Sample Confirmation Letter For Accounts Receivable

Description

How to fill out Letter To Confirm Accounts Receivable?

What is the most dependable service to obtain the Sample Confirmation Letter For Accounts Receivable and other updated versions of legal documents.

US Legal Forms is the answer! It boasts the largest collection of legal paperwork for any situation.

If you haven't set up an account with us yet, follow these steps to create one: Form compliance assessment. Prior to acquiring any template, ensure it aligns with your use case requirements and local or state regulations. Review the form description and use the Preview feature if it is available.

- Each template is expertly crafted and verified for adherence to federal and local statutes and regulations.

- They are categorized by field and jurisdiction, making it effortless to locate the one you require.

- Experienced users of the platform just need to Log In to their account, verify their subscription status, and click the Download button next to the Sample Confirmation Letter For Accounts Receivable to obtain it.

- Once downloaded, the document remains accessible for future use in the My documents section of your account.

Form popularity

FAQ

In a confirmation letter, detail the transaction ensuring to include the balance owed, payment terms, and any pertinent dates. You want to maintain a clear and professional tone throughout. A well-crafted sample confirmation letter for accounts receivable not only confirms details but also reinforces your business relationship.

To confirm receivables with debtors, send a sample confirmation letter for accounts receivable detailing the amount owed and any pertinent transaction details. Request that the debtor review the information and respond with their confirmation. Following up with a gentle reminder can improve response rates.

Positive accounts receivable confirmations are requests sent to debtors to confirm that they agree with the amounts stated in the sample confirmation letter for accounts receivable. These confirmations can enhance credibility and help identify any potential issues in the records. Businesses often prefer positive confirmations as they provide stronger assurance.

Accounts Receivable (AR) confirmation is a process used to verify outstanding bills with your clients. This involves sending a sample confirmation letter for accounts receivable to confirm that the client acknowledges their balance. It helps ensure accuracy in financial reporting and reduces discrepancies.

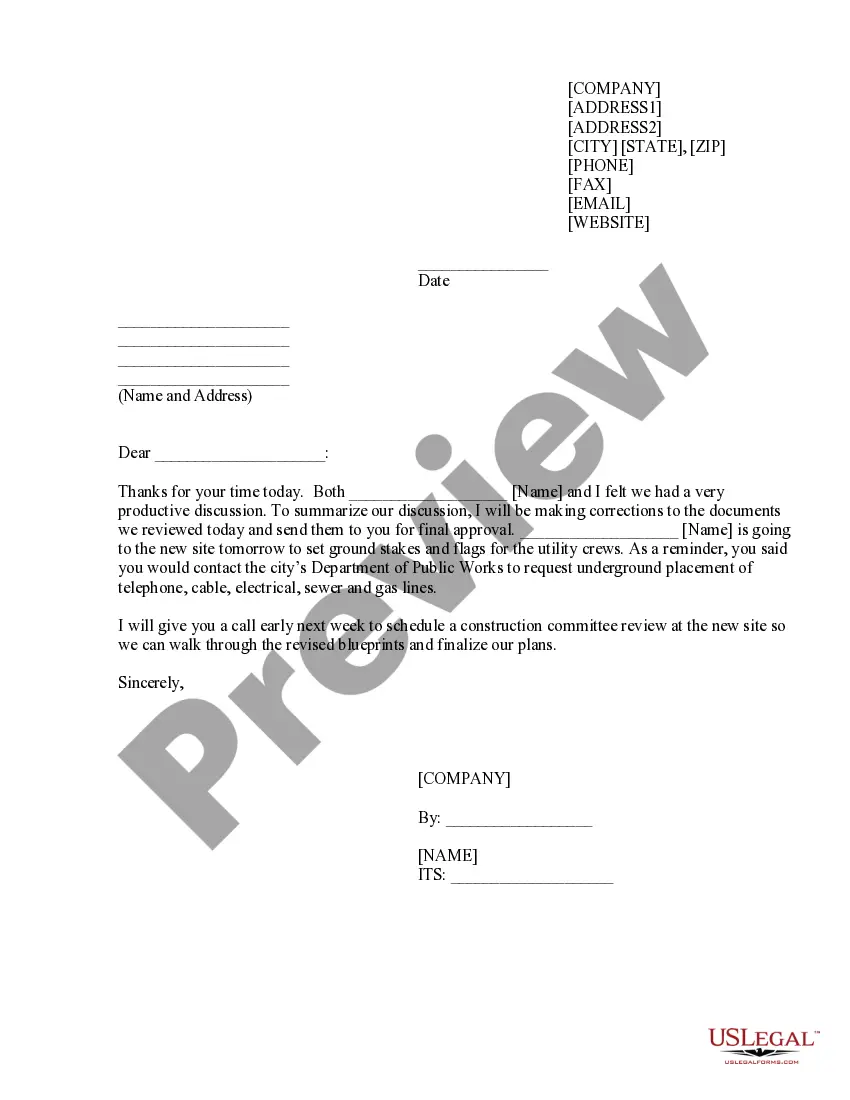

A simple confirmation letter should begin with your contact details and address it to the appropriate party. State the purpose of the letter immediately, and provide essential details regarding the accounts receivable transaction. Close the letter with your name and contact information for any follow-up.

Filling out a sample confirmation letter for accounts receivable involves providing accurate details regarding the transaction. Include information such as the amount owed, the payment terms, and relevant dates. Be sure to format the letter clearly and maintain a professional tone throughout.

To write a sample confirmation letter for accounts receivable, start with your contact information and the date. Then, include a clear subject line, such as 'Confirmation of Accounts Receivable'. Introduce the purpose of the letter, followed by a brief overview of the relevant transaction details, and conclude with your signature.

Filling out a balance confirmation letter involves specifying your company's details, outlining the amount owed, and providing a space for the customer to confirm or dispute. Include clear instructions for the recipient, ensuring they understand how to respond. A well-structured sample confirmation letter for accounts receivable can guide you in creating effective communications. This letter not only conveys professionalism but also encourages prompt responses.

You recognize receivables when you provide goods or services on credit to a customer. This accounting principle means recording the income as it is earned, even if payment has not yet been received. Additionally, ensuring timely confirmation of these balances is crucial for maintaining accurate financial records. A sample confirmation letter for accounts receivable can serve as a useful tool in this recognition process.

An accounts receivable confirmation is a formal method used to verify the amounts a customer owes you. Typically, this process involves sending a letter or email, which includes details of the receivable balance. The customer then responds, confirming whether the amount is accurate. To make this process easier, you can use a sample confirmation letter for accounts receivable to ensure consistency and completeness.