Executor Beneficiary Waiver Form California

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

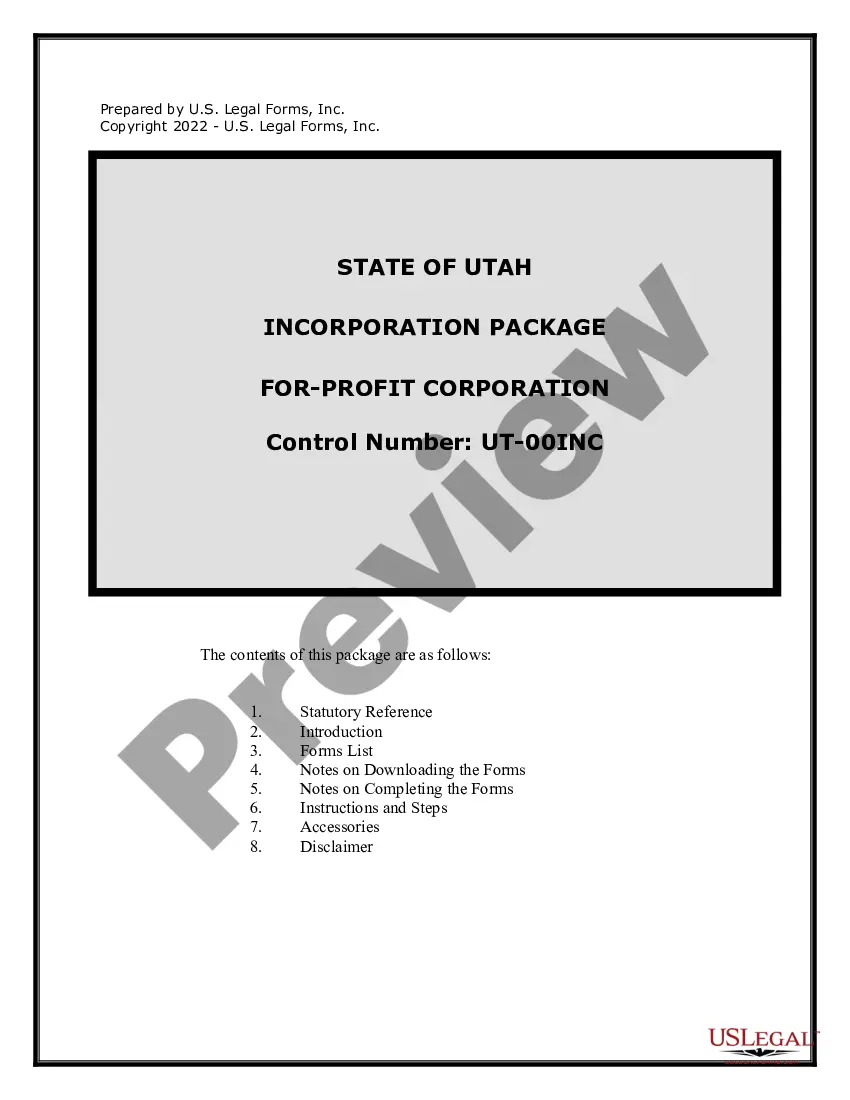

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more affordable way of preparing Executor Beneficiary Waiver Form California or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of over 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-compliant forms carefully prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Executor Beneficiary Waiver Form California. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Executor Beneficiary Waiver Form California, follow these recommendations:

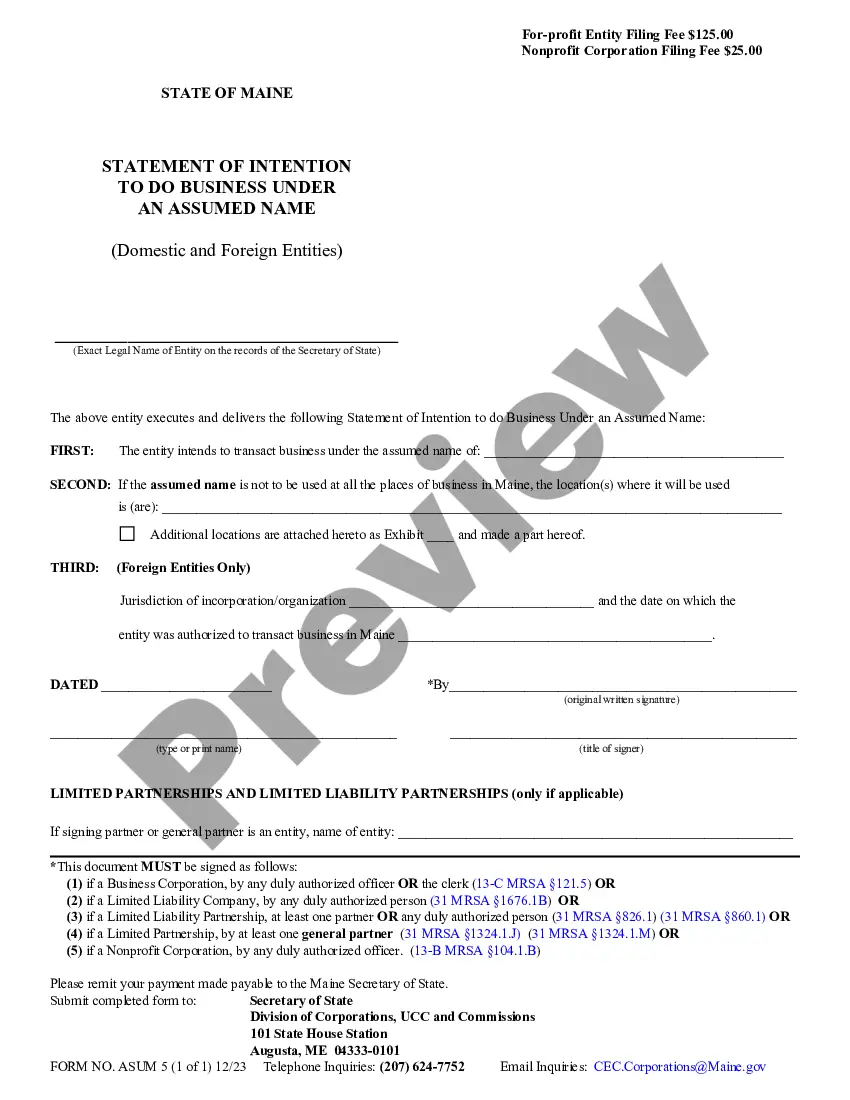

- Review the document preview and descriptions to ensure that you have found the form you are looking for.

- Check if template you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to get the Executor Beneficiary Waiver Form California.

- Download the form. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and turn document execution into something simple and streamlined!

Form popularity

FAQ

If you are eligible to receive part of an estate (the property of a deceased person), tell the court that you want to waive (give up) the requirement that the estate's personal representative (the person named as executor in the deceased person's will or the person appointed by the court to manage the estate of a ...

Specifically, the personal representative must list their name, address, and phone number in the probate form. Next, the representative must fill in the probate court name and location. In the Petition for Section, if the decedent has a will, the personal representative will mark one of the first two boxes.

Yes, the executor of the estate also can be a beneficiary of the will, and often is. Many people will select one of their grown children to be their executor. Children are primarily the beneficiaries of parents' wills. In California, an executor must be at least 18 years old and of sound mind.

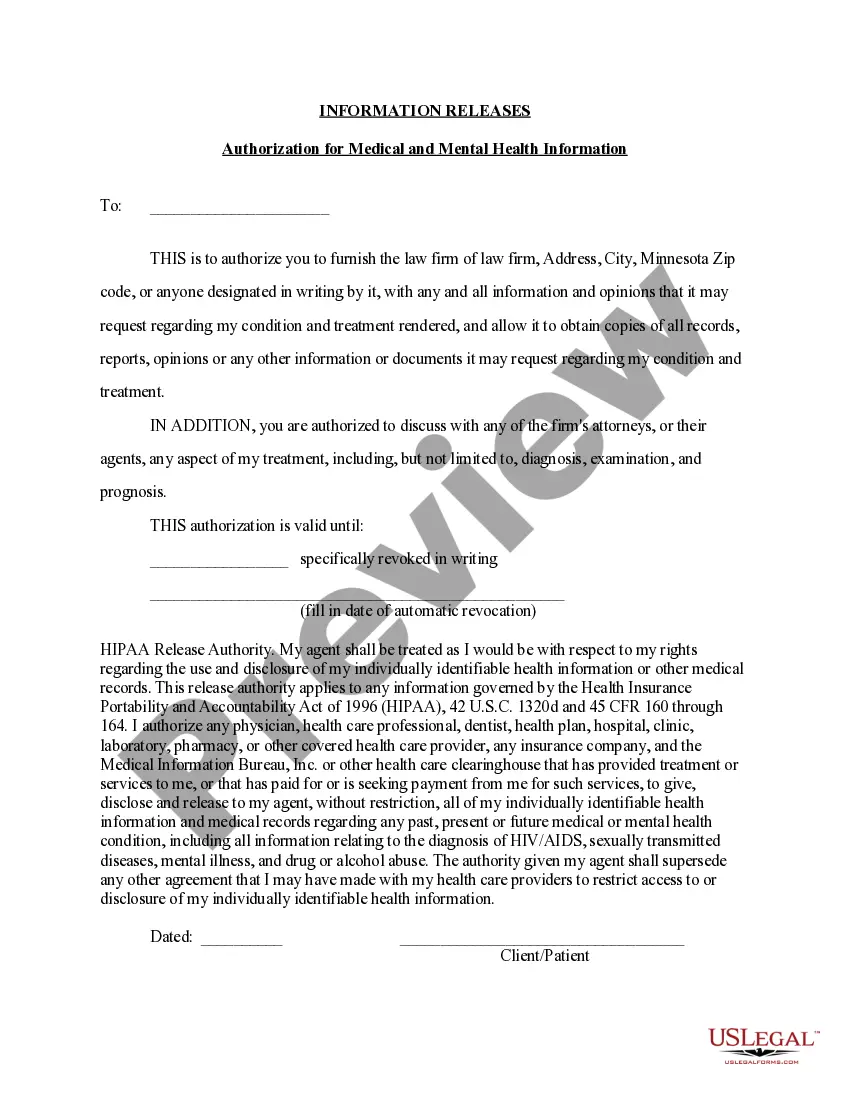

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements.

The executor must prepare a full accounting with the court, and beneficiaries should be provided with a copy. ing to the California Probate Code, an accounting should include the following information: The property and value of the estate at the beginning of the accounting period.