Loan Between Shareholders With Financial Information

Description

How to fill out Loan Agreement Between Stockholder And Corporation?

Legal document managing might be frustrating, even for the most experienced specialists. When you are interested in a Loan Between Shareholders With Financial Information and don’t get the a chance to devote in search of the right and up-to-date version, the processes might be nerve-racking. A strong web form library could be a gamechanger for anyone who wants to handle these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you may have, from personal to organization papers, all-in-one spot.

- Make use of advanced resources to complete and control your Loan Between Shareholders With Financial Information

- Gain access to a resource base of articles, guides and handbooks and resources connected to your situation and needs

Save effort and time in search of the papers you will need, and utilize US Legal Forms’ advanced search and Review tool to find Loan Between Shareholders With Financial Information and download it. If you have a subscription, log in to the US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to see the papers you previously saved and to control your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and get limitless use of all advantages of the platform. Listed below are the steps to consider after downloading the form you want:

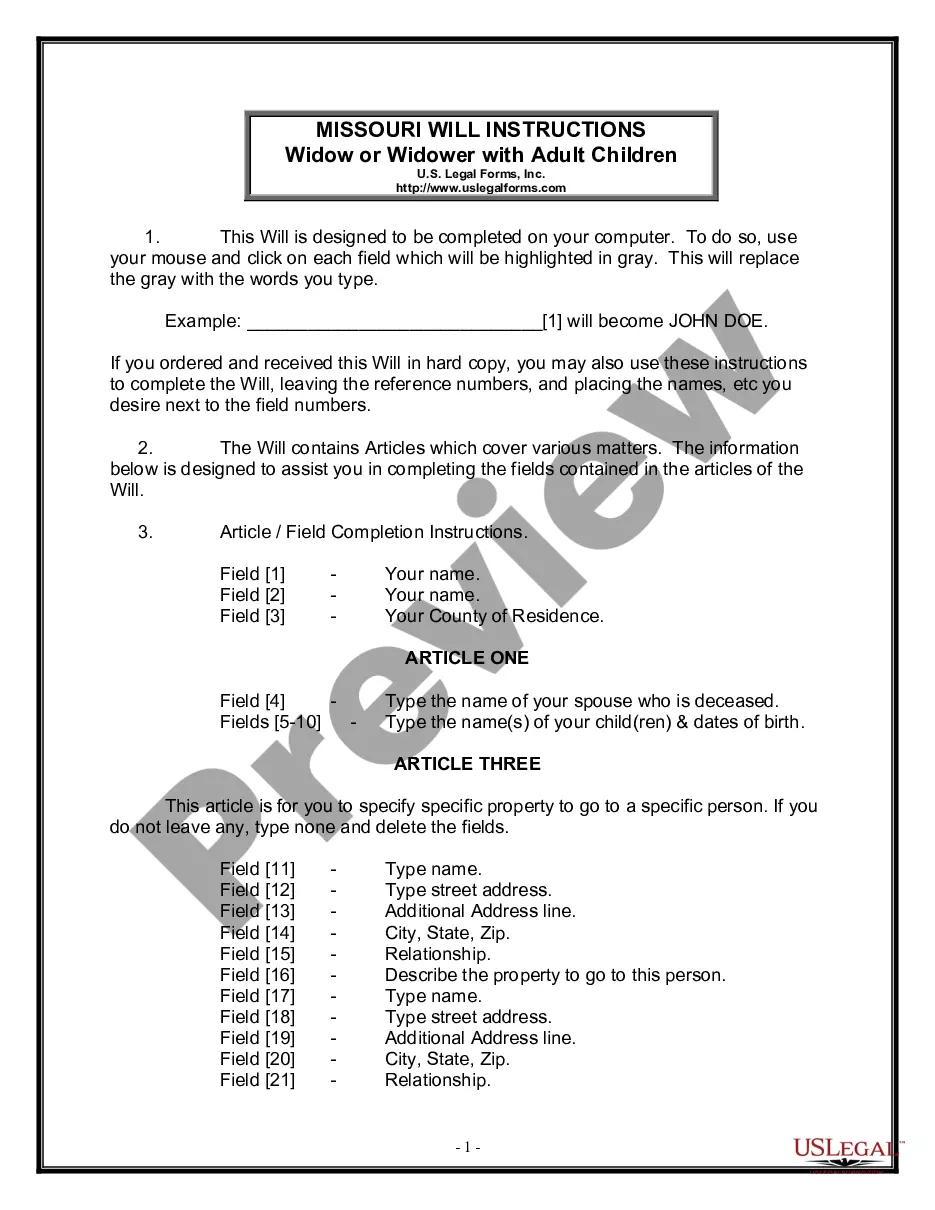

- Confirm it is the correct form by previewing it and looking at its information.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Find the file format you want, and Download, complete, eSign, print out and deliver your document.

Take advantage of the US Legal Forms web library, supported with 25 years of experience and stability. Enhance your everyday document management in to a easy and user-friendly process today.

Form popularity

FAQ

If you withdraw money from your incorporated business and it is not designated as salary or dividends paid to you, it is considered a loan from the company to you, the shareholder. Another common ?due from shareholder? loan takes place when company money is used to purchase a personal item.

The shareholder has borrowed money from the business and is responsible for paying it back with interest. This helps shareholders take out a personal loan from the business instead of going to a bank or other financial institution while the corporation benefits from making some extra money on the interest.

There is a misconception that when a shareholder borrows money from their corporation, the loan can remain outstanding indefinitely without any income tax consequences. This is generally not the case, unfortunately; however, there are various tax-efficient ways to repay or offset the loan.

Your shareholder loan balance will appear on your balance sheet as either an asset or a liability. It is considered to be a liability (payable) of the business when the company owes the shareholder. You'll see it as an asset (receivable) of the business when the shareholder owes the company.

Shareholder loans are debt-type financing provided by financial sponsors to companies. They sit between the most junior debt and equity and often make up the largest part of the capital invested. They are sometimes called ?shareholder notes?, ?preferred equity?, or the ?institutional strip?.