Church Promissory Note For Payment

Description

How to fill out Promissory Note College To Church?

Navigating through the red tape of traditional documents and templates can be daunting, particularly if one does not engage in that professionally.

Even selecting the appropriate template to secure a Church Promissory Note For Payment can be labor-intensive, as it must be valid and accurate to the last detail.

Nevertheless, you will require considerably less time locating a suitable template from a trusted source.

Obtain the correct form in a few straightforward steps.

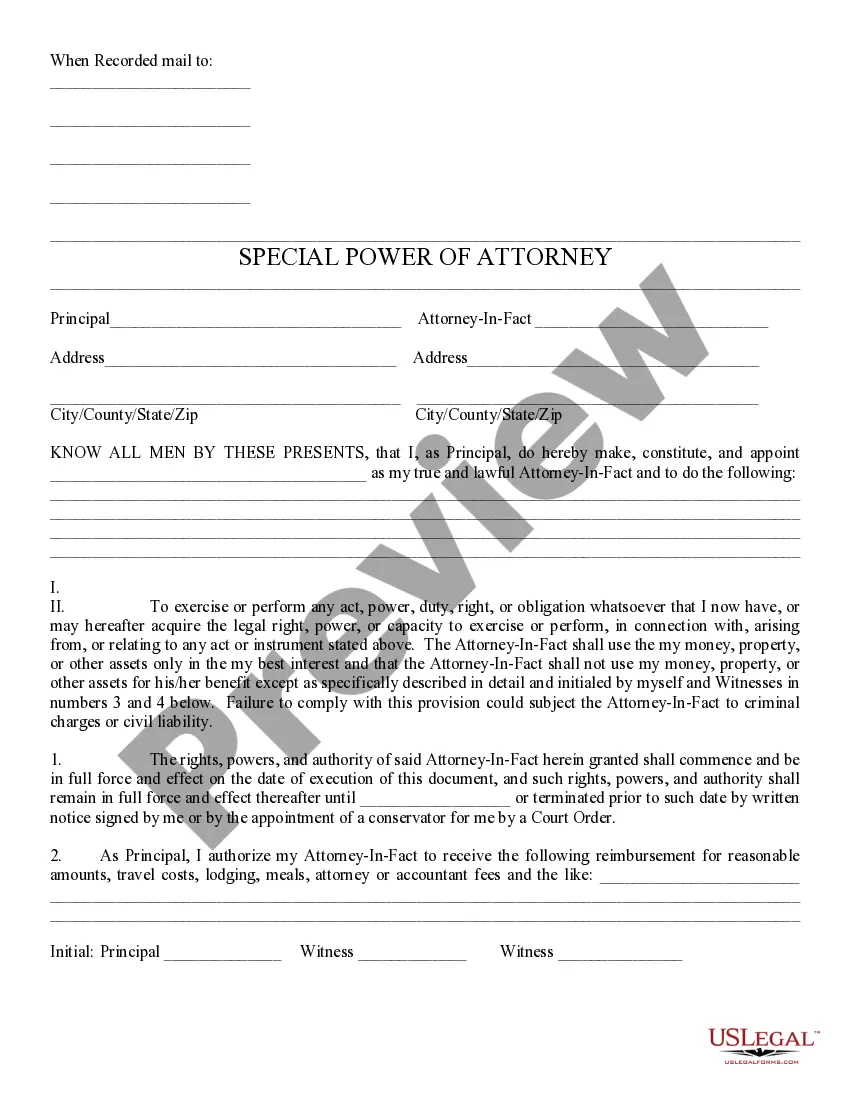

- US Legal Forms is a platform that streamlines the process of searching for the correct forms online.

- US Legal Forms is a single site where you can find the most recent samples of documents, consult their usage, and download these examples to complete them.

- It is a repository with over 85K forms applicable in various professional fields.

- Searching for a Church Promissory Note For Payment, you will not need to question its reliability as all the forms are validated.

- Creating an account at US Legal Forms will guarantee you have all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by simply clicking Log In on the library website.

- If you do not yet possess an account, you can always search anew for the template you require.

Form popularity

FAQ

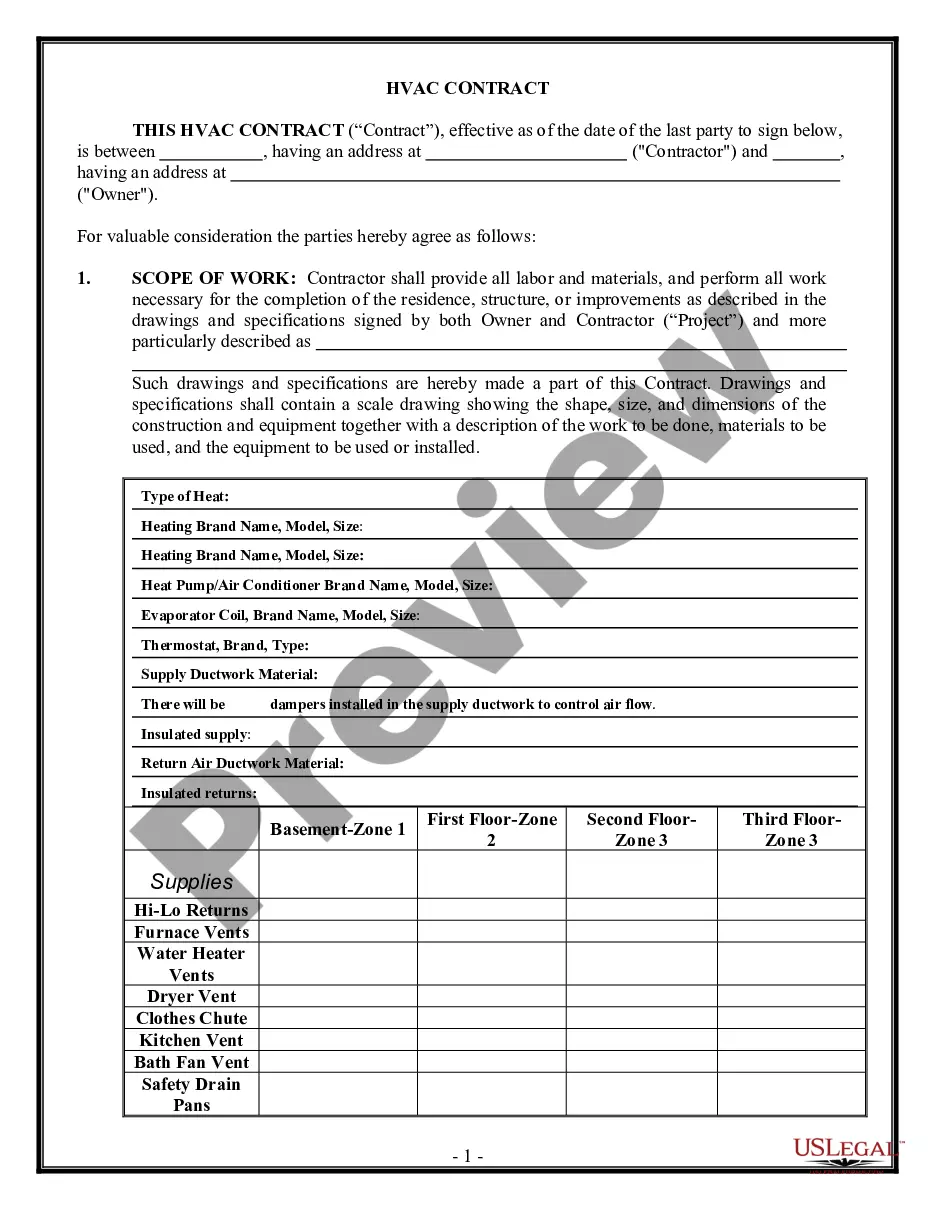

Important details any promissory note should state include the following:Payor or borrower : Include the name of the party who promised to repay the stated debt.Payee or lender : Include the name of the lender, the person or entity, lending the money.Date : List the exact date the promise to repay is effective.More items...

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.