Uniform Commercial Code Ucc Article 9

Description

How to fill out Notice Of Cancellation Of Sales Agreement Pursuant To Article 2 Of The Uniform Commercial Code?

- Log in to your existing US Legal Forms account or create a new account if this is your first visit.

- Search for the form related to UCC Article 9 in the preview mode and read through the form's description to ensure it's suitable for your needs.

- If you need a different document, utilize the Search tab to find alternative templates that meet your local jurisdiction requirements.

- Once you find the correct form, click the 'Buy Now' button and select your preferred subscription plan.

- Complete the registration process, if required, to access the library's extensive resources.

- Enter your payment details to finalize your purchase and obtain the document.

- Download the form to your device for completion. You can also access it later through the 'My Forms' section in your profile.

In conclusion, US Legal Forms provides a robust library of over 85,000 customizable legal documents, ensuring that individuals and attorneys can easily navigate UCC Article 9 requirements. With expert assistance available, you can confidently manage your legal documentation.

Start streamlining your legal form management today by exploring US Legal Forms!

Form popularity

FAQ

Article 9 of the New Jersey Uniform Commercial Code mirrors the broader principles of the Uniform Commercial Code UCC article 9, governing secured transactions within the state. It includes regulations regarding the creation, perfection, and enforcement of security interests in personal property. Understanding New Jersey's specific provisions can help businesses navigate local laws effectively.

Article 9 of the Uniform Commercial Code UCC article 9 deals specifically with secured transactions, focusing on how creditors can secure interests in personal property. It outlines the rules for creating security interests, the rights of secured parties, and the filing process for UCC statements. This article is essential for businesses that rely on loans, as it provides a legal framework for collateral agreements and transactions.

Think of Article 9 as a set of rules under the Uniform Commercial Code UCC article 9 that governs secured transactions. It explains how businesses can use personal property as collateral for loans, which helps lenders ensure they can claim the asset if necessary. By understanding Article 9, even a beginner can gain insights into how commercial lending operates and the rights and responsibilities tied to secured financing.

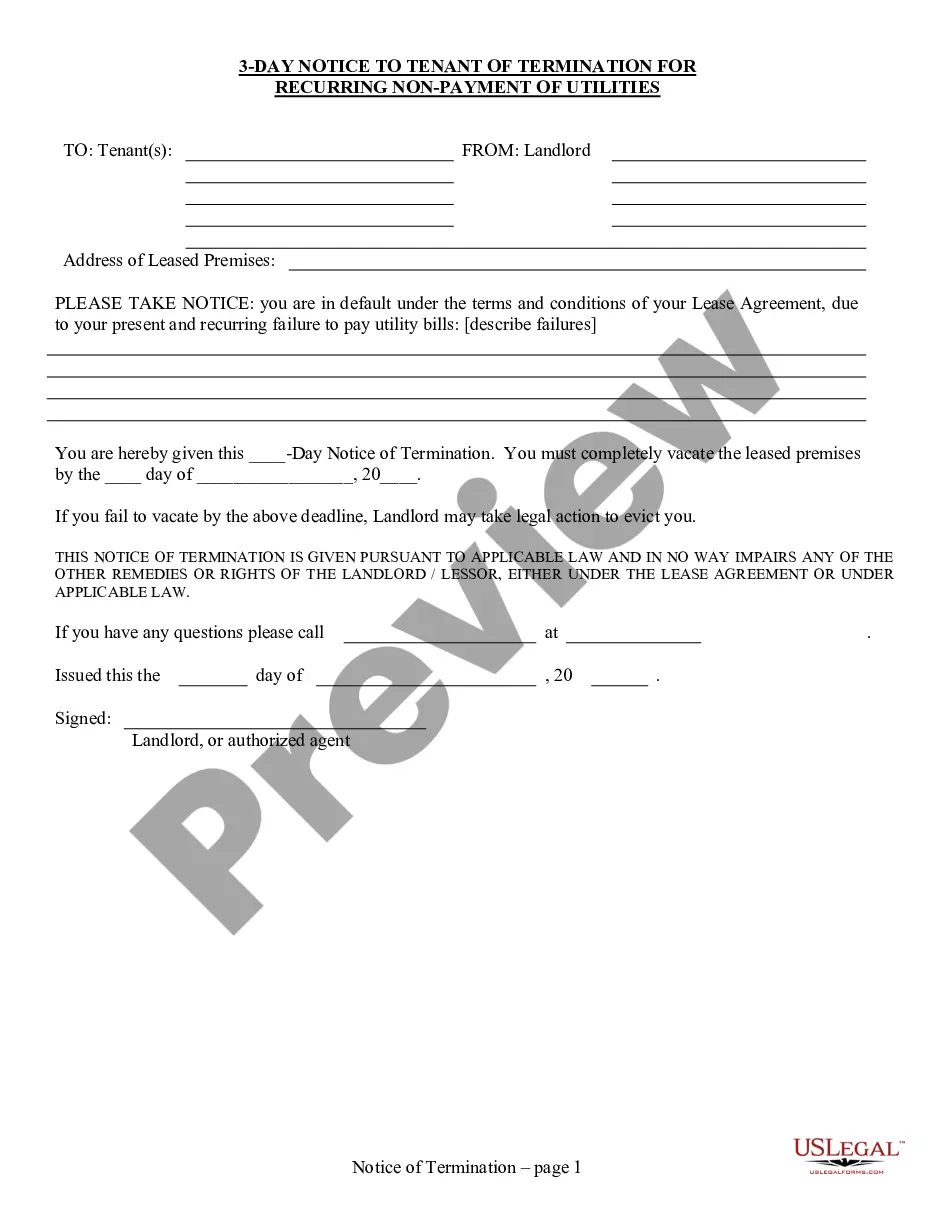

Filling out a UCC 1 form requires careful attention to detail. First, you need to provide essential information, such as the debtor’s name and address, along with the secured party's information. It's vital to describe the collateral accurately to ensure compliance with the Uniform Commercial Code UCC article 9. If you're unsure about the process, consider using USLegalForms to guide you through the requirements and help you fill out the form correctly.

The Uniform Commercial Code UCC applies to a wide range of commercial transactions, particularly those involving the sale of goods and secured transactions. It governs various aspects, such as leases and credit arrangements, ensuring that all parties involved have a clear understanding of their rights and obligations. Understanding the applicability of UCC in your business dealings is essential for compliance and risk management. Utilizing platforms like USLegalForms can help you access the necessary documents related to the Uniform Commercial Code UCC Article 9.

Article 9 of the Uniform Commercial Code UCC deals specifically with secured transactions and outlines how security interests in personal property should be created and enforced. This article is vital for financial institutions and businesses as it provides foundational rules for using assets as collateral. By defining the rights of debtors and creditors, Article 9 promotes a more reliable credit system. Familiarizing yourself with Article 9 UCC can greatly enhance your grasp of financial transactions.

The Uniform Commercial Code, or UCC, is a set of laws designed to standardize business transactions across the United States. Its primary purpose is to facilitate commerce by providing clear rules that everyone can follow. By harmonizing laws regarding sales, leases, and secured transactions, the UCC helps reduce confusion and disputes. Understanding the Uniform Commercial Code UCC Article 9 is critical for anyone involved in secured lending.

Article 9 of the Uniform Commercial Code UCC outlines the rules relating to secured transactions. In simple terms, it governs how businesses can use their assets, like inventory or equipment, to secure loans. This article ensures there are clear guidelines governing the rights of borrowers and lenders in these transactions. By understanding Article 9 UCC, you can better navigate the financial landscape and ensure compliance.

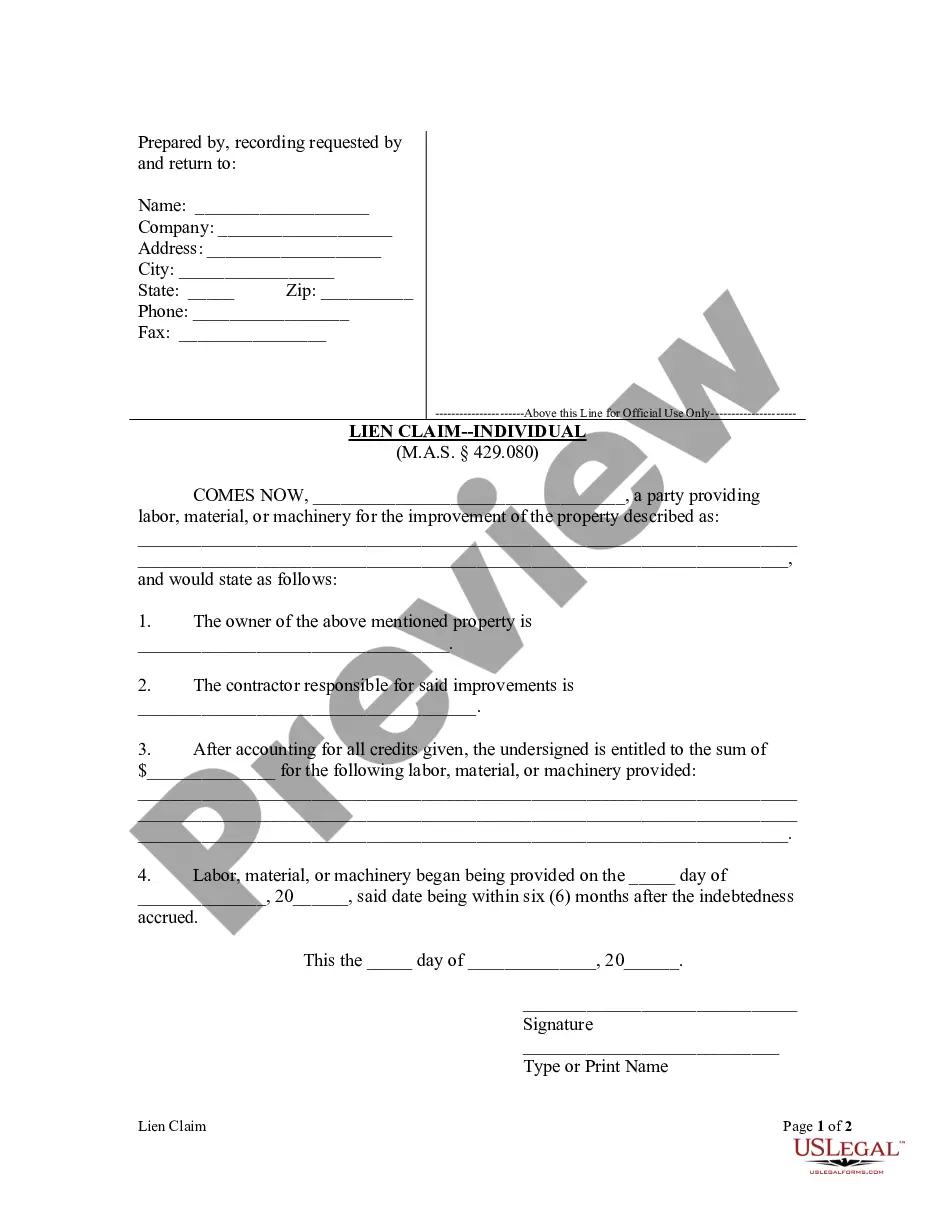

A UCC 9 filing refers to a specific type of UCC document that creates a security interest in personal property. This filing is common during transactions involving secured loans, where the lender wants to establish a claim on a borrower's assets. It ensures that the lender's rights are protected if the borrower fails to meet their obligations. Learning about the Uniform Commercial Code UCC Article 9 makes it easier to grasp the implications of this important document.

Individuals or businesses often choose to file a UCC document to secure loans or facilitate credit. A UCC filing serves as a legal claim against specific assets, which assures lenders that they have a right to collect if the borrower defaults. Essentially, it provides transparency in a transaction and helps manage the risks involved. Understanding the Uniform Commercial Code UCC Article 9 can empower you to navigate these financial aspects more effectively.