Charitable Nonprofit Exempt With Irs

Description

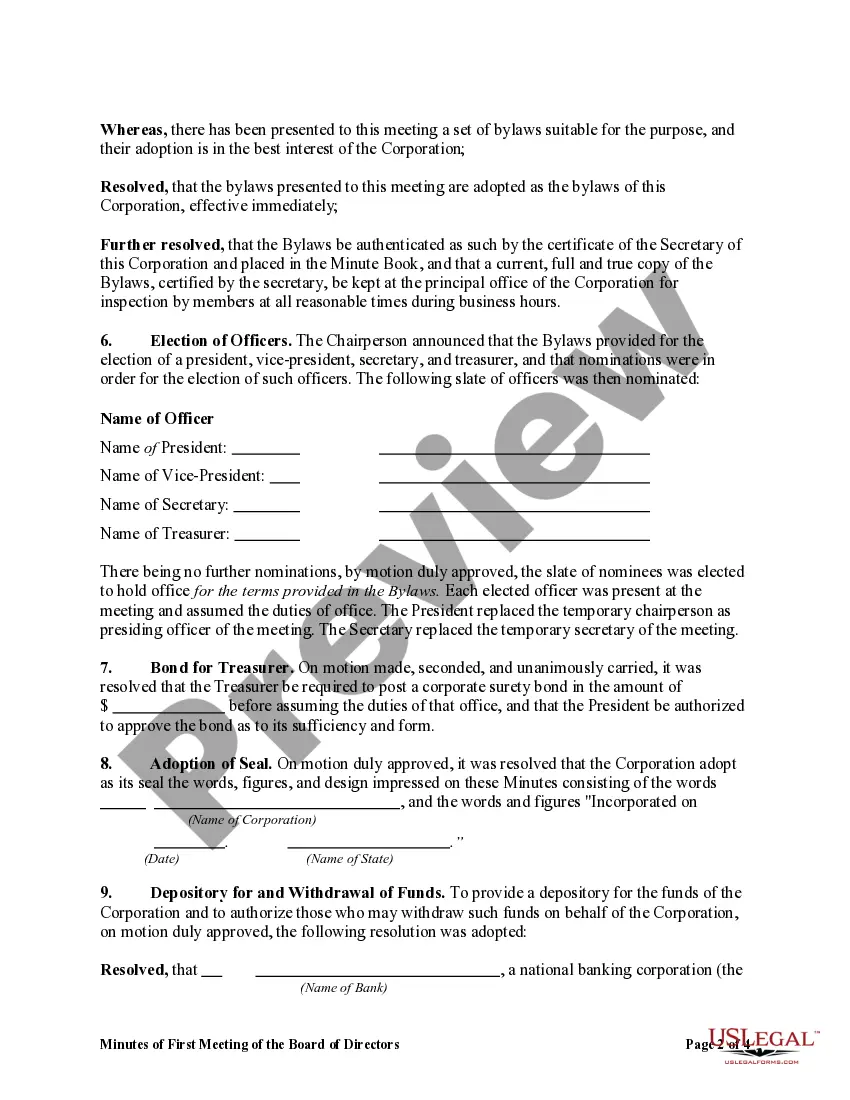

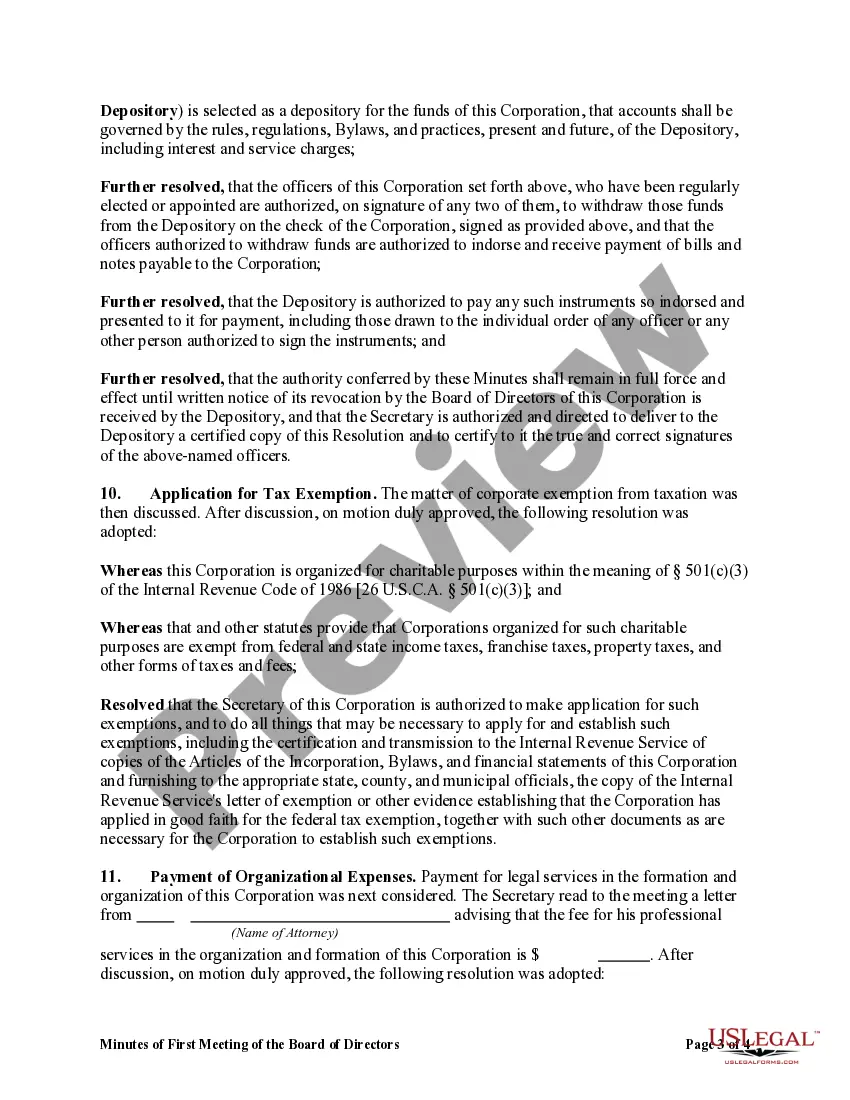

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of working with bureaucracy. Choosing the right legal documents demands accuracy and attention to detail, which is why it is vital to take samples of Charitable Nonprofit Exempt With Irs only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information about the document’s use and relevance for the circumstances and in your state or county.

Consider the listed steps to finish your Charitable Nonprofit Exempt With Irs:

- Make use of the library navigation or search field to locate your template.

- Open the form’s description to ascertain if it matches the requirements of your state and area.

- Open the form preview, if available, to ensure the template is definitely the one you are interested in.

- Get back to the search and find the correct template if the Charitable Nonprofit Exempt With Irs does not fit your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Select the document format for downloading Charitable Nonprofit Exempt With Irs.

- When you have the form on your device, you may modify it with the editor or print it and complete it manually.

Remove the headache that accompanies your legal paperwork. Check out the comprehensive US Legal Forms catalog where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

File either Form 1023 or Form 1023-EZ to apply for exemption under section 501(c)(3). The applications have instructions, checksheets and worksheets to help you provide the information required to process your application. The IRS will not process an incomplete application. Public Charity Exemption Application | Internal Revenue Service irs.gov ? charitable-organizations ? public-c... irs.gov ? charitable-organizations ? public-c...

To request a copy of either the exemption application (including all supporting documents) or the annual information or tax return, submit Form 4506-A, Request for a Copy of Exempt or Political Organization IRS FormPDF or Form 4506-B, Request for a Copy of Exempt Organization IRS Application or LetterPDF. Exempt Organizations Public Disclosure - Obtaining Copies ... - IRS irs.gov ? charities-non-profits ? exempt-org... irs.gov ? charities-non-profits ? exempt-org...

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. Exemption Requirements - 501(c)(3) Organizations - IRS IRS (.gov) ? charitable-organizations ? exem... IRS (.gov) ? charitable-organizations ? exem...

What is a not-for-profit organization? Similar to a nonprofit, a not-for-profit organization (NFPO) is one that does not earn profit for its owners. All money earned through pursuing business activities or through donations goes right back into running the organization.

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers. How to Fill Out a W-9 For Nonprofits | Step-by-Step Guide - Donorbox donorbox.org ? nonprofit-blog ? w-9-for-nonpro... donorbox.org ? nonprofit-blog ? w-9-for-nonpro...