Loan Between Form Agreement With Client

Description

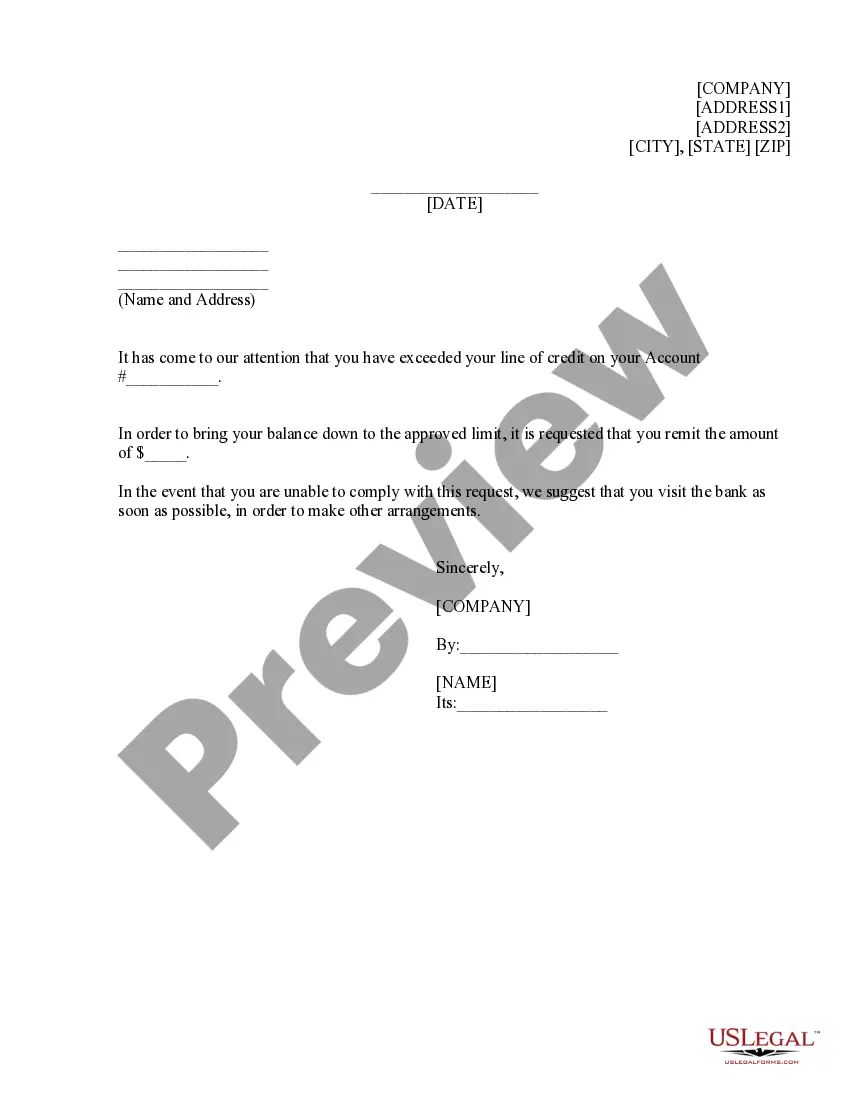

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Working with legal paperwork and procedures can be a time-consuming addition to your day. Loan Between Form Agreement With Client and forms like it often require that you look for them and navigate the best way to complete them properly. Therefore, whether you are taking care of financial, legal, or individual matters, using a thorough and convenient web library of forms at your fingertips will help a lot.

US Legal Forms is the top web platform of legal templates, offering more than 85,000 state-specific forms and a number of tools that will help you complete your paperwork effortlessly. Check out the library of relevant papers available with just one click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Protect your document managing procedures with a high quality service that lets you prepare any form within a few minutes without having extra or hidden charges. Just log in to your account, locate Loan Between Form Agreement With Client and download it right away within the My Forms tab. You may also access formerly downloaded forms.

Is it the first time utilizing US Legal Forms? Sign up and set up a free account in a few minutes and you will gain access to the form library and Loan Between Form Agreement With Client. Then, adhere to the steps listed below to complete your form:

- Ensure you have discovered the correct form by using the Review option and reading the form description.

- Choose Buy Now when ready, and select the monthly subscription plan that is right for you.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience supporting consumers handle their legal paperwork. Get the form you require today and streamline any operation without breaking a sweat.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

Once you have a template to work with, create your document in the following order, with each item clearly spelled out: Date of the contract and effective date of the loan. State governance for the loan agreement (usually the residence of the lender) Identities of the borrower and the lender, often including addresses.