Modified Endowment Contract Withdrawals

Description

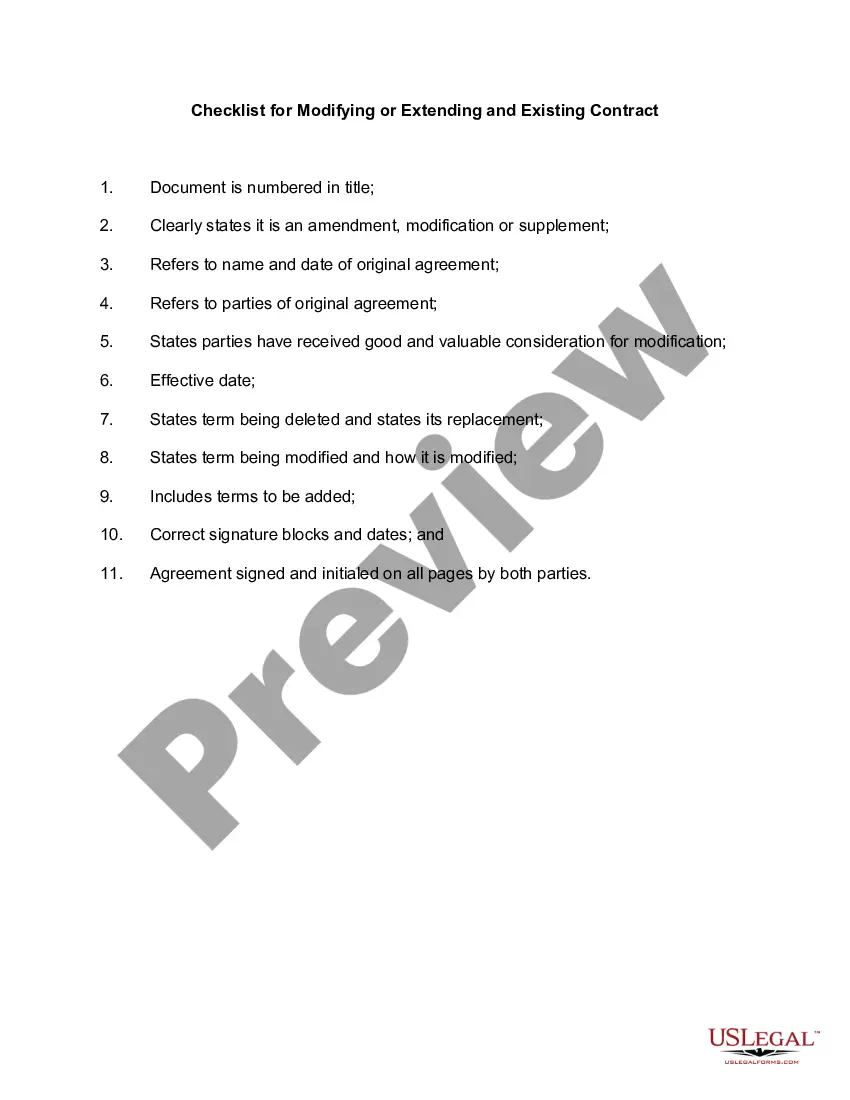

How to fill out Checklist For Modifying Or Extending And Existing Contract?

The Modified Endowment Contract Withdrawals you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Modified Endowment Contract Withdrawals will take you only a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or review the form description to ensure it satisfies your needs. If it does not, make use of the search bar to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Modified Endowment Contract Withdrawals (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

For example, MECs can function as an alternative or supplement to annuities in your retirement and estate planning. Like annuities, you can withdraw money in retirement with the earnings treated as ordinary income.

Under a modified endowment contract, the gains are withdrawn first, which are taxed as ordinary income. MEC withdrawals also typically incur a 10% tax penalty if you take out the money before turning 59½ years old.

Withdrawals are taxed similarly to those of a non-qualified annuity. For withdrawals before the age of 59½, a penalty of 10% may apply. 6 As with traditional life insurance policies, MEC death benefits aren't subject to taxation.

Withdrawing money from a modified endowment contract is similar to withdrawing from a non-qualified annuity, which is funded with post-tax dollars. When you take money out of your MEC, the earnings are taxable as ordinary income before you turn 59 ½ and you also incur a 10% penalty.

Like nonqualified annuities, MECs act as investment products that are funded with after-tax dollars. When you take money out of an MEC, you only need to pay taxes on the earnings you receive. The IRS treats this money as ordinary income.