11 Usc 522 Withdrawal

Description

How to fill out Motion To Avoid Creditor's Lien?

Using legal templates that meet the federal and state laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time searching for the right 11 Usc 522 Withdrawal sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all papers organized by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when obtaining a 11 Usc 522 Withdrawal from our website.

Getting a 11 Usc 522 Withdrawal is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the steps below:

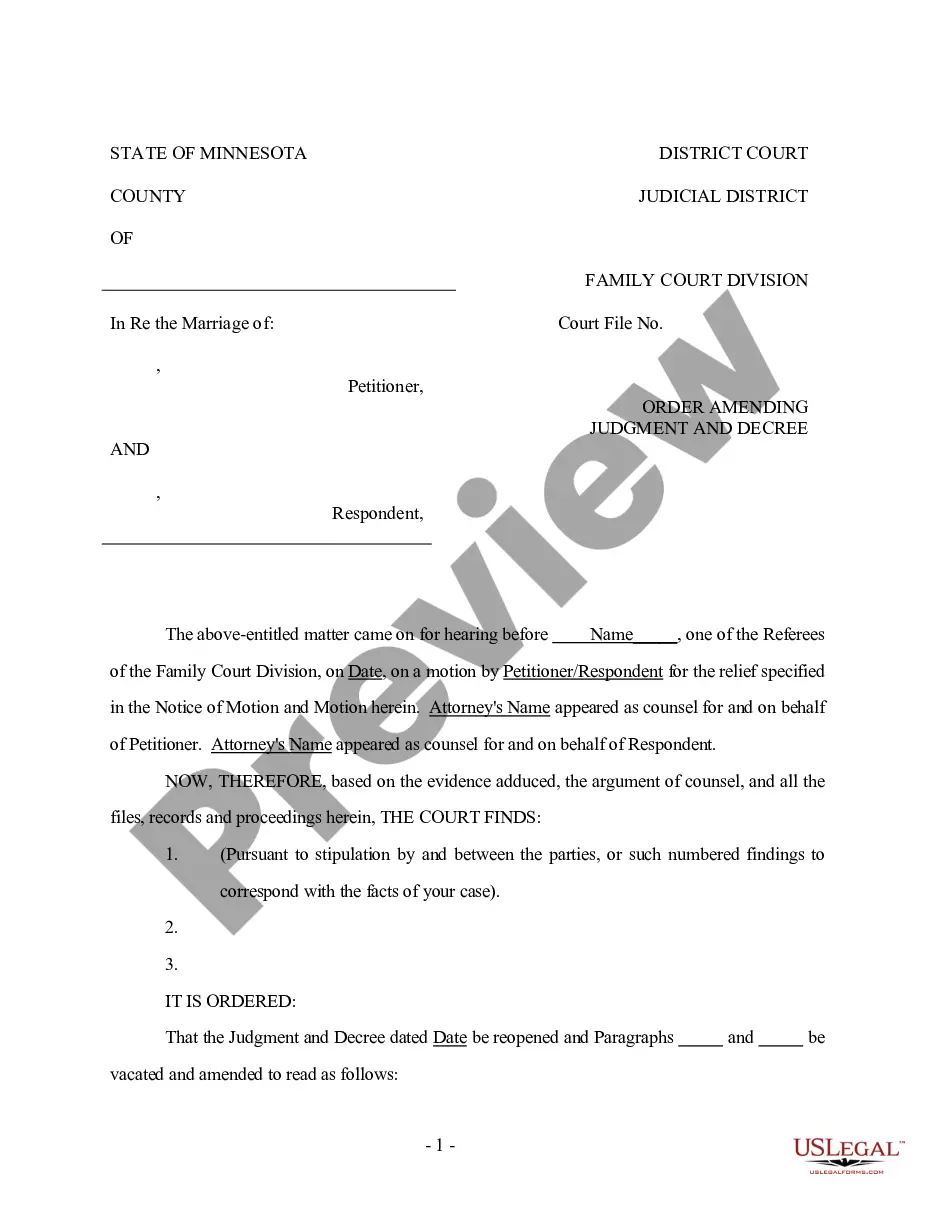

- Analyze the template using the Preview feature or via the text outline to ensure it meets your requirements.

- Browse for another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your 11 Usc 522 Withdrawal and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

To qualify for relief under chapter 7 of the Bankruptcy Code, the debtor may be an individual, a partnership, or a corporation or other business entity.

'Debtor' refers not only to a goods and services client but also to someone who borrowed money from a bank or lender. For example, if you take a loan to buy your house, then you are a debtor in the sense of borrower, while the bank holding your mortgage is considered to be the creditor.

Only an individual with regular income that owes, on the date of the filing of the petition, noncontingent, liquidated debts of less than $2,750,000 or an individual with regular income and such individual's spouse, except a stockbroker or a commodity broker, that owe, on the date of the filing of the petition, ...

The debtor is the party that owes the money (debt), while the creditor is the party that loaned the money. For example, if Jay loans Reva $100, Reva is the debtor and Jay is the creditor. One way to remember this is that the debtor is the party that owes the debt.

Notwithstanding any other provision of this section, only a person that resides or has a domicile, a place of business, or property in the United States, or a municipality, may be a debtor under this title.