Addendum Sales Contract With Seller Financing

Description

How to fill out Addendum To Contract For Sale And Purchase Of Real Property?

Whether for commercial objectives or personal matters, everyone must confront legal circumstances at some point in their life.

Filling out legal paperwork necessitates meticulous care, starting from choosing the appropriate form template.

Once saved, you can fill out the form using editing software or print it out and complete it by hand. With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the perfect form for any occasion.

- For example, if you select an incorrect version of the Addendum Sales Contract With Seller Financing, it will be rejected upon submission.

- Thus, it is essential to have a reliable source of legal documents like US Legal Forms.

- If you need to acquire an Addendum Sales Contract With Seller Financing template, follow these simple steps.

- Obtain the template you require by using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your needs, state, and county.

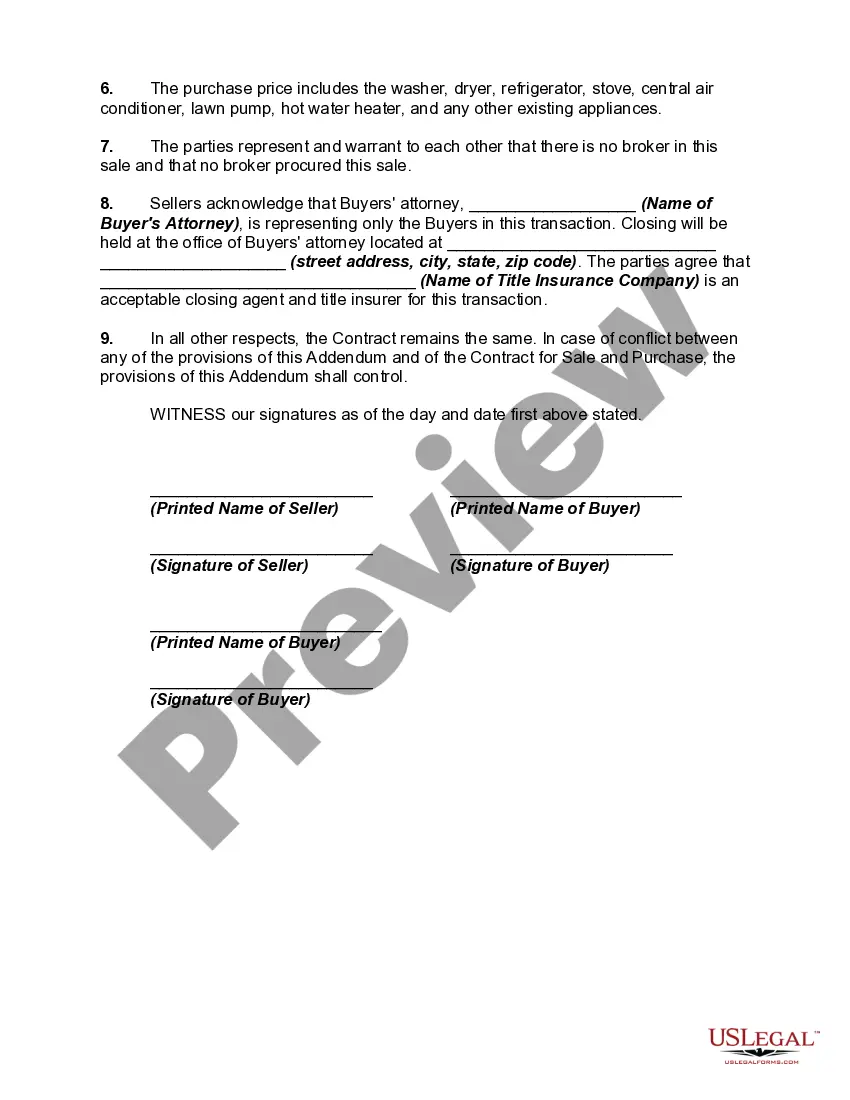

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Addendum Sales Contract With Seller Financing sample you need.

- Download the template once it satisfies your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you have not yet created an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Addendum Sales Contract With Seller Financing.

Form popularity

FAQ

This is called an installment sale, or in some cases, seller financing. Instead of paying for something all at once, the buyer will make a series of annual payments.

Here are a few things to consider when you are negotiating the terms of the loan. Don't use current market interest rates to create the interest rate for your seller financing loan. ... The higher the price?the longer the loan term. ... Bring as little cash to the deal as possible. ... Defer payments if possible.

How Does Seller Financing Work? A bank isn't involved in a seller-financed sale; the buyer and seller make the arrangements themselves. They draw up a promissory note setting out the interest rate, the schedule of payments from buyer to seller, and the consequences should the buyer default on those obligations.

In seller financing, the buyer and seller agree on the terms of the loan, including the interest rate, repayment schedule, and other terms. The buyer makes regular payments to the seller over an agreed-upon period, typically with a down payment upfront.

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.