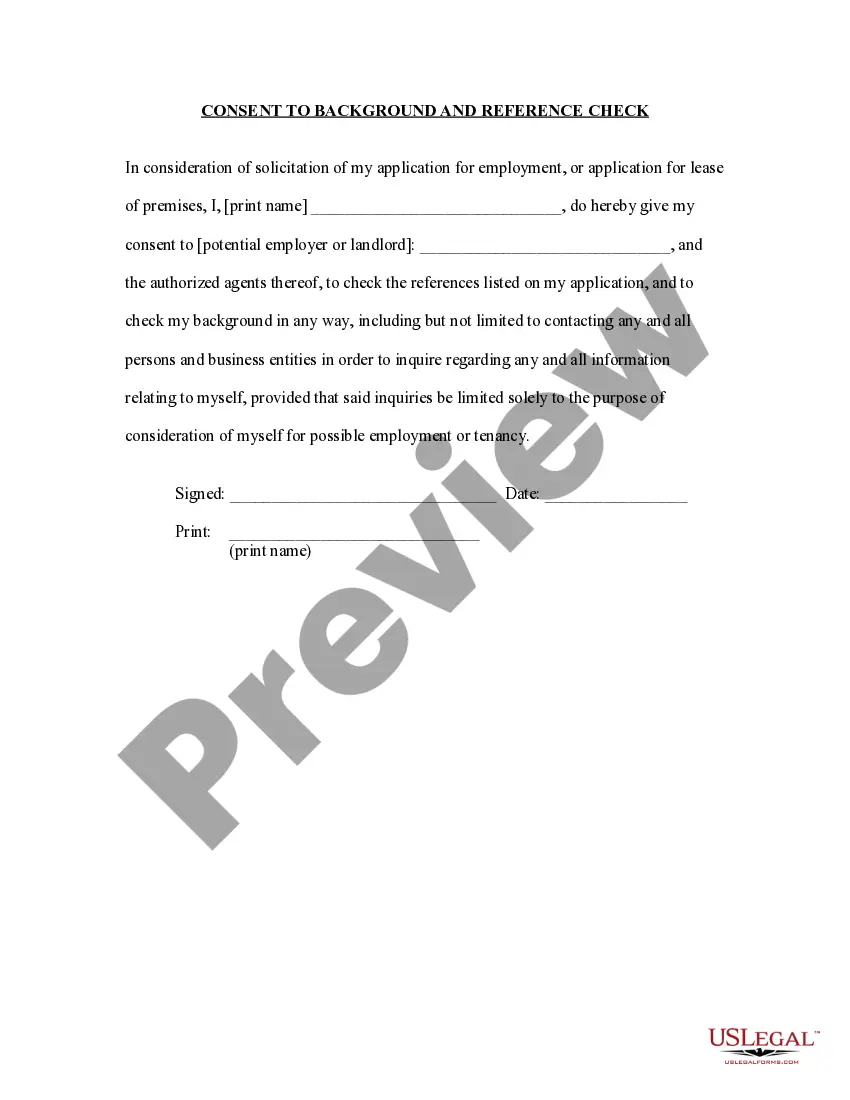

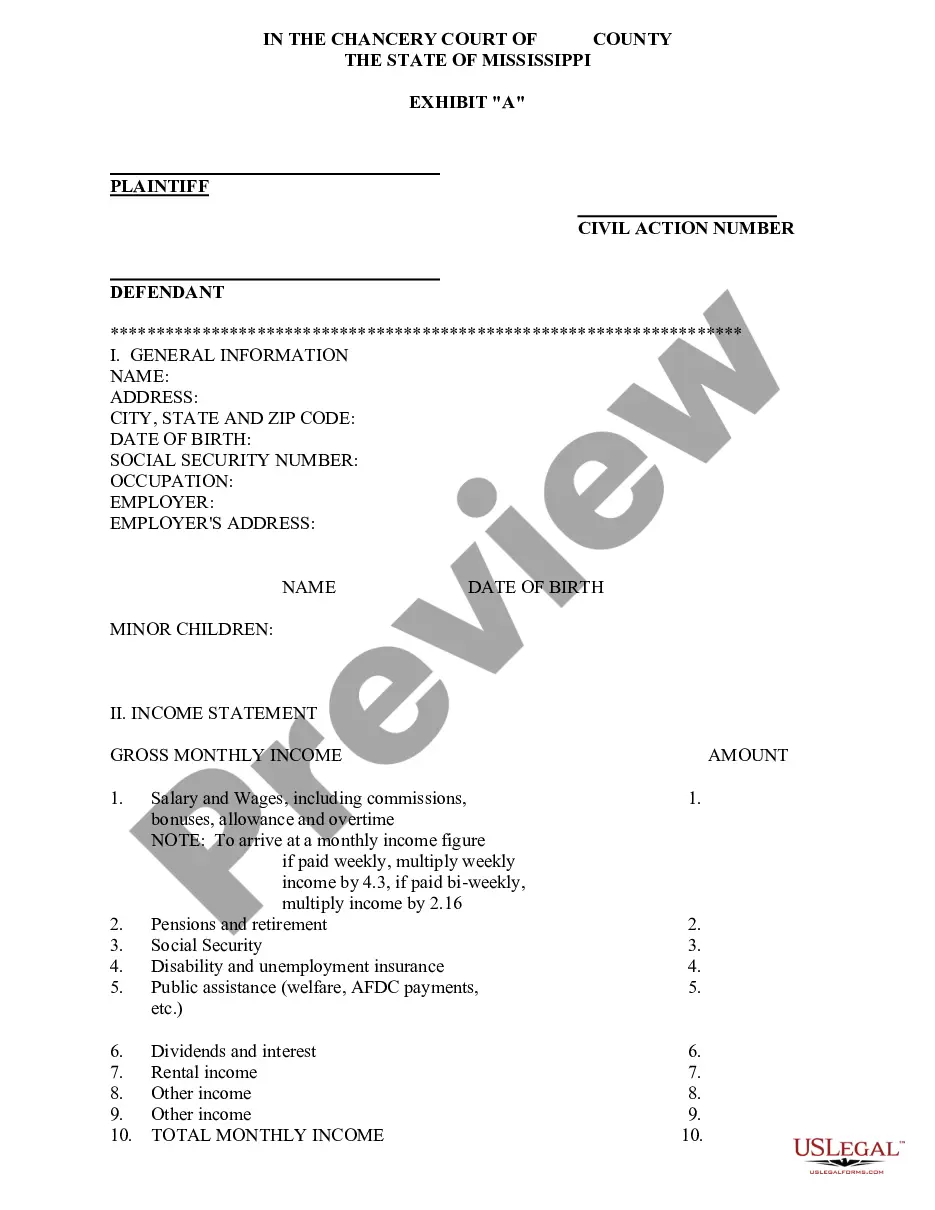

- Examine the page contents thoroughly to guarantee it includes the sample you need.

- To assist with this, utilize the form description and preview options, if available.

- Employ the Search field above to look for another template if the current one doesn’t meet your needs.

- Click Buy Now next to the template title once you find the appropriate one.

- Choose the preferred subscription plan and create an account or Log In.

Form popularity

FAQ

An unincorporated association does not have owners in the traditional sense like a corporation does. Instead, it is managed by its members, who collectively make decisions and share responsibilities. This structure fosters collaboration and community involvement. To streamline the formation process, consider utilizing a Template for unincorporated association, which helps clarify roles and responsibilities among members.

An unincorporated association typically does not need an Employer Identification Number (EIN) unless it meets specific criteria, such as having employees or operating as a tax-exempt organization. However, obtaining an EIN can simplify banking and identification purposes. Consider using a Template for unincorporated association to create the necessary documentation and determine if an EIN is appropriate for your needs.

Unincorporated associations do not typically file taxes as a separate entity. Instead, the income or losses are reported on the tax returns of the individual members. However, it is important to understand your specific tax obligations by consulting a tax professional. Using a Template for unincorporated association, you can better manage financial responsibilities and understand potential tax implications.

An unincorporated association is not the same as a non-profit organization, although both can serve similar purposes. An unincorporated association lacks formal incorporation, while a non-profit is legally recognized and may qualify for tax-exempt status. If you're considering forming one, a Template for unincorporated association can simplify the process. It helps you outline your goals, membership, and operational guidelines clearly.

Yes, unincorporated associations may need to file a tax return. If the association generates income or has certain financial activities, it is essential to follow IRS requirements. You should consider using a Template for unincorporated association to understand your filing obligations. This template can help streamline your documentation and ensure compliance with tax laws.

An unincorporated association may need an EIN for tax purposes, particularly if it has income or employees. If your group engages in taxable activities or needs to file certain forms, obtaining an EIN ensures compliance with IRS regulations. It's best to evaluate your association's activities to determine if an EIN is necessary. A comprehensive template for unincorporated association can help clarify your tax obligations.

An example of an unincorporated association could be a neighborhood book club, a sports team, or a local charity group. These groups come together with a shared interest or purpose but do not have formal incorporation. Understanding how these associations operate can be beneficial if you aim to create one. Using a template for unincorporated association can guide you in establishing your group.

A nonprofit organization is a specific legal structure recognized by the state and may qualify for tax-exempt status, whereas an unincorporated association is a looser group without separate legal status. Nonprofits are often more formally organized and have specific compliance requirements. In contrast, unincorporated associations focus on common goals without the same level of regulatory scrutiny. For clarity on these differences, a template for unincorporated association can be helpful.

The organizing document for an unincorporated association typically includes a constitution or bylaws that outline its purpose, structure, and operation. This document serves as a foundation, specifying rules for member participation, decision-making, and governance. Creating a clear template for unincorporated association ensures that all members understand their roles and responsibilities within the group.

Unincorporated associations are usually not required to file tax returns unless they generate significant income or engage in certain business activities. However, they must report income if they have tax liabilities. It's crucial to stay informed about the tax obligations relevant to your association. A template for unincorporated association can help clarify your potential filing requirements.