Executor Beneficiary Waiver For Estate

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Whether for business purposes or for individual affairs, everyone has to manage legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, starting with choosing the correct form template. For instance, when you pick a wrong edition of the Executor Beneficiary Waiver For Estate, it will be turned down once you submit it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you have to get a Executor Beneficiary Waiver For Estate template, stick to these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and region.

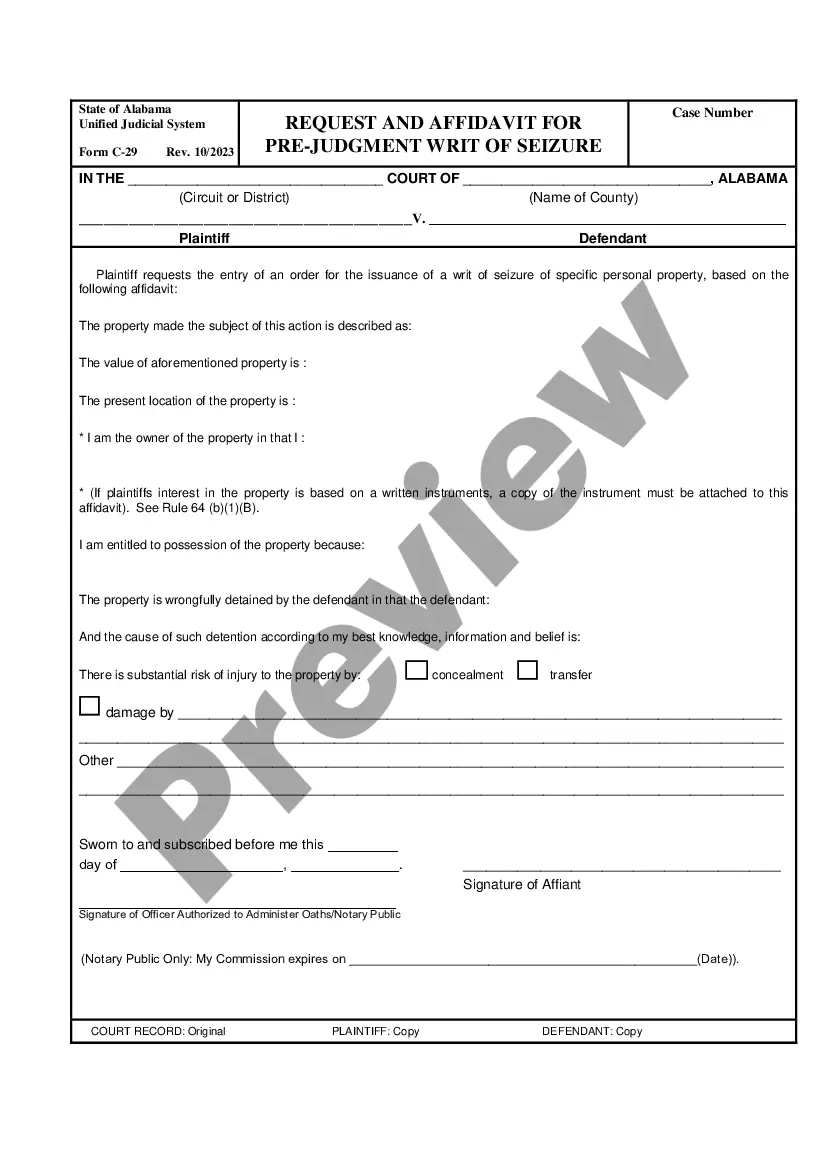

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to locate the Executor Beneficiary Waiver For Estate sample you need.

- Get the file when it matches your needs.

- If you have a US Legal Forms profile, just click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Executor Beneficiary Waiver For Estate.

- Once it is saved, you are able to complete the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the internet. Make use of the library’s easy navigation to find the appropriate form for any situation.

Form popularity

FAQ

An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated obligations. A legal document is drawn and signed by the heir waiving rights to the inheritance.

The Waiver and Consent is used to speed up the process when everybody agrees that the Will is valid and that the Will should be admitted to probate. If every distributee signs this Waiver and Consent it can save the estate significant time and expense.

If you are eligible to receive part of an estate (the property of a deceased person), tell the court that you want to waive (give up) the requirement that the estate's personal representative (the person named as executor in the deceased person's will or the person appointed by the court to manage the estate of a ...

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

A beneficiary can override an executor if the executor fails to follow the terms of the Will. Beneficiaries can override an executor if the executor breaches their fiduciary duty. A beneficiary who simply disagrees with an executor or does not like the executor's decisions cannot override the executor.