Credit Verification Release Form Amex For Business

Description

How to fill out Authorization To Release Credit Information?

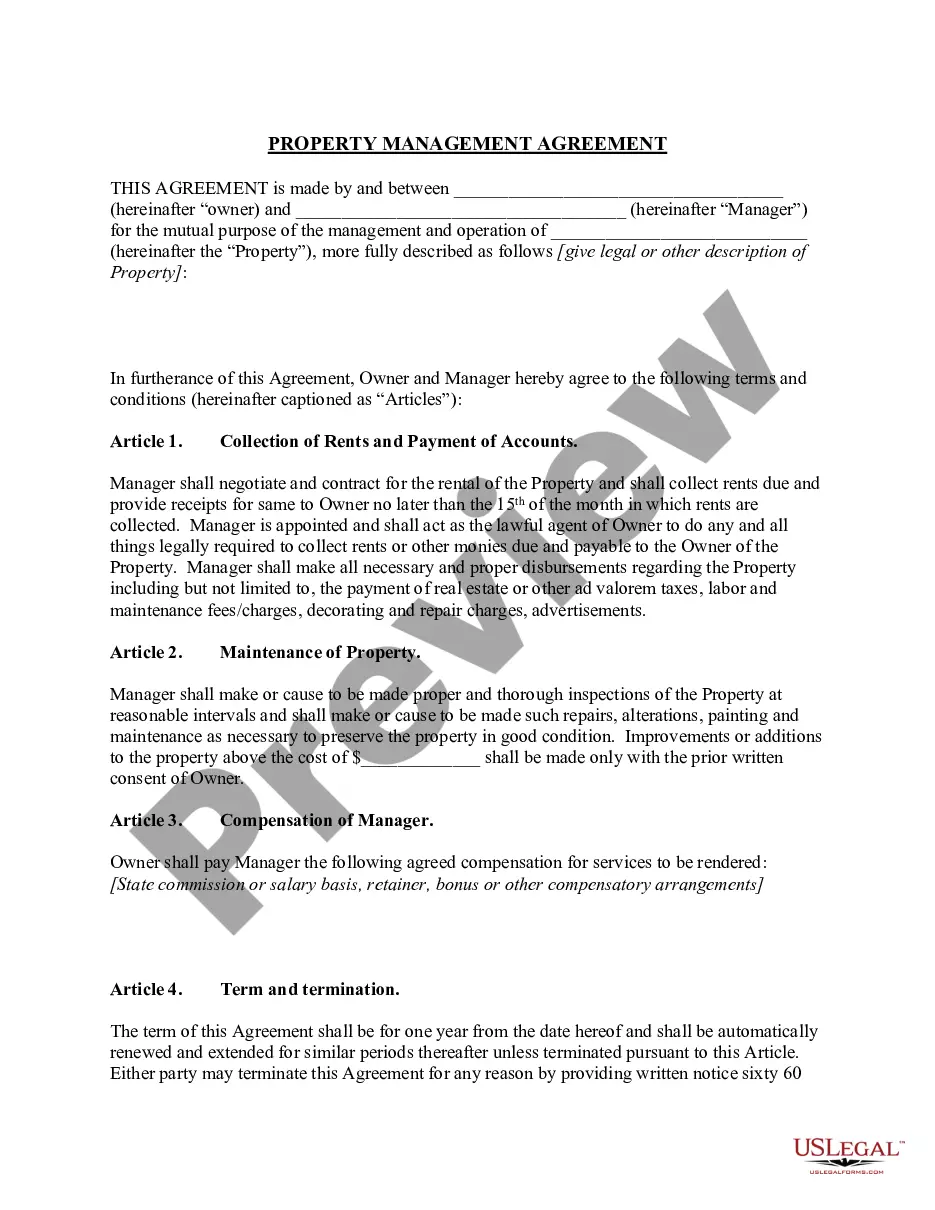

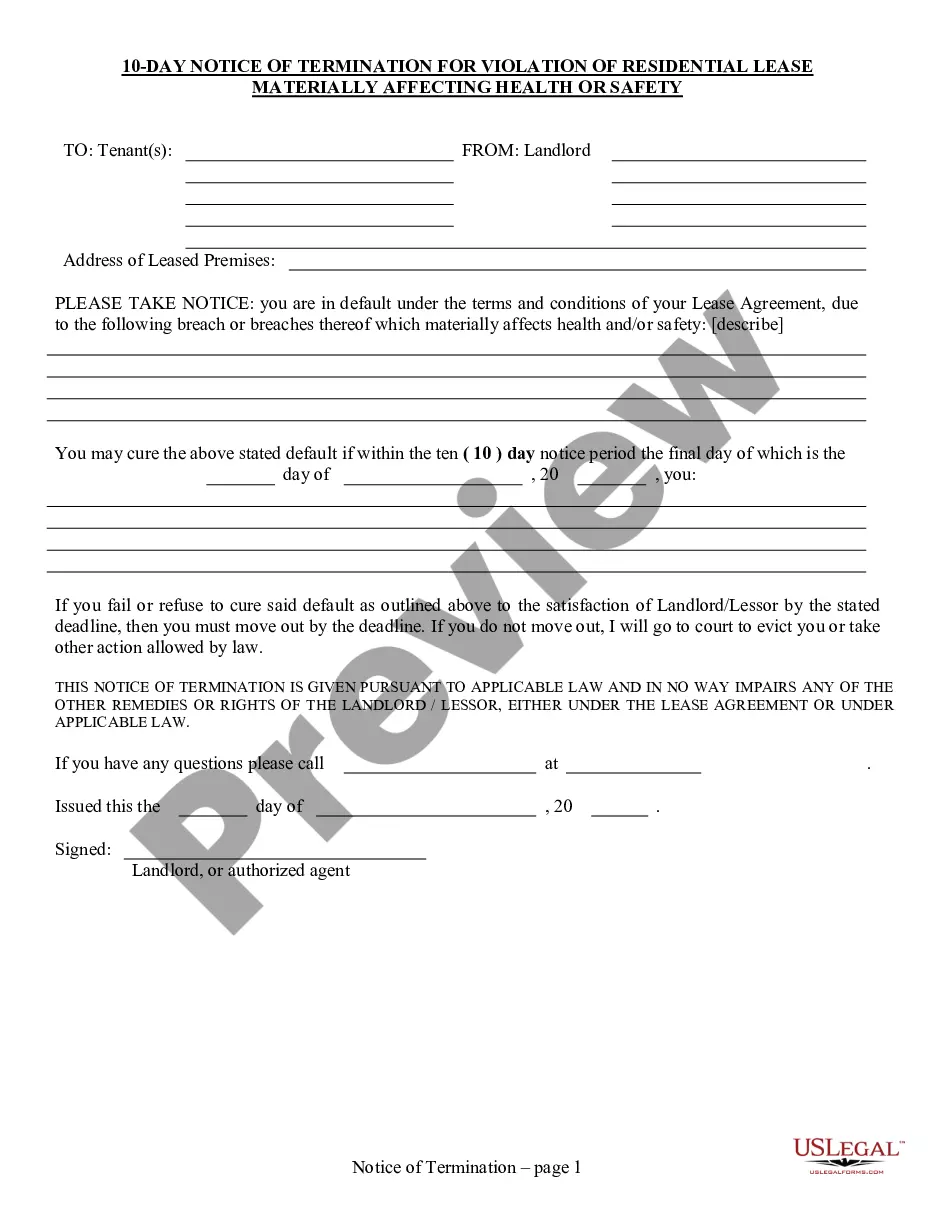

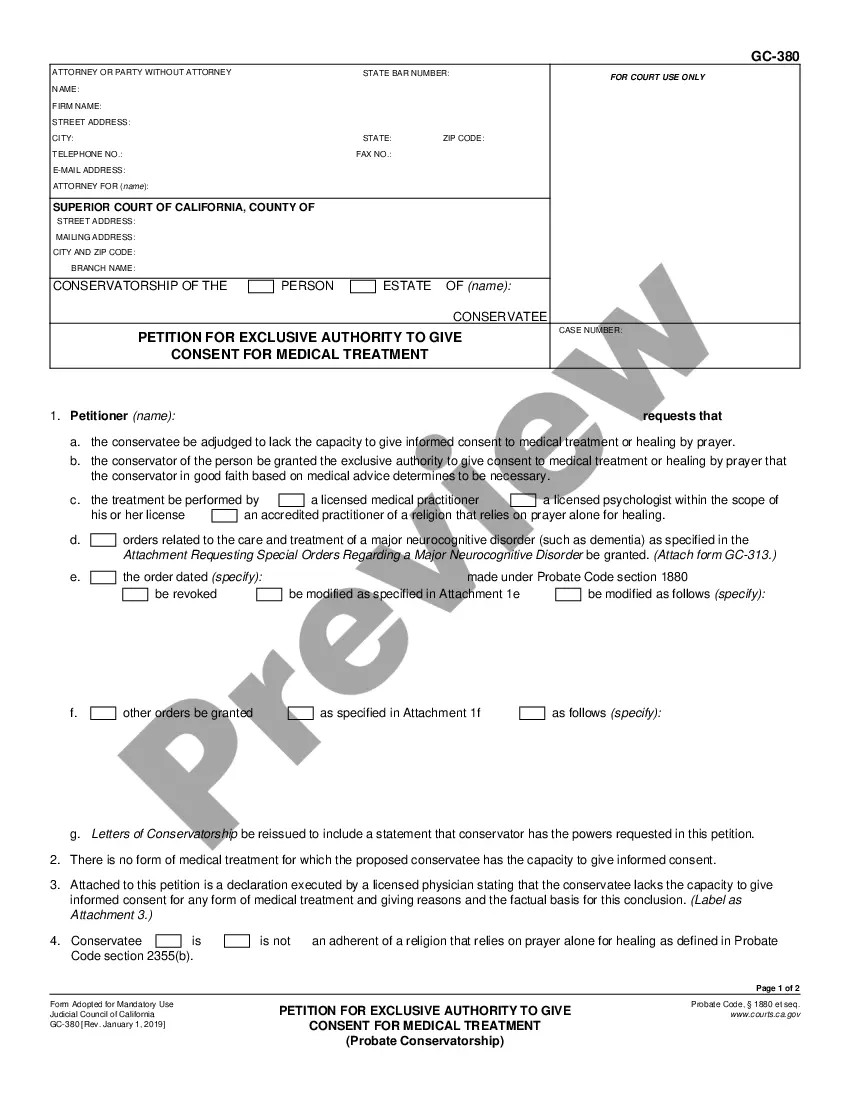

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Filling out legal documents demands careful attention, beginning from selecting the right form sample. For example, if you select a wrong edition of the Credit Verification Release Form Amex For Business, it will be declined when you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Credit Verification Release Form Amex For Business sample, stick to these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Credit Verification Release Form Amex For Business sample you require.

- Download the file when it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Choose the file format you want and download the Credit Verification Release Form Amex For Business.

- After it is downloaded, you can complete the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the right sample across the web. Take advantage of the library’s easy navigation to get the proper template for any situation.

Form popularity

FAQ

American Express uses all three major credit bureaus: TransUnion, Equifax, and Experian. Either one or more credit bureaus may be used when evaluating am American Express credit card application. Credit reports, however, don't differ that much from bureau to bureau.

American Express appears to primarily pull credit reports from Experian, but this doesn't mean it doesn't occasionally pull from one or both of the other major consumer credit bureaus as well.

If you're looking to build your business credit, having one or more business credit cards could help you build it, but it depends on whether or not the creditor actually reports your activity to credit bureaus. American Express only reports only negative activity to Dun & Bradstreet (D&B).

Your Card PIN is a Personal Identification Number which helps us to verify your identity when using your Card. It's made up of four digits and is uniquely bound to your Card; it acts as a passcode to help prevent fraud.

All of the major business credit card issuers ? including American Express, Bank of America and Capital One ? report card activity to commercial credit bureaus and can be a good tool to build business credit. Responsible usage is key, though.