Executor Beneficiary Things With Your Mind

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

It’s well known that you can’t immediately become a legal expert, nor can you quickly master how to efficiently prepare Executor Beneficiary Documents With Your Mind without possessing a particular set of abilities. Compiling legal documents is a lengthy process that demands specific training and expertise. So why not entrust the preparation of the Executor Beneficiary Documents With Your Mind to the experts.

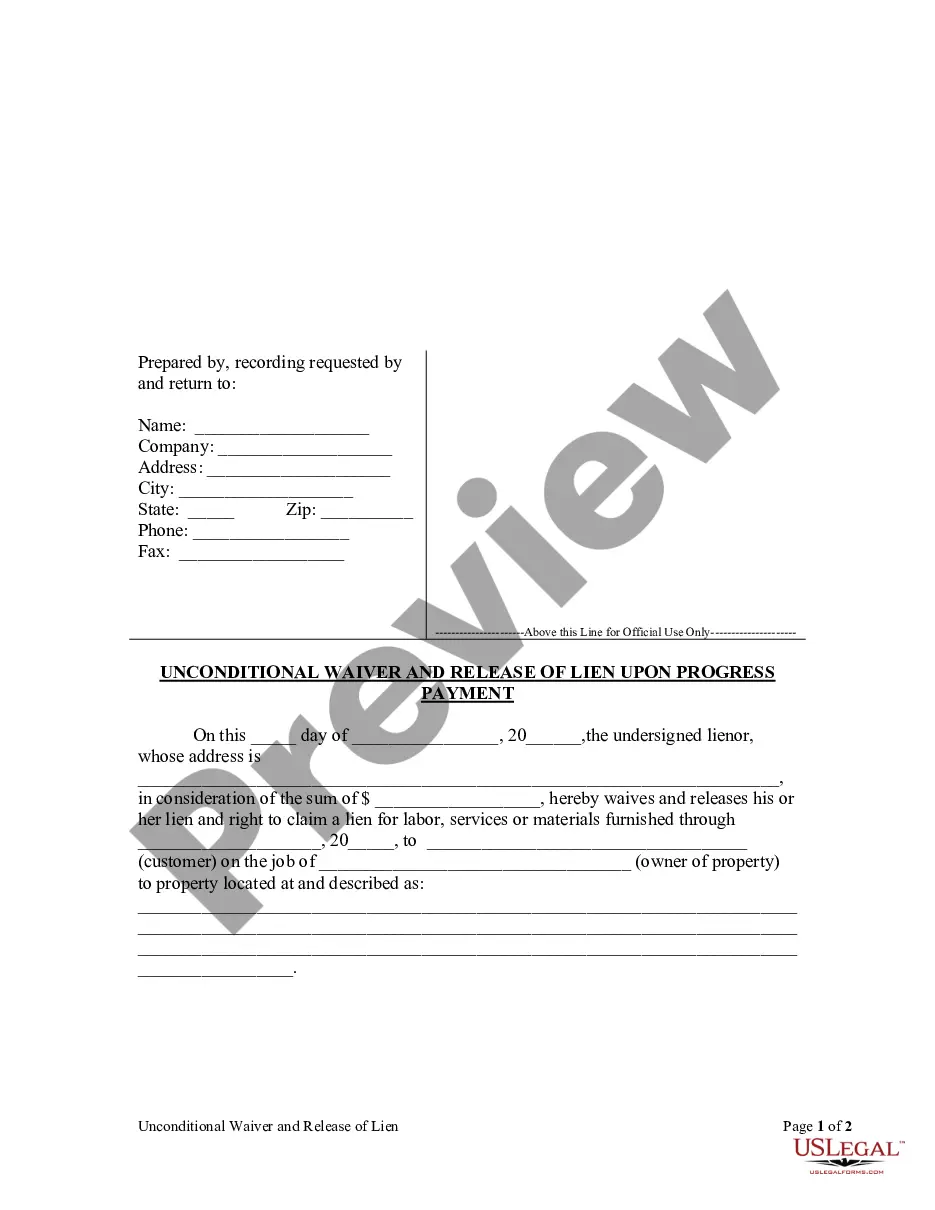

With US Legal Forms, one of the largest legal document repositories, you can find everything from court papers to templates for office correspondence. We recognize the significance of compliance and adherence to federal and state laws and regulations. That’s why, on our site, all templates are location-specific and current.

Here’s how to get started with our website and obtain the document you need in just a few minutes.

You can re-access your forms from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your forms—whether it’s financial and legal, or personal—our website has what you need. Try US Legal Forms today!

- Find the document you require by using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Executor Beneficiary Documents With Your Mind is what you need.

- Begin your search again if you require a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the transaction is complete, you can acquire the Executor Beneficiary Documents With Your Mind, fill it out, print it, and send or mail it to the necessary individuals or entities.

Form popularity

FAQ

What information should an Executor provide to a Beneficiary? Beneficiaries should be provided with general information about the estate and the assets involved and also a copy of the Will should they request one.

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty. However, the beneficiary of a Will is very different than an individual named in a beneficiary designation of an asset held by a financial company.

Yes, in their capacity as the people who handle deceased's estates and execute their Wills, executors can move funds from a deceased's bank account to an estate account and take from it to pay estate debts, taxes, etc., but not as their own.

If an executor in California commits misconduct while handling the estate of a deceased person, the heirs and beneficiaries may be able to get their rightful assets back by filing a lawsuit against the executor.

To ensure the executor remains honest over the course of administration, beneficiaries should make it a point to play an active role in administration. They should be familiar with the contents of the will, the nature of their inheritance, the duties of the executor and the steps of the administration process.