Writ Of Garnishment Form Oregon

Description

How to fill out Sample Letter For Writ Of Garnishment?

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more cost-effective way of creating Writ Of Garnishment Form Oregon or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Writ Of Garnishment Form Oregon. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and explore the catalog. But before jumping straight to downloading Writ Of Garnishment Form Oregon, follow these recommendations:

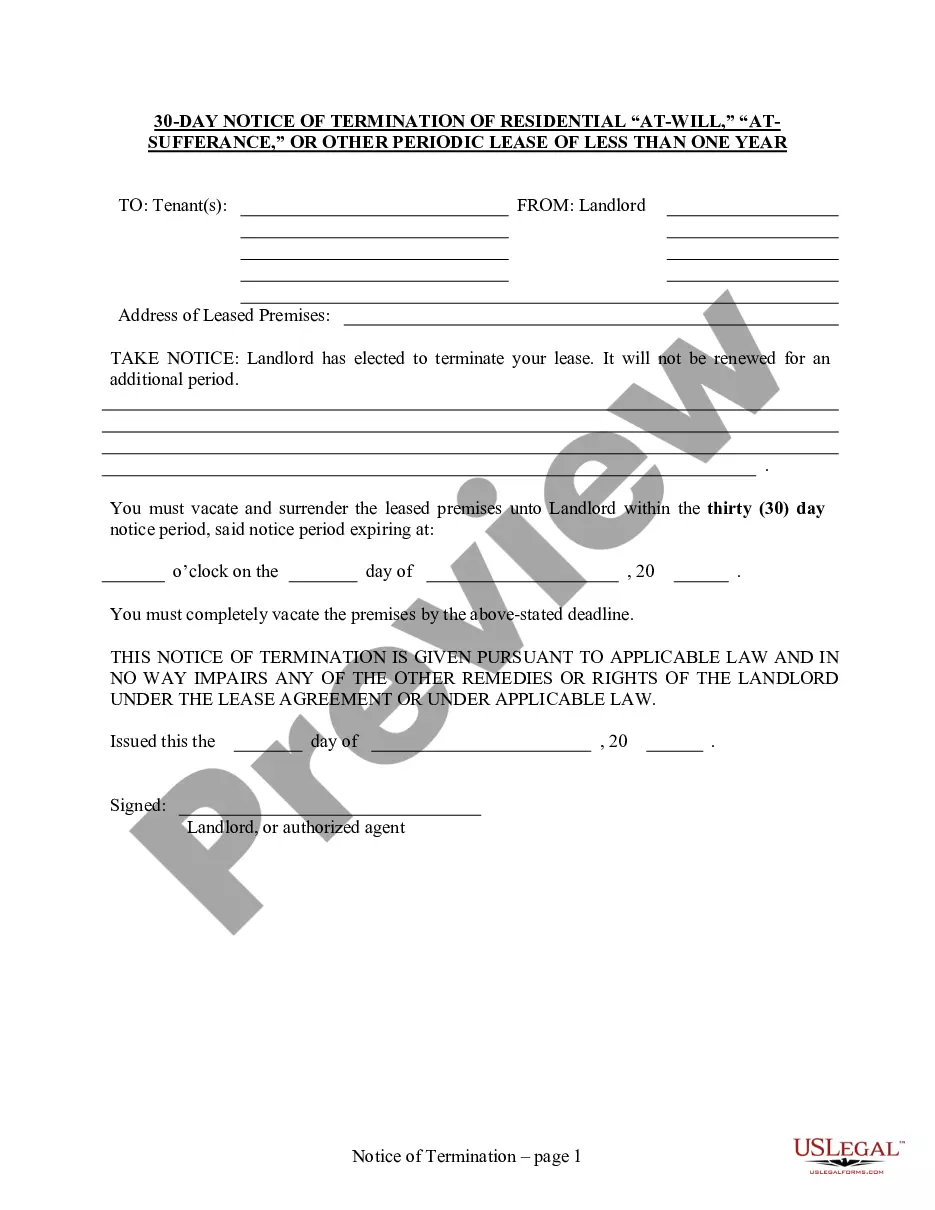

- Check the form preview and descriptions to make sure you have found the form you are looking for.

- Check if form you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Writ Of Garnishment Form Oregon.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and transform document completion into something easy and streamlined!

Form popularity

FAQ

Wage Garnishment in Oregon? To garnish your wages in Oregon, the debt collector has to have a judgment. They can then send a writ of garnishment to your employer. Your payroll department has to fill out paperwork to tell them how often you get paid and the date of your next pay day.

Filling Out the Garnishment Forms The form should be typed or neatly printed in ink. Fill in the case caption (plaintiff, defendant, and case number) on all the forms. Indicate who the garnishment is being served on. ... The date of judgment must be filled in, and can be found on your notice of entry of judgment.

Hear this out loud PauseIf you think that we have garnished property or money that is exempt (protected by law) from garnishment you may submit a Challenge to Garnishment through Revenue Online or submit the Challenge to Garnishment form.

Stop Oregon wage garnishment with a claim of exemption Use the Claim of Exemption form from the Oregon State Courts website or the court clerk's office in the county where the garnishment is taking place. Fill out the form and provide all required information, including the specific exemptions you claim.

Under Oregon law, a Wage Garnishment can last up to a maximum of 90 days from when it is delivered. It will stop earlier than that if the debt is paid in full. Unfortunately, there is no restriction under Oregon law to stop a creditor from issuing a new Wage Garnishment once the first garnishment expires.