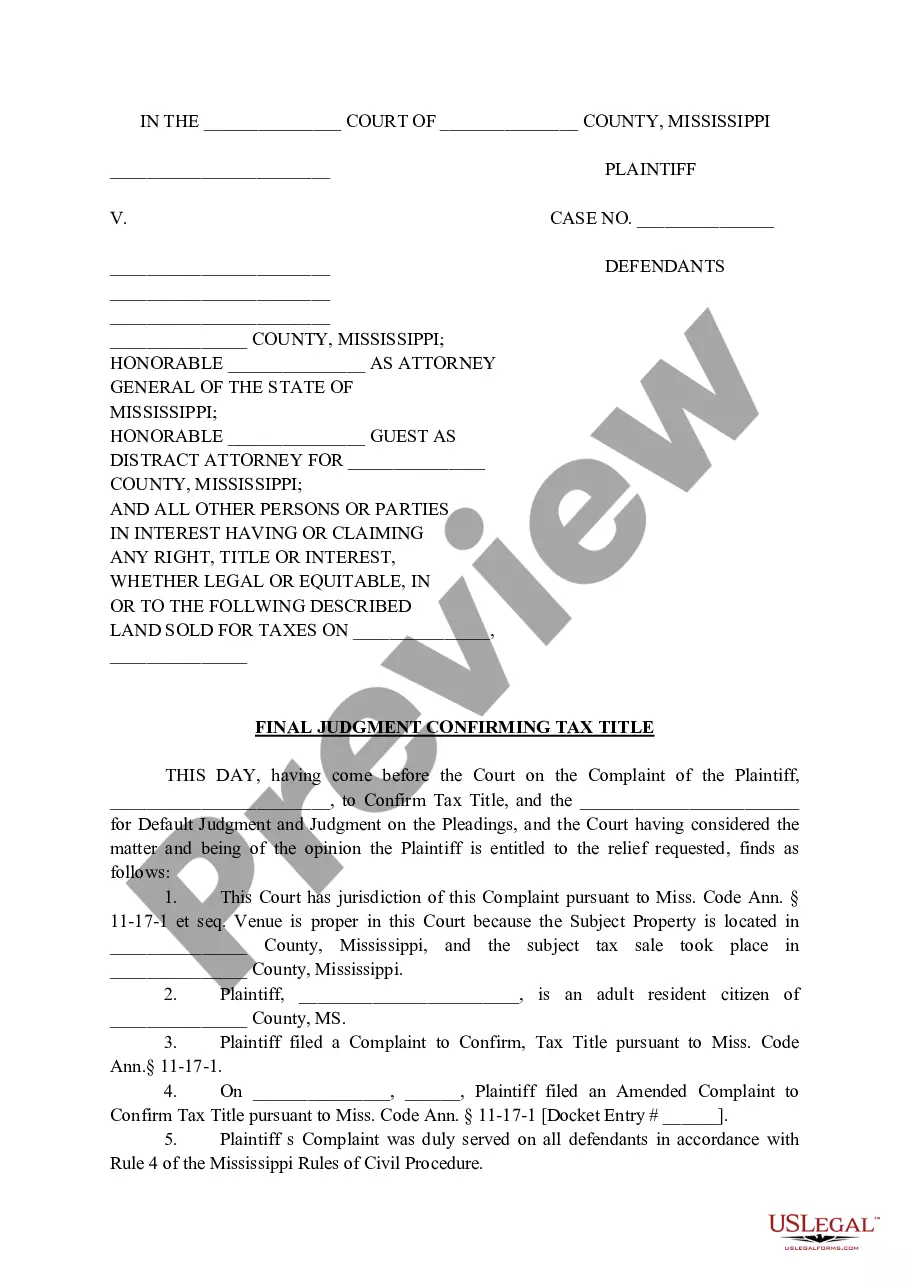

Supplemental Needs Trust Form For Elderly

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

It’s well-known that you can’t transform into a legal expert in a flash, nor can you determine how to swiftly prepare Supplemental Needs Trust Form For Elderly without possessing a distinct set of abilities.

Assembling legal documents is a labor-intensive task that demands specialized training and competencies. So, why not entrust the preparation of the Supplemental Needs Trust Form For Elderly to the professionals.

With US Legal Forms, one of the largest libraries of legal templates, you can discover anything from court documents to templates for internal business communication.

If you need another template, start your search again.

Create a free account and select a subscription plan to purchase the template. Then select Buy now. After the payment is finalized, you can access the Supplemental Needs Trust Form For Elderly, fill it out, print it, and either send it by mail or deliver it to the specified individuals or organizations.

- We understand how vital compliance and adherence to both federal and local laws are.

- That’s why, on our platform, all templates are localized and current.

- Here’s how to begin with our website and obtain the document you need in just minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this feature is available) and read the accompanying description to determine if the Supplemental Needs Trust Form For Elderly is what you seek.

Form popularity

FAQ

For a hypothetical example, if two parents have one child and jointly earn $1,000 per week, then the non-custodial parent must pay $233 in child support each week. If these parents had two children, the non-custodial parent would pay $257 per week.

Is Retroactive Child Support Allowed in the State of New Jersey? In the State of New Jersey, no retroactive child support is allowed other than in cases where there is a motion for child support or child support modification that is pending.

You may request a certified copy of a Final Judgment of Divorce from the Superior Court Clerk's office. Provide the Docket number (M or FM#), case title, county of venue and the document you wish to obtain in your request.

There is no child support arrears forgiveness in New Jersey. In other words, a non-paying parent cannot reduce the amount of back child support they owe. Therefore, if a parent owes $10,000 in back child support pursuant to a court order, that parent cannot go back to court and attempt to reduce that amount.

Retroactive Child Support is Not Permitted in New Jersey Parties can only seek retroactive application back to the date that the pending action or motion for child support was filed.

Code § 0-20.4. Section 0-20.4 - Reopening a closed case (a) A closed WFNJ/TANF case shall be reopened if new information is received that may make establishment of paternity and/or an order for support, including medical support, or enforcement of an order possible.

Is There a Statute of Limitations for Collecting Back Child Support? In New Jersey, the statute of limitations for collecting child support is five years after the child reaches the legal age of emancipation.

In the State of New Jersey, no retroactive child support is allowed other than in cases where there is a motion for child support or child support modification that is pending. In these cases, the retroactive date of the child support will go back to the date that the notice or the motion was filed/mailed.