Commission In Policy

Description

How to fill out Sales Commission Policy?

Accessing legal documents that comply with federal and state regulations is essential, and the web provides a variety of selections to consider.

However, what is the purpose of spending time searching for the ideal Commission In Policy example on the internet if the US Legal Forms online archive has already curated such documents in one location.

US Legal Forms is the largest online legal repository with more than 85,000 customizable forms created by attorneys for any business and personal situation. They are easy to navigate with all documents organized by state and intended use.

Explore additional samples using the search feature at the top of the page if necessary.

- Our experts keep updated with legal modifications, ensuring your paperwork is always current and compliant when acquiring a Commission In Policy from our platform.

- Acquiring a Commission In Policy is quick and easy for both existing and new users.

- If you already hold an account with an active subscription, Log In and download the document sample you need in your preferred format.

- For new visitors to our site, follow the steps below.

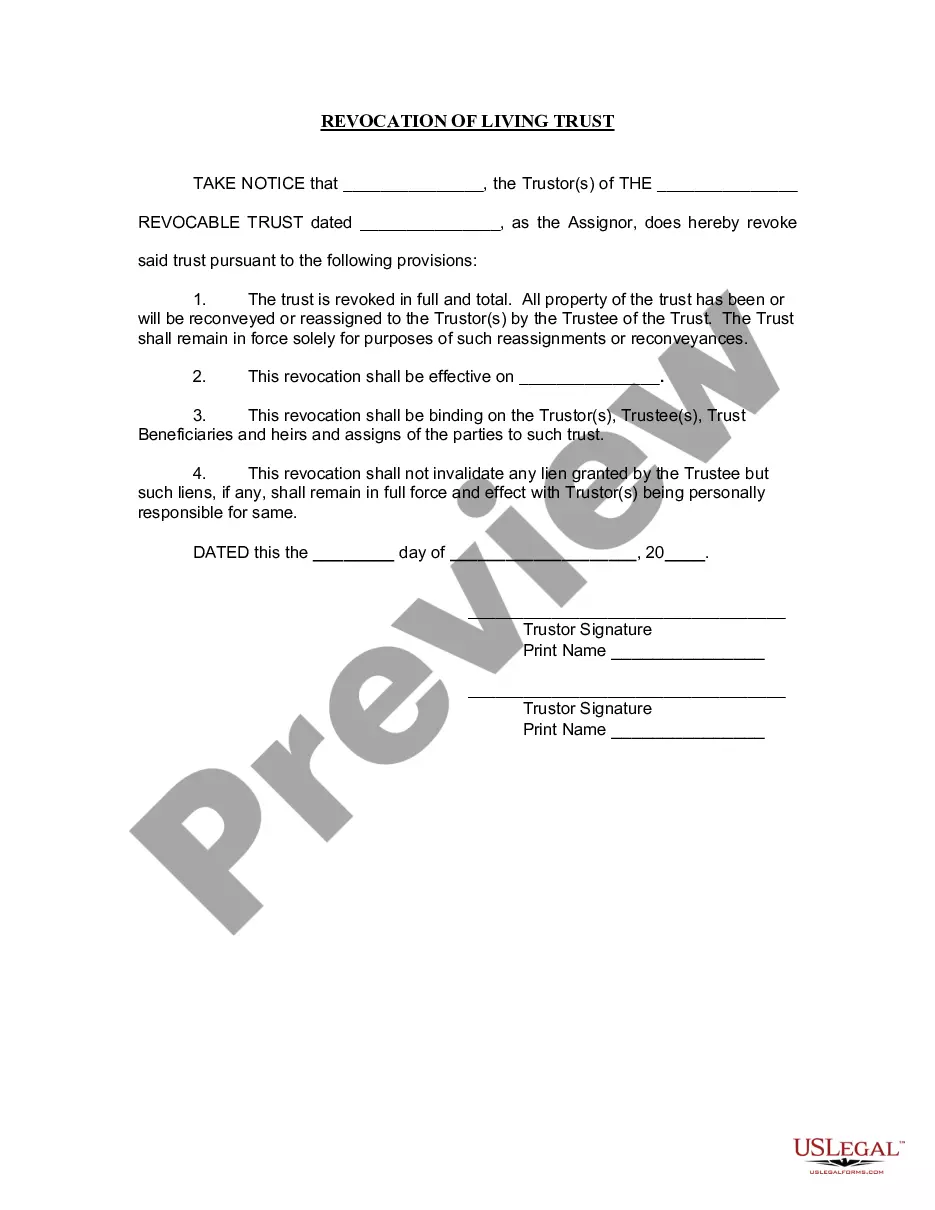

- Review the template using the Preview function or through the outline text to confirm it meets your requirements.

Form popularity

FAQ

To calculate 6% commission on $300,000, you simply multiply the total amount by the commission rate. In this instance, 6% of $300,000 equals $18,000. Understanding such calculations for commission in policy is crucial for agents to know what they can earn and for clients to appreciate the financial impact of these commissions.

The commission in insurance refers to the compensation that agents receive for selling insurance policies. It is an essential aspect of how the insurance industry operates, allowing agents to earn a living while facilitating policy purchases for clients. Grasping the meaning of commission in policy empowers consumers to make informed choices regarding their insurance needs.

A commission policy statement serves as a clear guide outlining how commissions are earned and distributed within an organization. It helps ensure transparency and consistency in the commission process. By defining the rules and expectations regarding commissions in policy, it protects both the company and its employees, fostering trust and clarity.

The income of commission-based insurance agents can vary widely, with some earning a modest income and others making six figures annually. This discrepancy depends on factors such as location, experience, and the types of policies sold. Many agents find that diversifying their offerings can increase their earning potential over time. Utilizing tools like those offered by US Legal Forms can help agents maximize their commissions in policy.

Typically, agents earn a commission ranging from 5% to 20% of the insurance policy premium. This percentage greatly varies depending on the type of insurance product being sold and the individual agency's structure. Understanding these percentages is essential for both agents and clients to grasp how commissions in policy work. At US Legal Forms, we offer insights to clarify these financial details.

To earn commission from insurance, you first need to obtain the necessary licenses and build a client base. After that, you can sell policies and earn a percentage of the premium. Investing time in developing relationships and providing excellent service can lead to long-lasting client trust, which directly impacts your success in earning commission in policy. Platforms like US Legal Forms can assist with the paperwork involved, making the process smoother.

Many insurance agents leave the field due to high competition and the challenges of finding clients. Transitioning to a commission in policy structure can be difficult for some as it often takes time to build a steady income. Furthermore, agents may become discouraged if they do not see immediate results. At US Legal Forms, we provide resources that help agents understand the commission in policy framework more effectively.

To fill out a commission agreement, start by clearly stating the parties involved and the terms of the commission arrangement. Include details such as the commission percentage, payment schedule, and any performance metrics. A well-structured commission in policy within the agreement prevents misunderstandings. US Legal Forms offers templates that can guide you in drafting the perfect document.

A sales commission policy might state that sales representatives earn 10% of the total sales made within a quarter. This motivates representatives to exceed their targets while providing a predictable compensation structure. Having a detailed commission in policy ensures that everyone understands how payments are determined. Consider exploring US Legal Forms for additional resources.

A good commission plan motivates employees while ensuring profitability. It typically includes reasonable targets and rewards for achieving or exceeding those targets. An effective commission in policy balances company interests and employee satisfaction. Consider using flexible plans that adapt as your business grows.