Disclosed To Or With

Description

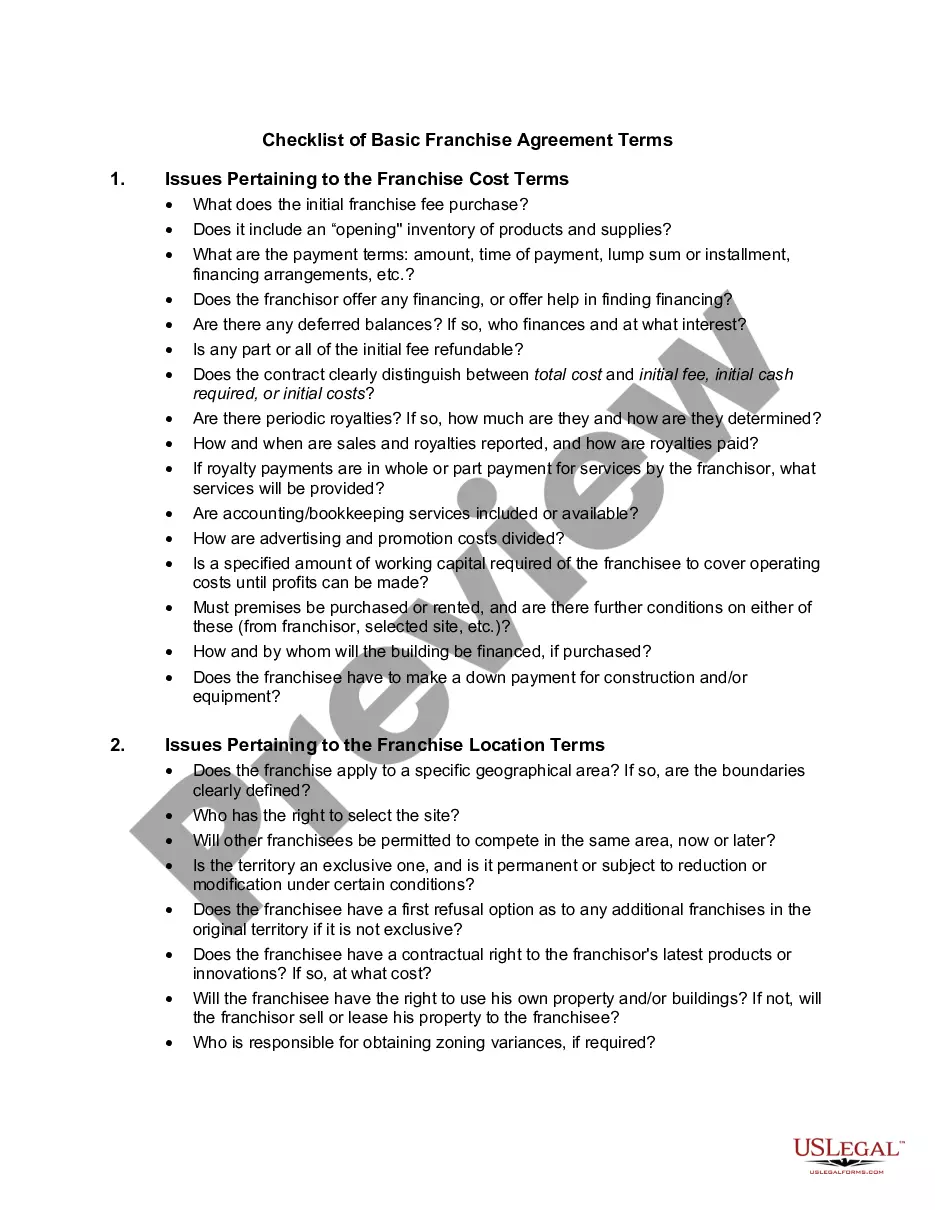

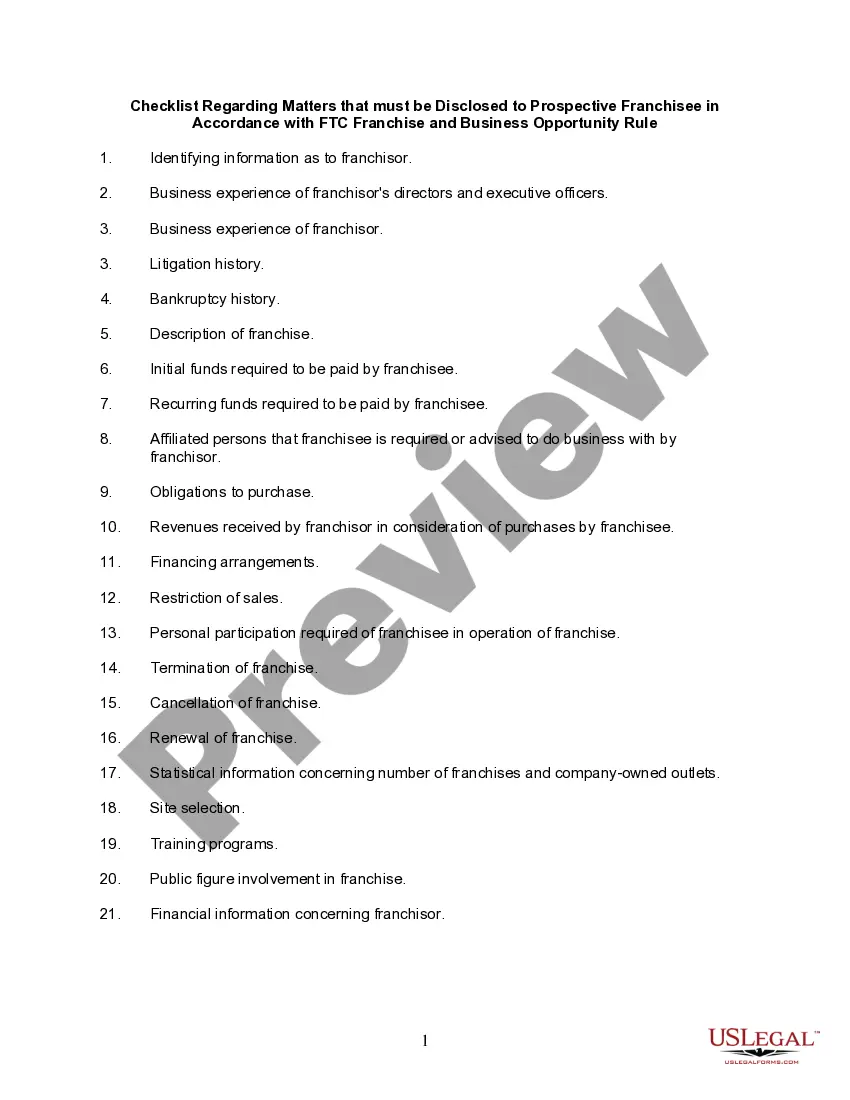

How to fill out Checklist Regarding Matters That Must Be Disclosed To Prospective Franchisee In Accordance With FTC Franchise And Business Opportunity Rule?

Utilizing legal templates that adhere to federal and state regulations is essential, and the internet provides a variety of options to select from.

However, why squander time searching for the suitable Disclosed To Or With example online when the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by lawyers for any professional and personal situation.

Examine the template using the Preview feature or through the text outline to ensure it fits your needs.

- They are straightforward to navigate with all documents categorized by state and purpose.

- Our specialists keep up with legal updates, so you can trust that your form is current and compliant when acquiring a Disclosed To Or With from our site.

- Obtaining a Disclosed To Or With is simple and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you need in the appropriate format.

- If you are unfamiliar with our website, follow the steps below.

Form popularity

FAQ

The phrase 'get disclosed' refers to the process when information becomes revealed or shared. For example, when a document gets disclosed with the necessary parties, it lets them know important facts that might affect their decision-making. This term emphasizes the act of bringing private information into the open.

The Vermont Sales and Use Tax is 6%. To determine tax due, multiply the sales amount by 6% (or 7% if the sale is subject to local option tax), and round up to the nearest whole cent ing to the following rules: Tax computation must be carried to the third decimal place, and.

Though Vermont strongly encourages merchants to register online, you can also use form BR-400 to register by mail or fax (802-828-5787). You'll need this information to register for a sales tax permit in Vermont: Personal identification info (SSN, address, etc.) Business identification info (EIN, address, etc.)

Vermont Tax Rates, Collections, and Burdens Vermont also has a graduated corporate income tax, with rates ranging from 6.00 percent to 8.5 percent. Vermont has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.30 percent.

It's important to note that Vermont Resale Certificates do not expire. However, the seller must keep the certificate on file for three years from the date of the last sale.

Email: tax.business@vermont.gov Contact us with questions regarding Business Registration, Meals & Rooms Tax, Sales & Use Tax, Withholding, Miscellaneous Taxes, myVTax Support, Local Option Tax, Nonprofits and Exempt Organizations.

If you buy products at retail in order to resell them, you can often avoid paying sales tax when purchasing those products by using a Vermont resale certificate, otherwise known as an exemption certificate. With a verified resale certificate, you don't have to pay sales tax when buying goods for resale.

This exemption is based on the type of organization making the purchase or sale. Some exempt organizations are the federal government, State of Vermont, nonprofit organizations qualifying for exempt status under federal law at 26 U.S.C. § 501(c)(3), agricultural organizations qualifying under 26 U.S.C.

Some customers are exempt from paying sales tax under Vermont law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.