Damages Wrongful Termination Withdrawal

Description

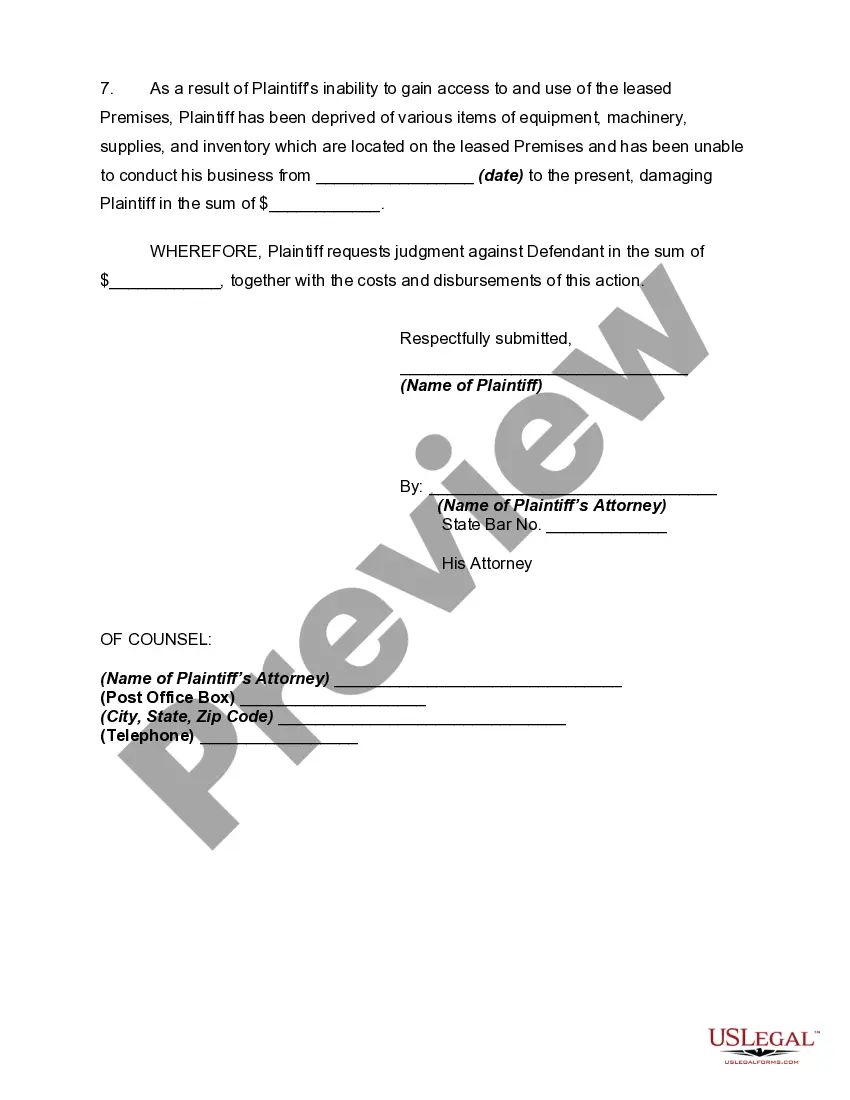

How to fill out Complaint - Damages For Wrongful Termination Of Lease?

The Damages Unfair Dismissal Withdrawal you observe on this page is a reusable formal template prepared by expert attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable method to acquire the papers you require, as the service ensures the highest level of information security and anti-malware safeguards.

Register for US Legal Forms to have authenticated legal templates for all of life’s circumstances at your fingertips.

- Search for the document you need and review it.

- Examine the file you searched and preview it or read the form description to ensure it meets your needs. If it doesn't, use the search feature to locate the correct one. Click Buy Now once you have found the template you require.

- Register and Log In.

- Choose the pricing plan that fits you and set up an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Pick the format you desire for your Damages Unfair Dismissal Withdrawal (PDF, DOCX, RTF) and download the sample onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with an eSignature.

- Redownload your documents once more.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

The formula for calculating damages typically includes lost wages, benefits, and the potential impact of the termination on your career. Start by documenting your earnings before the termination and any additional costs incurred. Next, factor in emotional distress and long-term consequences resulting from the wrongful termination withdrawal. A legal professional can provide you with a precise formula tailored to your specific circumstances.

Punitive damages serve as a financial punishment for the employer's wrongful acts. They go beyond compensatory damages aimed at making you whole and seek to deter future misconduct. In cases of wrongful termination withdrawal, punitive damages may be awarded if the employer's behavior was particularly egregious. Understanding these damages can be vital for your case, and seeking expert advice is recommended.

Calculating damages in wrongful termination involves a review of your employment history and the reasons behind your dismissal. Begin by assessing lost wages, benefits, and any potential future earnings lost due to the termination. Furthermore, consider the emotional and psychological impact of the wrongful termination withdrawal on your well-being. Using a platform like USLegalForms can help streamline the documentation and calculation process.

To determine compensation for unfair dismissal, start by gathering all relevant income information. Consider lost wages, benefits, and any other financial losses incurred due to your termination. Additionally, calculate any future earnings that may be impacted by the wrongful termination withdrawal. Consult with a legal expert for precise calculations and guidance tailored to your situation.

The calculation of wrongful termination damages involves several factors such as the length of employment and the circumstances surrounding your dismissal. Typically, it includes your lost income and benefits up to the point of settlement. Additionally, future lost earnings may also be taken into account. If you're navigating this process, uslegalforms can provide templates and resources to help clarify how to effectively assess damages wrongful termination withdrawal.

Damages for wrongful termination can vary widely based on circumstances. Generally, they include lost wages, lost benefits, and sometimes emotional distress compensation. In addition, you may also recover damages related to expenses incurred while seeking new employment. Understanding damages wrongful termination withdrawal is crucial to evaluate your case effectively.

The burden of proof lies with the employee in a wrongful termination case. The employee must prove that their employer fired them for an unlawful reason and that they suffered damages as a result.

You may be able to sue for and recover compensation for several different types of damage in a wrongful termination case, including: Medical Expenses. ... Lost Benefits and Earnings. ... Job Search Costs. ... Punitive Damages and Attorney Fees.

Seek legal counsel if your employer wrongfully fired you for a reason not under state or federal law. Before you sue your employer for discrimination, you must file a report with the Equal Employment Opportunity Commission (EEOC).

Quantifying your damages requires calculating your entire annual compensation from your former position, including annual salary, bonuses, future raises, lost benefits. This amount is multiplied by the sum of the number of years you have been unemployed and the number of years you can expect to remain unemployed.