Estate Distribution Account For Probate

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

The Estate Distribution Account For Probate displayed on this page is a reusable legal document created by expert attorneys in adherence to federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 authenticated, state-specific templates for any business and personal necessity. It is the quickest, simplest, and most trustworthy method to acquire the documentation you require, as the service assures bank-level data security and anti-malware safeguards.

Register with US Legal Forms to access verified legal templates for all of life's circumstances at your fingertips.

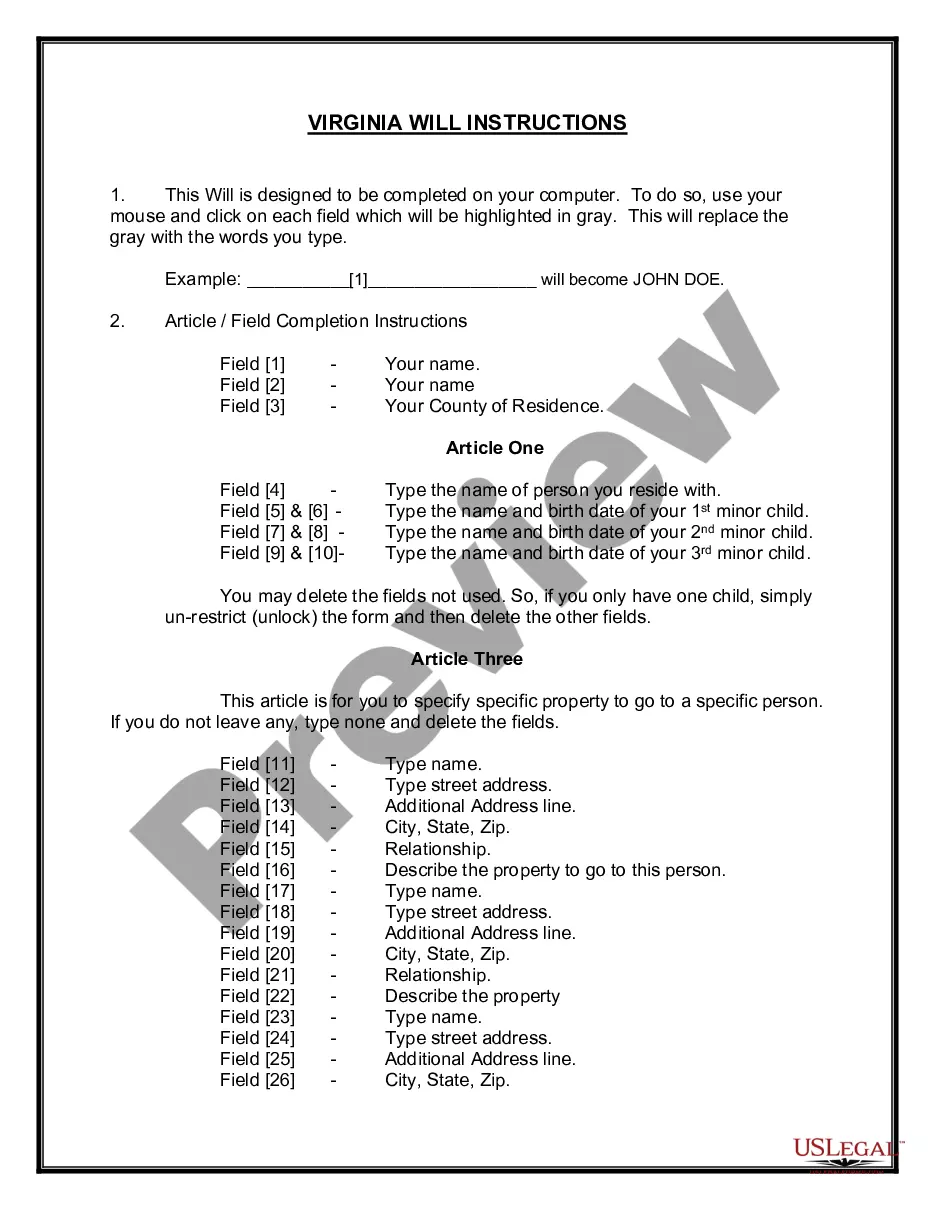

- Seek the document you require and examine it.

- Browse through the sample you searched and preview it or analyze the form description to verify it meets your requirements. If it does not, use the search function to find the appropriate one. Click Buy Now once you identify the template you need.

- Register and Log In.

- Choose the payment plan that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Select the format you prefer for your Estate Distribution Account For Probate (PDF, Word, RTF) and save the document on your device.

- Fill out and sign the documents.

- Print the template to complete it manually. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and sign your form with an eSignature.

- Download your documents once more.

- Reuse the same document whenever required. Access the My documents tab in your profile to redownload any previously stored forms.

Form popularity

FAQ

Completing an estate account involves tracking all income and expenses related to the estate during the probate process. You will need thorough documentation of disbursements, including payments to creditors and distributions to beneficiaries. Financial software can simplify this task, ensuring accuracy in managing your estate distribution account for probate.

So call us today! Create an Inventory of Your Possessions. ... Consider Your Family's Needs After Your Death. ... Decide Who Your Beneficiaries Will Be. ... Indicate How You Want Your Estate Divided. ... Store Your Documents Properly. ... Update Your Estate Plan Regularly. ... Seek Help from a Trusted Estate Planning Lawyer.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

You should add together the totals for assets, changes, and income, then take away the totals for liabilities and expenses. This final figure should then be divided into the appropriate portions and then assigned to the list of beneficiaries.

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.