Avoid Lien Foreclosure

Description

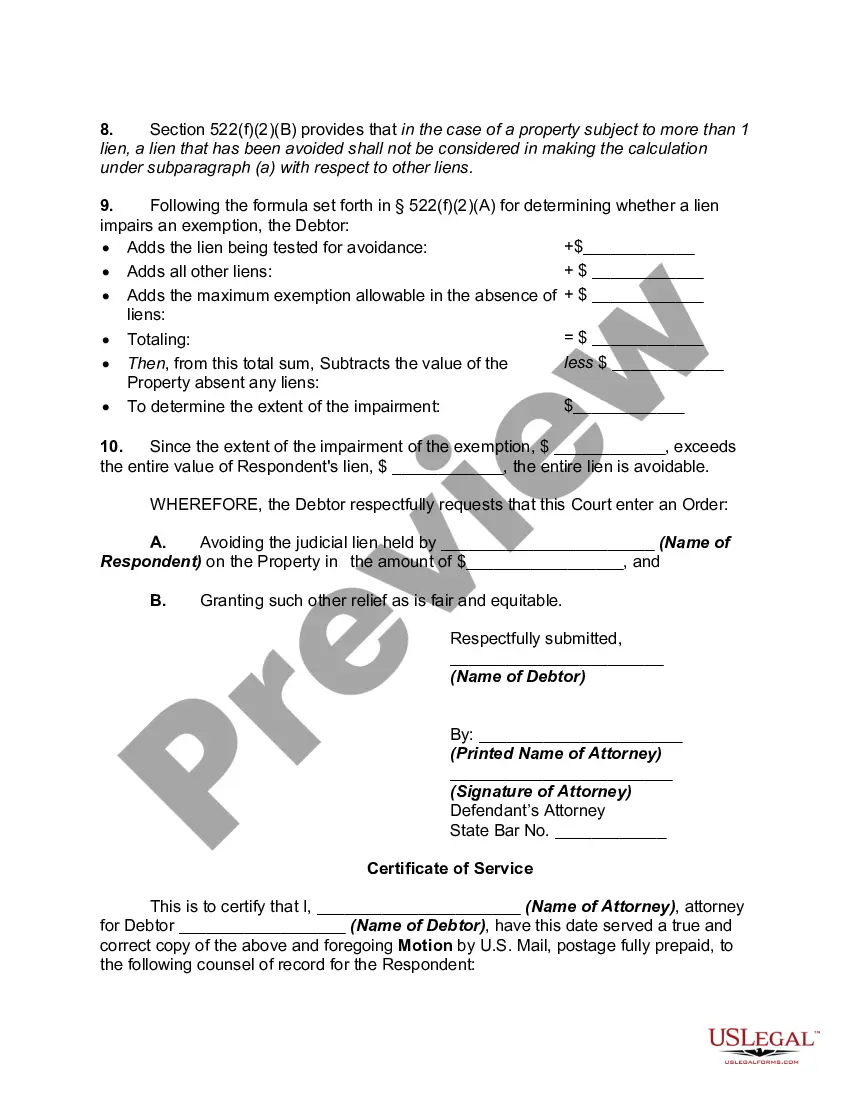

How to fill out Motion To Avoid Creditor's Lien?

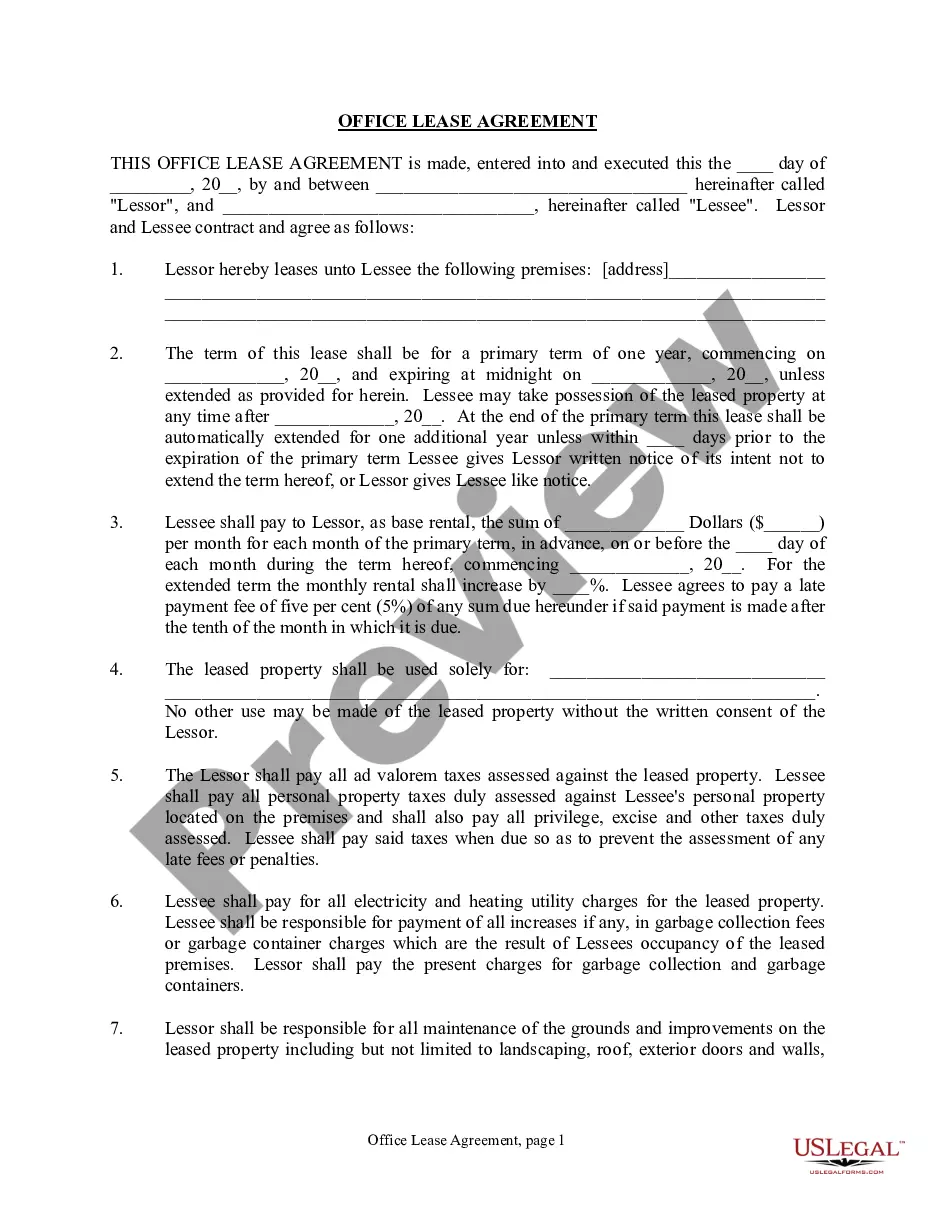

The Prevent Lien Foreclosure you see on this webpage is a versatile legal template crafted by expert attorneys according to federal and state standards.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation.

Select the format you desire for your Prevent Lien Foreclosure (PDF, DOCX, RTF) and save the document on your device.

- Search for the document you require and examine it.

- Browse through the sample you located and preview it or review the form description to ensure it meets your needs. If it doesn't, use the search feature to find the correct one. Click Buy Now once you have found the template you require.

- Subscribe and Log In.

- Choose the payment plan that works for you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

You will need the following forms for a Motion to Modify: Family and Probate Matter Summary Sheet (FM-002); Social Security Number Confidential Disclosure Form (CR-CV-FM-PC-200); Motion to Modify (FM-062); Acknowledgment of Service (two copies) (CV-036); and. Child Support Affidavit (if applicable) (FM-050).

Retroactive. Child support orders may be modified retroactively but only from the date that notice of a petition for modification has been served upon the opposing party, pursuant to the Maine Rules of Civil Procedure.

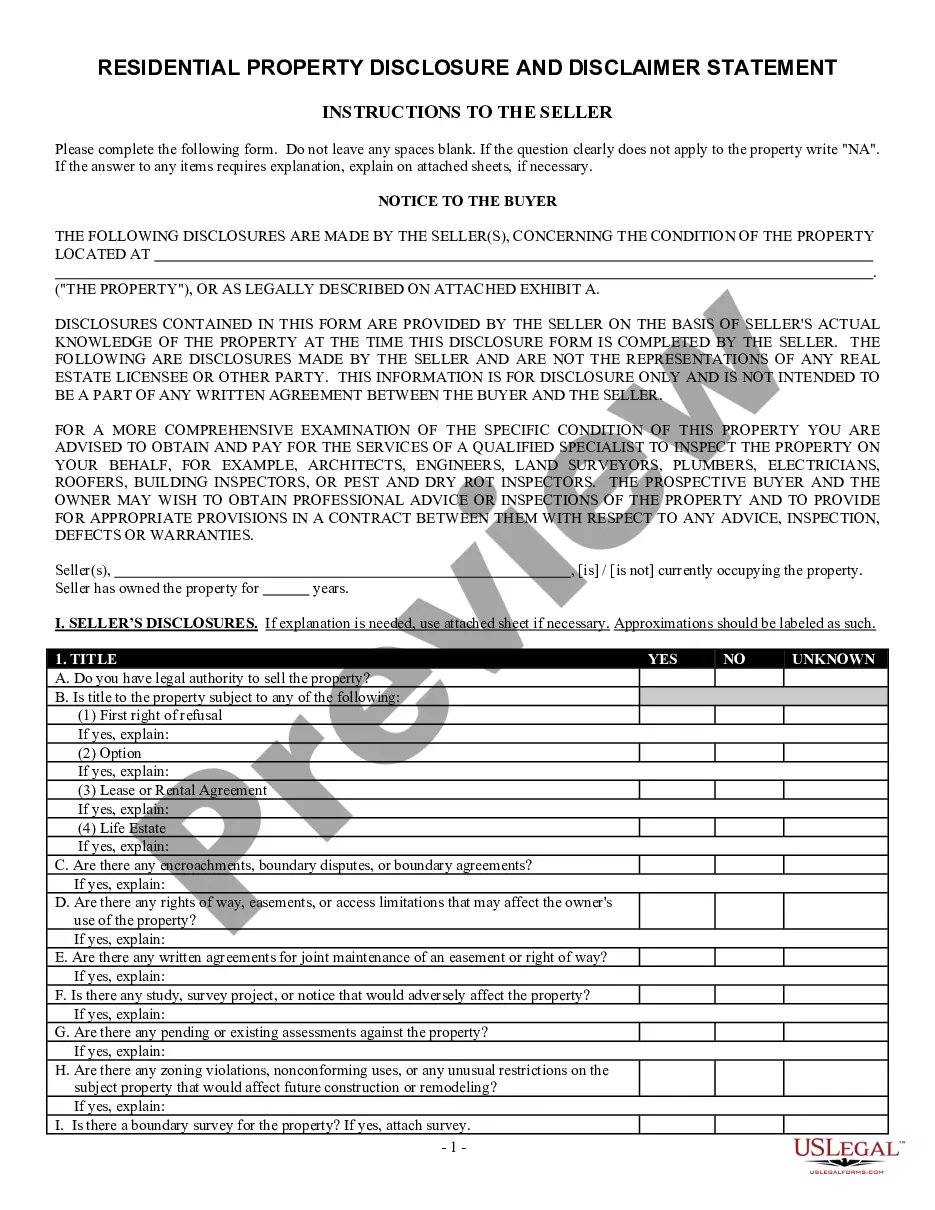

Support Enforcement and Recovery Services Collect past due support; Impose penalties for non-paying parents, such as putting liens on property, revoking licenses or passports, collecting directly from bank accounts or lottery winnings, or reporting the child support debt to credit bureaus; Establish paternity; and.

If you fall more than 30 days behind in your child support payments and there is no enforceable Immediate Income Withholding Order, DHHS may still be able to take your income. If you fall behind on court-ordered support, DHHS may send you a Notice of Debt. The Notice of Debt will state the amount DHHS thinks you owe.

Maine law does not specify a specific age at which a child can decide where he or she will live. If the child is old enough to have a meaningful preference, the court can take their input into consideration.

State law requires all parents to support their children. It does not matter if the parents were ever married. If you do not live with your children, you will probably be required to send regular child support payments to the parent or other person who is caring for your child.

In Maine, there is no statute of limitations of enforecement of child support orders. But payment is presumed after a period of 20 years.

In Maine, the obligation to pay child support ordinarily ends when a child turns 18. A court may extend the obligation until a child's 19th birthday if the child is still in high school, or special circumstances apply.