Bankruptcies Tradução

Description

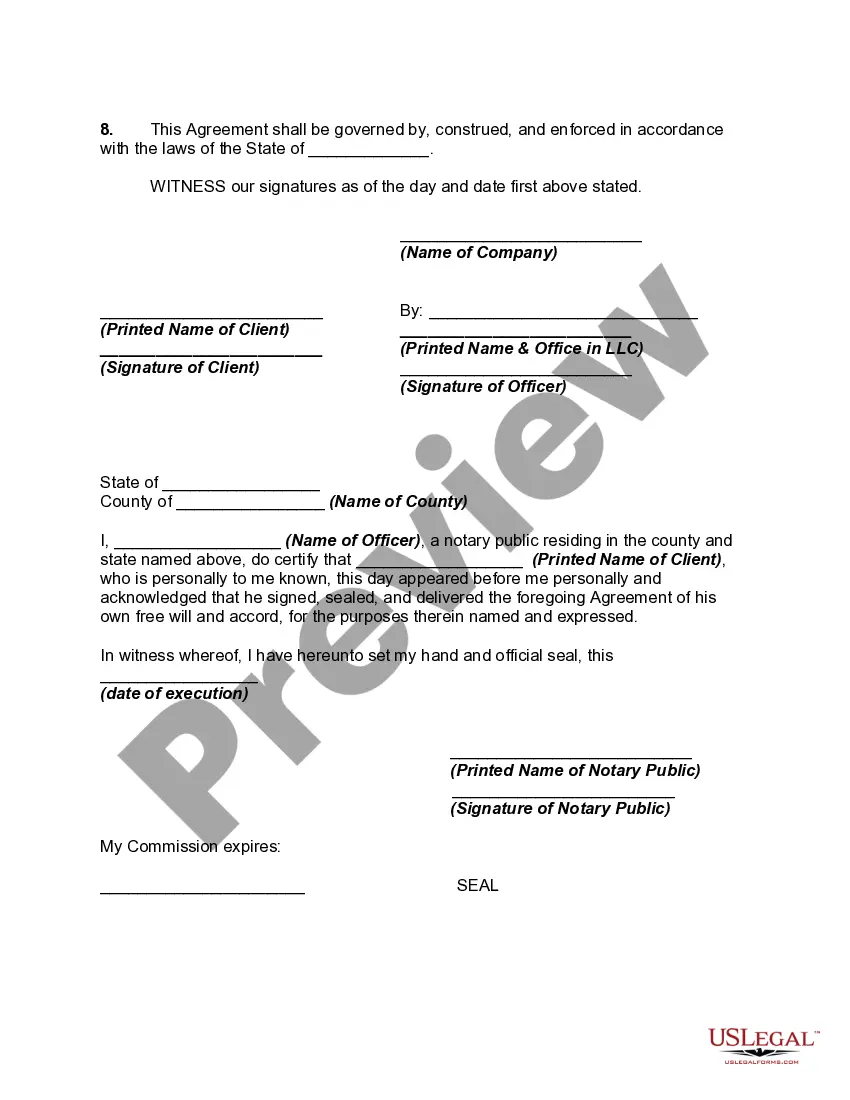

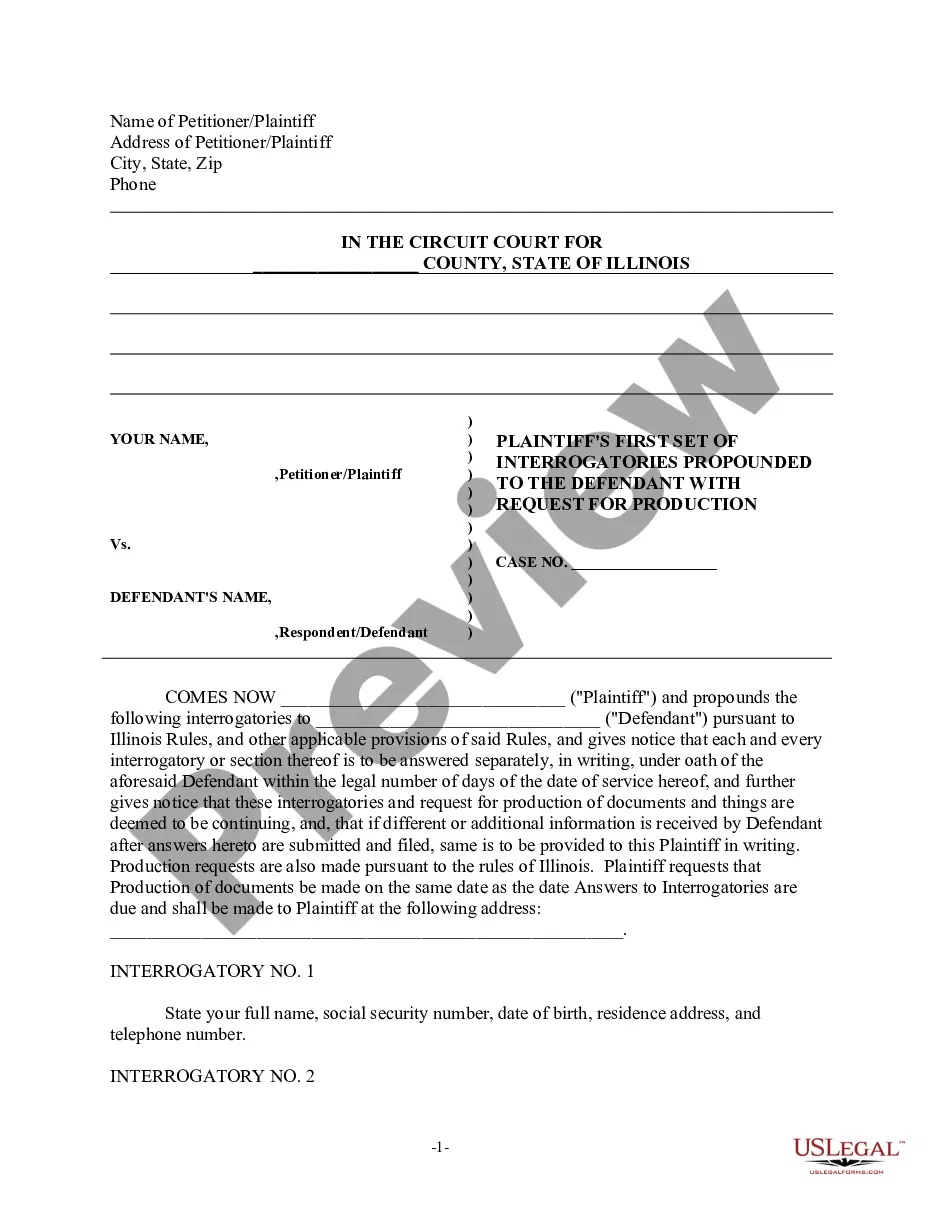

How to fill out Agreement To Attempt To Locate Unclaimed Property Of Client?

- If you're an existing user, log in to your account and check your subscription status.

- Browse the extensive library and find the form that meets your legal needs. Use the Preview mode to review the document's details.

- If necessary, search for alternative templates that better suit your requirements using the Search tab.

- Purchase the document by clicking on the 'Buy Now' button and select your preferred subscription plan.

- Complete your transaction with your credit card or PayPal information to finalize your subscription.

- Download the form to your device and access it anytime through the My Forms section in your profile.

By utilizing US Legal Forms, you gain access to a robust collection of over 85,000 customizable legal templates and expert assistance to ensure your documents are accurate and compliant.

Start leveraging the power of US Legal Forms today to streamline your legal paperwork. Explore the platform and discover how easy it can be!

Form popularity

FAQ

There are multiple reasons for individuals to consider filing bankruptcies. Primarily, people often seek relief from overwhelming debt, which can provide a fresh financial start. Additionally, filing for bankruptcy can stop creditor harassment and wage garnishments. Choosing to work with uslegalforms can clarify the reasons and advantages of pursuing this path effectively.

Several factors may disqualify you from filing Chapter 7 bankruptcies. If you have previously filed for bankruptcy and received a discharge, there are timing restrictions that apply. Moreover, if you have committed certain types of fraud or if your income surpasses the state median, you may not qualify. Understanding these criteria can reduce confusion, and uslegalforms can guide you through the specific requirements.

To file bankruptcies, you must meet certain eligibility criteria. Primarily, your financial situation should reflect an inability to repay debts. This often involves showing that your debts exceed your income and that you lack assets to cover those debts. Additionally, you can benefit from using resources through platforms like uslegalforms, which provide clear guidelines on the process.

Disqualifications for filing bankruptcies can arise from various scenarios. For example, if you have filed for bankruptcy multiple times, or if you recently received a discharge in a bankruptcy case, you may face barriers. Additionally, failing to complete the required credit counseling can prevent you from filing. It is essential to explore your options with tools related to bankruptcies tradução for a clearer understanding of your situation.

Filing for Chapter 7 bankruptcy may lead to losing certain non-exempt assets, such as luxury items or second homes. However, many people keep essential assets like their home, car, and personal belongings due to state exemptions. Before proceeding, assess what you might lose versus the relief that bankruptcies tradução can provide. You can get valuable insights through resources available on uslegalforms.

While there is no specific minimum debt requirement to file for Chapter 7 bankruptcy, having significant unsecured debts, such as credit cards, can strengthen your case. Courts primarily look at your overall financial situation to determine eligibility. If you are considering this path, remember that understanding the implications of bankruptcies tradução can help you make informed decisions regarding your financial future.

The debt to income ratio is a critical factor when filing for Chapter 7 bankruptcy. Generally, a ratio above 40% can raise red flags during the application. Lenders and courts assess this ratio to evaluate your ability to repay debts. To navigate this aspect smoothly, consider how bankruptcies tradução can be explored on platforms like uslegalforms, to guide you through your financial journey.

Several factors could disqualify you from filing Chapter 7 bankruptcy. These include having a high income that exceeds the state median, previous bankruptcy filings, or failing the means test. If you've previously received a discharge under Chapter 7, you may also not qualify. Understanding these factors is crucial, especially when discussing the nuances of bankruptcies tradução.