Board Nonprofit Form Application For Employment

Description

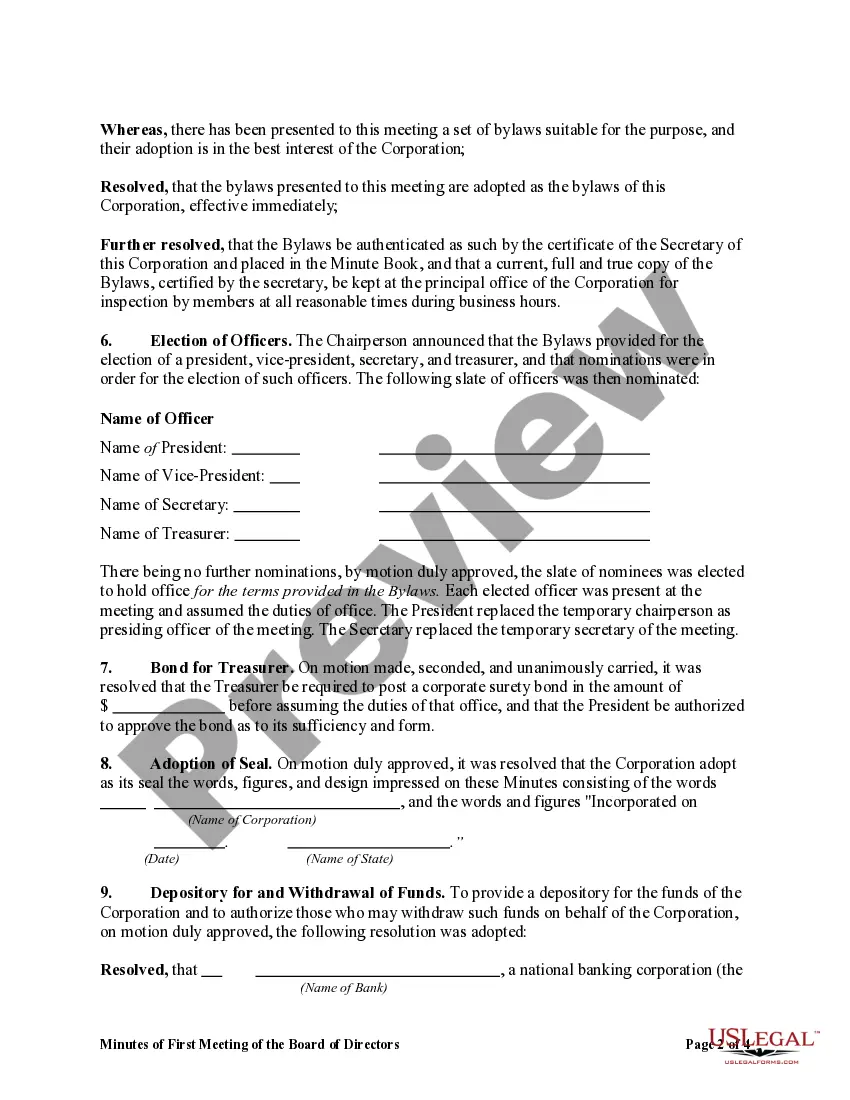

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Whether for business purposes or for individual affairs, everybody has to handle legal situations at some point in their life. Completing legal paperwork needs careful attention, starting with picking the correct form template. For example, when you choose a wrong version of a Board Nonprofit Form Application For Employment, it will be turned down when you send it. It is therefore crucial to have a trustworthy source of legal files like US Legal Forms.

If you need to get a Board Nonprofit Form Application For Employment template, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to locate the Board Nonprofit Form Application For Employment sample you require.

- Download the file if it meets your requirements.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Board Nonprofit Form Application For Employment.

- Once it is downloaded, you are able to complete the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate sample across the web. Utilize the library’s easy navigation to get the proper template for any occasion.

Form popularity

FAQ

Definition. IRS Form W9 is used by a taxpayer, usually a business, to obtain the Social Security number or Federal Employer Tax ID number from a person or business entity. This is most often for the purposes of issuing them an annual Form 1099-MISC for any contract payments made by the requesting party.

Applications for nonprofit status must be submitted online to the IRS. If an organization is eligible to apply for nonprofit status with Form 1023-EZ, the process can take as little as four weeks. For those who must file Form 1023, the process could take up to six months or longer.

501(c)(3) Application: The Basics Completed your nonprofit needs assessment, including asking yourself critical questions. Chosen your type of nonprofit, such as a sole member nonprofit. Drafted your nonprofit vision statement. Chosen your nonprofit name. Registered your nonprofit on the state level.

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.