Executor Beneficiary Form For Trust

Description

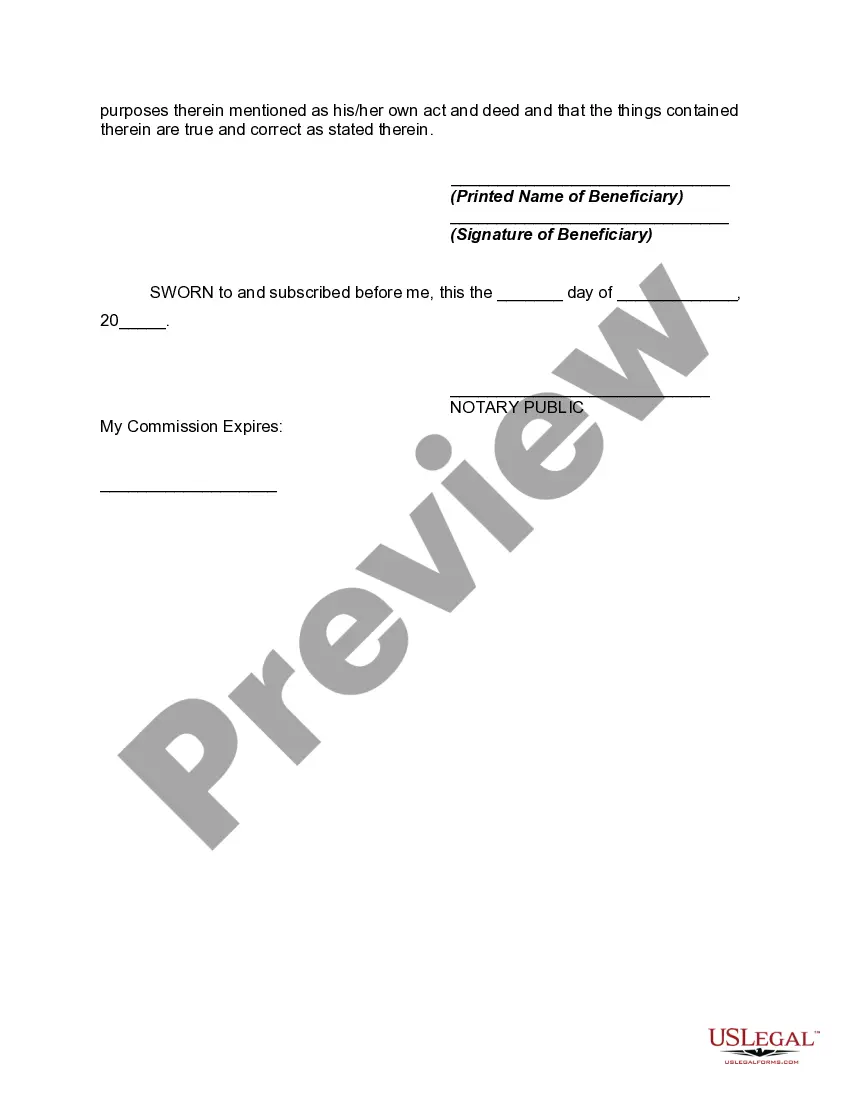

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

It’s obvious that you can’t become a law professional immediately, nor can you grasp how to quickly prepare Executor Beneficiary Form For Trust without having a specialized set of skills. Creating legal documents is a time-consuming process requiring a specific education and skills. So why not leave the preparation of the Executor Beneficiary Form For Trust to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Executor Beneficiary Form For Trust is what you’re looking for.

- Start your search again if you need any other form.

- Register for a free account and select a subscription plan to purchase the form.

- Choose Buy now. Once the payment is complete, you can download the Executor Beneficiary Form For Trust, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

A trust can give you more control over how your assets are distributed. You can name a trust as a direct beneficiary of an account. Upon your death, your assets transfer to the trust and distributions are made from the trust to its beneficiaries ing to your wishes.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.

A primary beneficiary is the first person you name to receive the proceeds from your insurance policy upon your death. You can designate 100% of the proceeds to one primary beneficiary or you can divide the proceeds among multiple primary beneficiaries.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.