Ad valor em and specific duty are two important terms used in the context of international trade and taxation. Understanding these concepts is crucial for businesses and governments involved in import and export activities. In this article, we will delve into the definitions of ad valor em and specific duty, explore their differences, and highlight some different types of each. Ad valor em duty is a type of import duty or tax that is calculated as a percentage of the value of the goods being imported. The term "ad valor em" stems from the Latin phrase "according to value." This type of duty is levied on the assessed value of the goods, which is usually determined based on the transaction value or the customs value. The percentage rate of ad valor em duty varies depending on the product category and the country's customs regulations. The primary advantage of ad valor em duty is that it automatically adjusts according to the value of the imported goods. This means that as the value of the goods increases or decreases, the amount of duty payable also fluctuates proportionally. Consequently, countries often employ ad valor em duties to generate revenue and protect domestic industries simultaneously. There are various types of ad valor em duty, including specific ad valor em duty and compound ad valor em duty. Specific ad valor em duty refers to a specific percentage applied to the assessed value of the goods. For instance, if the specific ad valor em duty for a particular product category is 10%, and the customs value of the imported goods is $1,000, the duty payable would be $100 (10% of $1,000). On the other hand, compound ad valor em duty is a combination of both ad valor em and specific duty. It involves applying a percentage rate on top of a specific amount per unit. This method is often used for goods that require a higher level of protection or where certain cost components need to be factored in alongside the value of the goods. Now let's shift our focus to specific duty. Unlike ad valor em duty, specific duty is not based on the value of the goods. Instead, it is a fixed amount, often determined per unit of weight, volume, length, or quantity. Specific duty is commonly employed for goods that are considered essential or those that require stricter controls. Common examples include alcohol, tobacco, fuel, and firearms. Specific duty is less prone to value fluctuations, providing certainty in terms of the tax payable for both the importing business and the customs authorities. However, it lacks the flexibility of ad valor em duty in adjusting according to changes in the value of goods. Governments may utilize specific duty rates as a means to control consumption or to promote domestic production of specific goods, independent of their value. In conclusion, both ad valor em and specific duty play crucial roles in international trade, customs valuation, and revenue generation. Ad valor em duty is a percentage-based tax calculated on the value of imported goods, whereas specific duty is a fixed amount per unit. The choice between these types depends on various factors, including the nature of the goods, administrative ease, revenue needs, and trade policies. Understanding these concepts is essential for businesses engaged in global trade and policymakers striving for effective customs regulations.

Ad Valorem And Specific Duty

Description

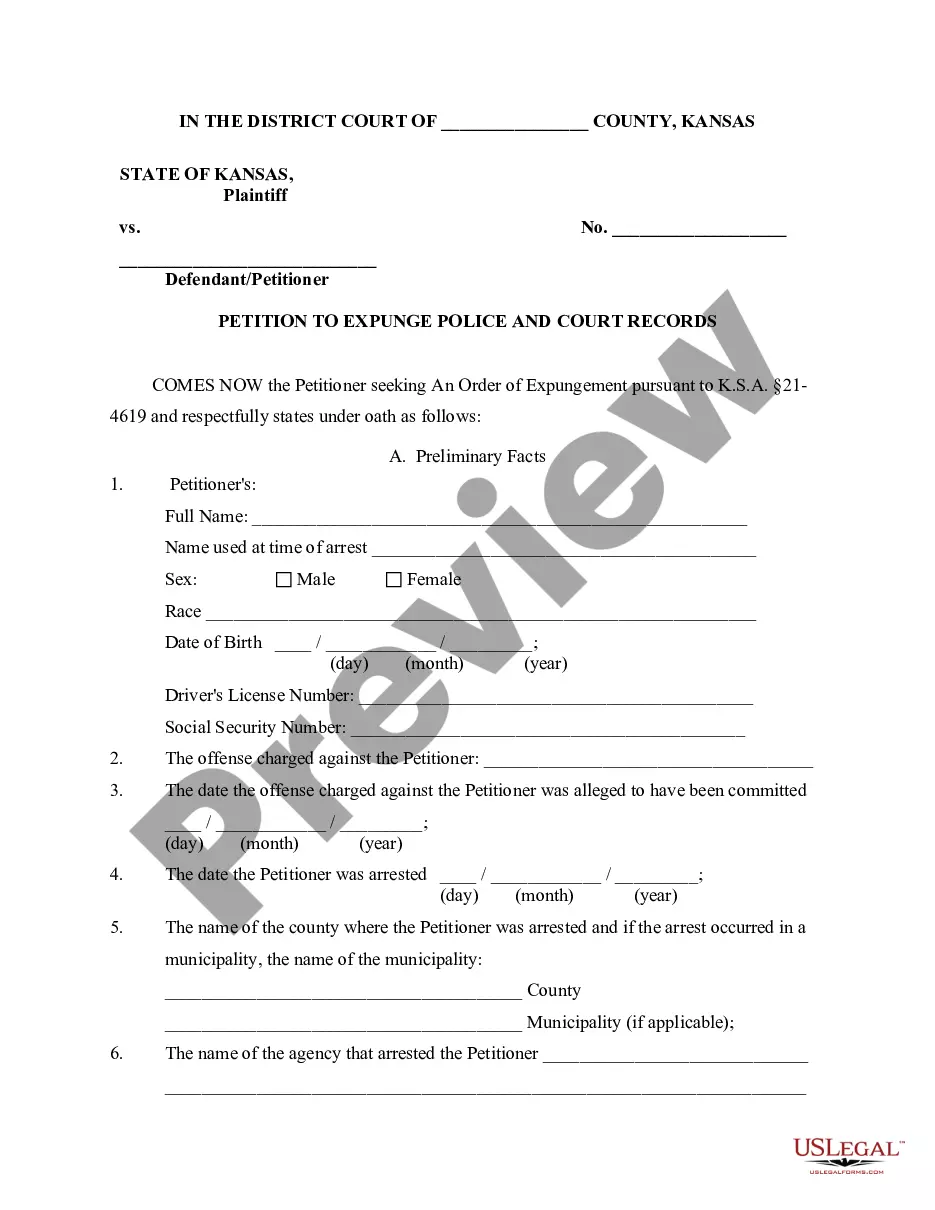

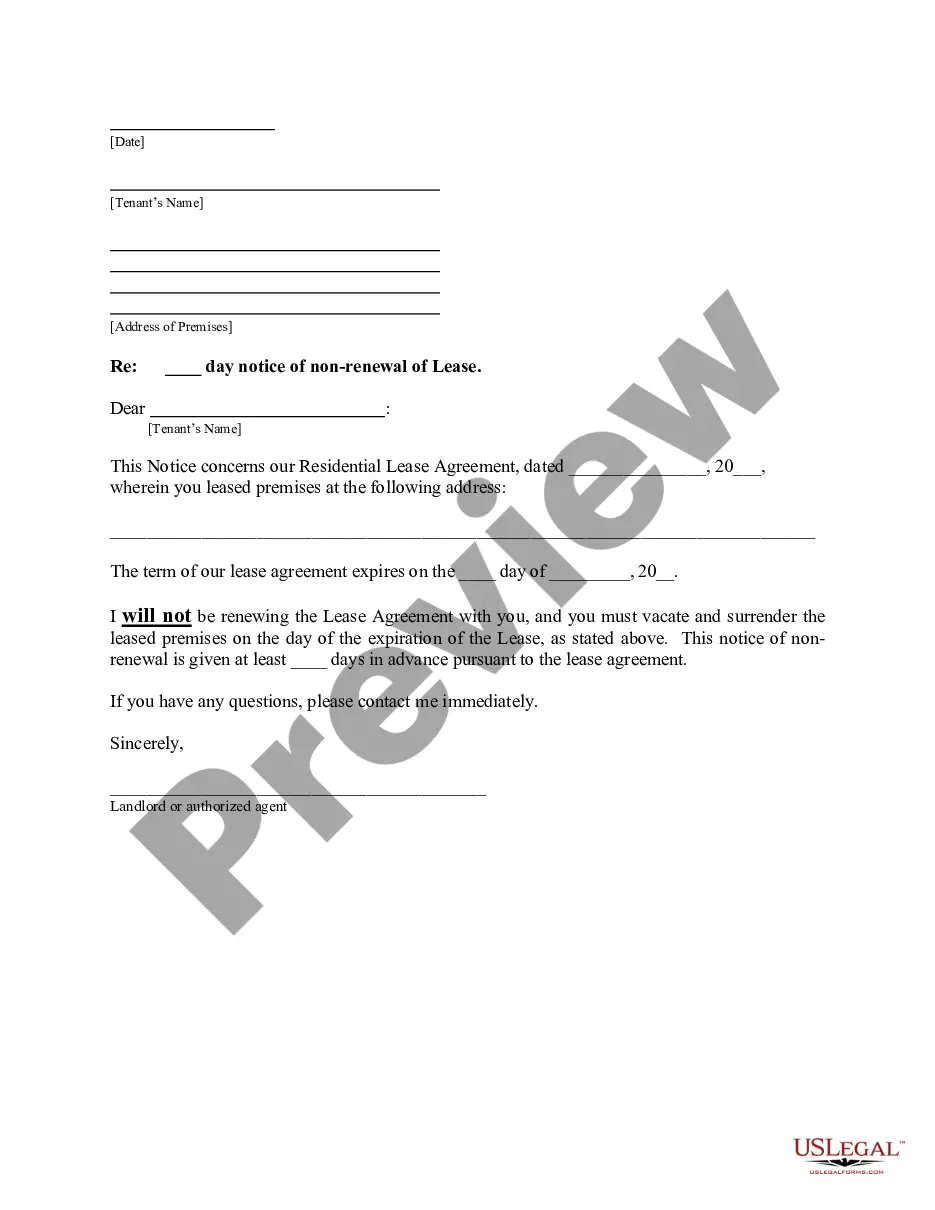

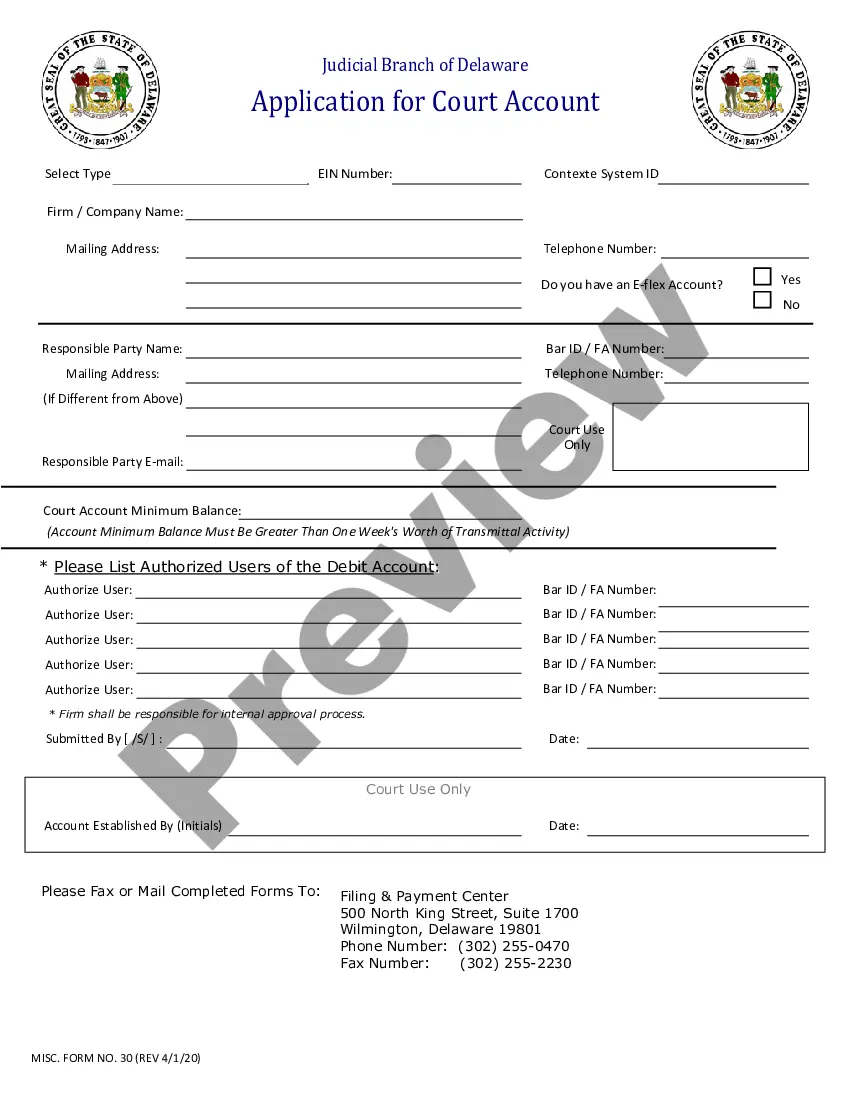

How to fill out Ad Valorem And Specific Duty?

Managing legal documents and processes can be a tedious addition to your day.

Ad Valorem And Specific Duty and similar forms often necessitate searching for them and comprehending the most effective way to fill them out accurately.

Thus, whether you're addressing financial, legal, or personal issues, having an extensive and user-friendly online repository of forms readily available will be highly beneficial.

US Legal Forms is the leading online resource for legal templates, offering more than 85,000 state-specific forms and a variety of tools to help you finalize your documents swiftly.

Is it your first time utilizing US Legal Forms? Register and create an account in just a few minutes to gain entry to the form library and Ad Valorem And Specific Duty. Then, follow these steps to complete your form: Ensure you have the correct form by using the Preview feature and examining the form details. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download and then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting users with their legal documentation. Locate the form you require today and streamline any process effortlessly.

- Discover the library of pertinent documents available to you with just a click.

- US Legal Forms equips you with state- and county-specific forms accessible anytime for download.

- Protect your document management activities with a premium service that allows you to compose any form in minutes without extra or hidden charges.

- Simply Log In to your account, search for Ad Valorem And Specific Duty, and obtain it instantly in the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

Ad valorem taxes are based on the value of property or goods, whereas special assessment taxes are typically levied for specific public projects that benefit property owners. This means that while ad valorem affects general taxation, special assessments are targeted and time-limited. Understanding these distinctions can help you navigate your tax responsibilities more effectively.

To get an ad valorem tax assessed, you may need to contact your local tax authority or a professional advisor who specializes in tax assessments. They will evaluate the value of your property or goods, which will determine the tax amount. Utilizing platforms like USLegalForms can help streamline the process and ensure you meet all necessary requirements for your assessments.

The specific method of valuation applies a fixed duty rate to goods, while the ad valorem method uses a percentage based on the value of the goods. This fundamental difference leads to varying calculations for duty owed. Depending on the nature of your goods, one method may be more beneficial than the other. Understanding these differences can be crucial when planning your import strategy.

The primary difference between specific duty and ad valorem duty lies in how they are calculated. Specific duty charges a fixed amount based on quantity, such as weight or volume, while ad valorem duty is expressed as a percentage of the total value of the goods. This distinction affects how businesses budget for costs related to importing. Familiarizing yourself with both types of duties can enhance your financial planning and import strategies.

A combination of specific and ad valorem duties is commonly referred to as a compound duty. This duty type aims to impose a fair tax burden by combining a fixed amount for quantity and a percentage based on value, thus ensuring equity in tax collection. By leveraging this approach, authorities can adapt to market changes and ensure adequate revenue. Understanding compound duties can assist businesses in effectively calculating expected costs for importing goods.

A combination of specific and mixed tariffs creates what is known as ad valorem tariffs, which are calculated as a percentage of the total value of imported goods. This approach ensures that tariffs reflect the current market value of products, offering a balanced method for revenue generation. By utilizing both specific and mixed tariff components, countries can effectively manage trade while generating revenue. With a clear understanding of these tariffs, businesses can strategize their import activities accordingly.

Ad valorem taxes are typically reported in the section for personal property on your tax return. These taxes are based on the assessed value of property, which means they directly impact your overall tax liability. When preparing your return, it is essential to include this information to ensure compliance with tax regulations. Understanding where to report these taxes can help you avoid any potential issues with tax authorities.

The difference between ad valorem and specific duty lies in their calculation methods. Ad valorem duties are determined by a percentage of the good's value, making them variable. In contrast, specific duties are a fixed amount per unit, providing predictability for importers. Knowing this distinction is crucial for anyone involved in international trade.

Ad valorem taxes are assessed based on the value of an asset or good, while specific taxes are fixed amounts irrespective of value. This means that an ad valorem tax may increase or decrease with asset value, while specific taxes remain constant. Recognizing these differences helps businesses in financial planning and compliance.

The primary difference between ad valorem and specific duties lies in how they are calculated. Ad valorem duties are percentage-based and vary with the item's value, while specific duties are flat fees per unit, independent of value. This distinction is significant for importers seeking to estimate their total costs and compliance.