Executor Beneficiary Form For Life Insurance

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

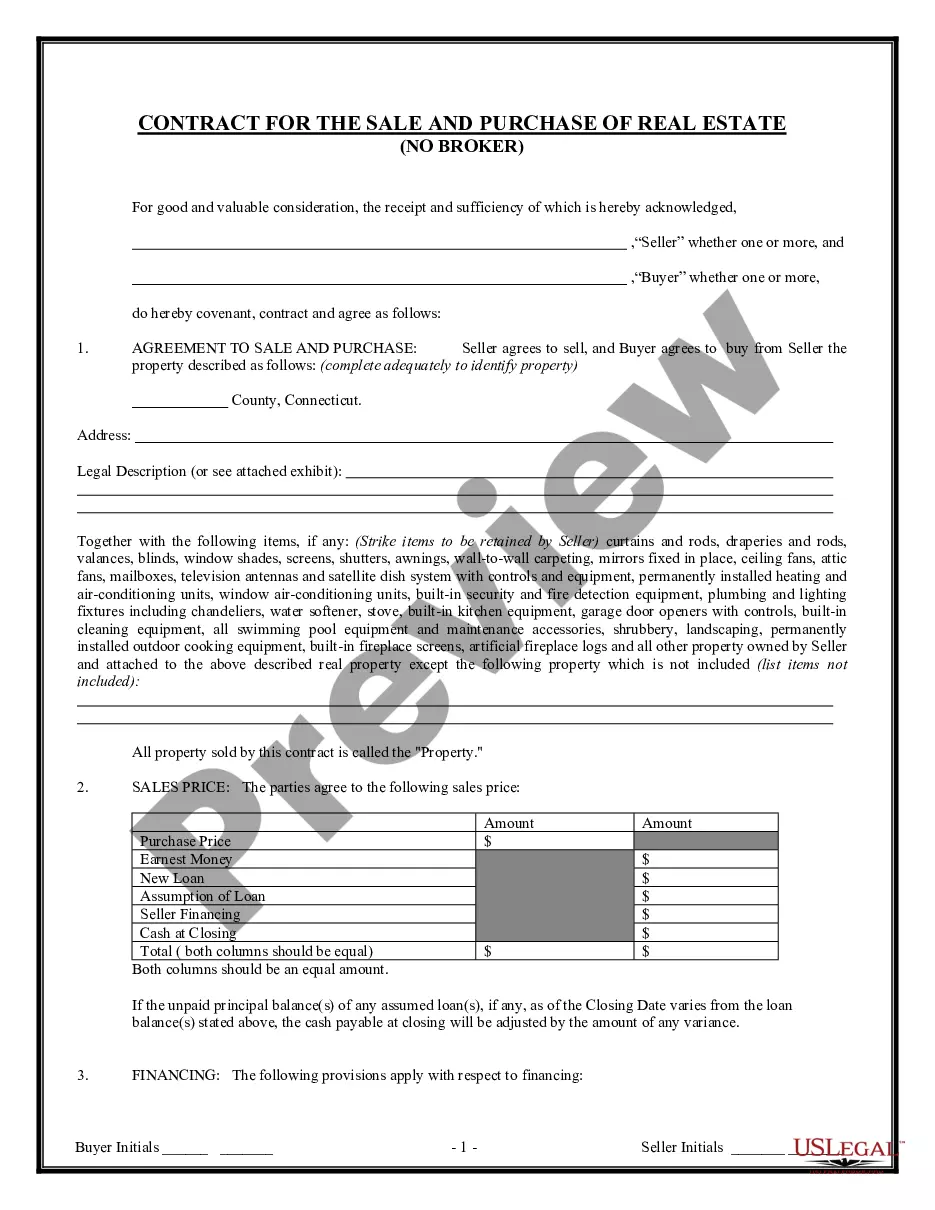

Handling legal paperwork and operations could be a time-consuming addition to your day. Executor Beneficiary Form For Life Insurance and forms like it often require you to look for them and navigate the way to complete them correctly. As a result, whether you are taking care of financial, legal, or personal matters, using a thorough and practical online library of forms when you need it will go a long way.

US Legal Forms is the best online platform of legal templates, featuring over 85,000 state-specific forms and numerous tools to help you complete your paperwork easily. Discover the library of relevant papers available to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Safeguard your papers management procedures by using a high quality support that allows you to put together any form within minutes without any extra or hidden fees. Just log in in your profile, find Executor Beneficiary Form For Life Insurance and download it straight away from the My Forms tab. You can also gain access to previously saved forms.

Would it be the first time utilizing US Legal Forms? Sign up and set up up an account in a few minutes and you’ll have access to the form library and Executor Beneficiary Form For Life Insurance. Then, stick to the steps below to complete your form:

- Make sure you have the right form by using the Preview option and reading the form information.

- Choose Buy Now when all set, and select the subscription plan that meets your needs.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise supporting users control their legal paperwork. Obtain the form you require today and streamline any operation without having to break a sweat.

Form popularity

FAQ

By listing the estate as the beneficiary of the life insurance policy, the proceeds become an asset of the probate estate and subject to the claims of creditors. Probate. Assets that are titled in your individual name upon death or in the name of your estate will require probate to collect and distribute the assets.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.

Executors are bound to the terms of the will, which means that they are not permitted to change beneficiaries. The beneficiaries who were named by the decedent will remain beneficiaries so long as the portions of the will in which they appear are not invalidated through a successful will contest.

Name only living persons as beneficiaries, unless you are naming a trust, your estate or an organization. Do not name the same person or organization as both a primary and secondary beneficiary. Do not use the word ?or? when designating multiple beneficiaries. Do not impose any conditions on payment.