A deed is an instrument by which an owner (the grantor) transfers an interest in land to a new owner (the grantee). No consideration is required to make the deed effective. The deed is necessary to transfer title to land even if it is a gift. It has no effect, and title does not pass until the deed has been delivered. The recording of the deed is not required to make the deed effective to pass title between the buyer and the seller. However, recording is necessary so that the public will know that the buyer is the present owner. Recording constitutes "notice to the world" of the transfer in title.

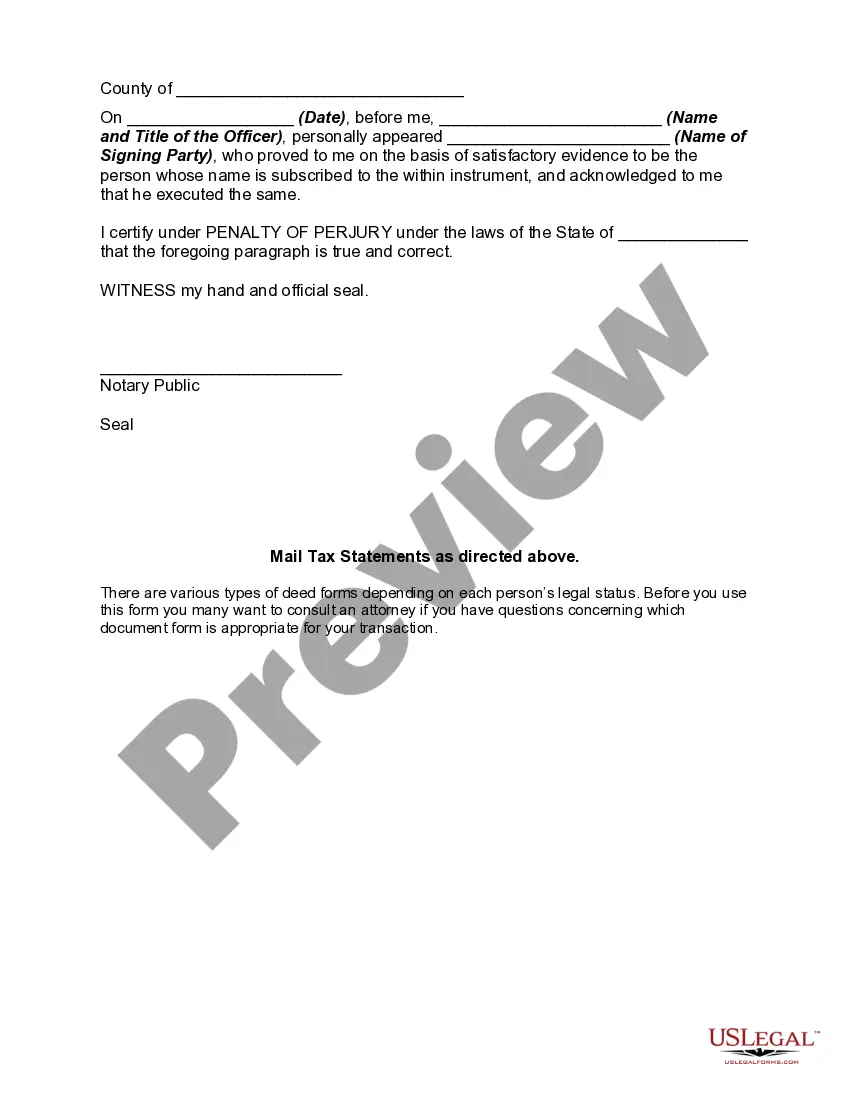

The grantor is the person selling the property. The grantee is the person buying the property. A grant deed is a deed containing an implied warranty that there are no encumbrances on the property not described in the deed and that the person transferring the property actually owns the title. It must describe the property by legal description of boundaries and/or parcel numbers, be signed by all people transferring the property, and be acknowledged before a notary public. It is in contrast to a quit claim deed, which only conveys the interest that the transferor actually owns, if any, without a warranty of ownership.