Lien Made Property With Federal

Description

How to fill out Assignment Of Lien By General Contractor?

Creating legal documents from the ground up can sometimes be overwhelming.

Certain situations may require extensive research and substantial financial investment.

If you’re seeking a simpler and more cost-effective method for preparing Lien Made Property With Federal or any other documents without having to navigate complexities, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific forms meticulously assembled for you by our legal professionals.

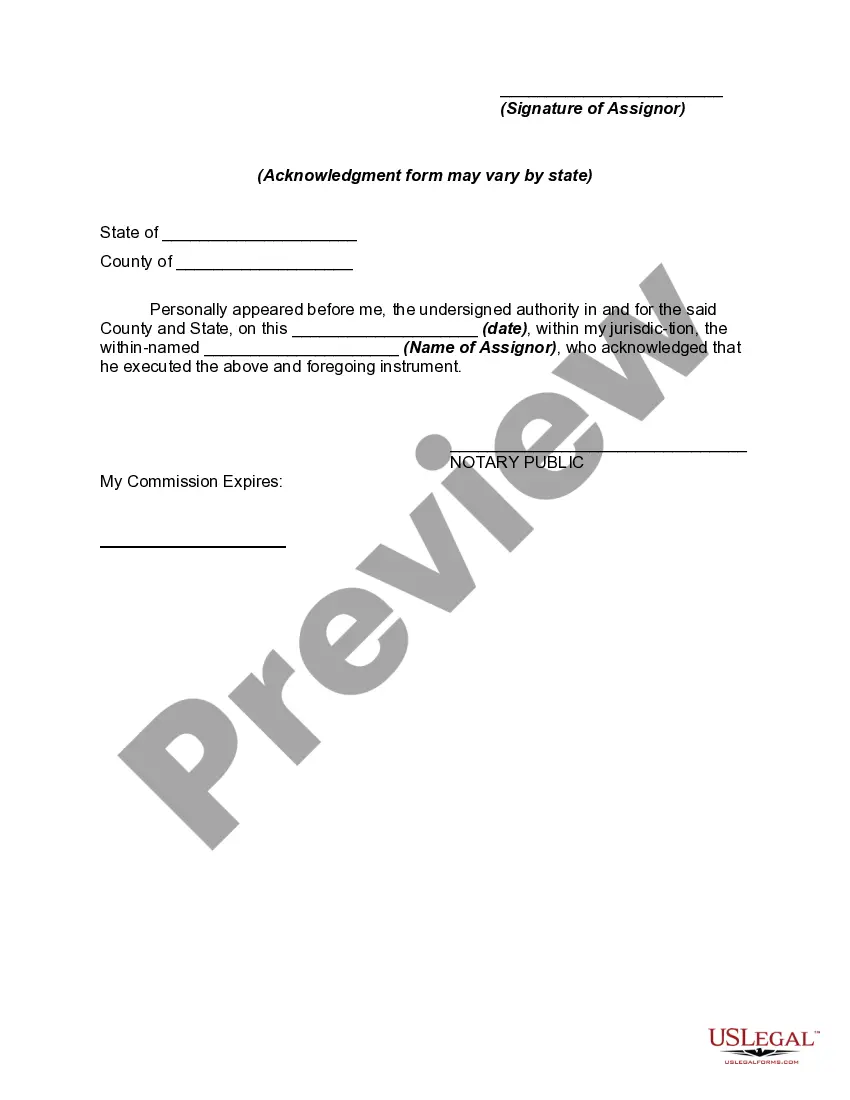

Examine the document preview and descriptions to ensure you are on the correct document you are seeking. Verify that the form you choose adheres to the standards of your state and county. Select the appropriate subscription option to purchase the Lien Made Property With Federal. Download the form, then fill it out, sign, and print it. US Legal Forms enjoys a solid reputation and more than 25 years of expertise. Join us now and simplify document completion into something effortless and efficient!

- Utilize our platform whenever you require trusted and dependable services through which you can effortlessly find and download the Lien Made Property With Federal.

- If you’re familiar with our website and have previously registered an account with us, simply Log In to your account, locate the form and download it or re-download it at any moment in the My documents section.

- Not registered yet? No worries. It requires minimal time to register and browse the library.

- However, before directly downloading Lien Made Property With Federal, consider these suggestions.

Form popularity

FAQ

How to Get Rid of a Lien. Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt.

Complete Form 14135, Application for Certificate of Discharge of Federal Tax Lien attached with this publication.

Completing Form 14135 Your personal information: Be sure to enter the information as it appears on the Notice of Federal Tax Lien. Your representative's information (attach Form 2848, Power of Attorney) Information about your lender or finance company. A description and appraisal of the property.

2. Mail the completed Form 14135 and the appropriate attachments to: IRS Advisory Consolidated Receipts 7940 Kentucky Drive, Stop 2850F Florence, KY 41042 (Refer to Publication 4235 Collection Advisory Group Addresses for additional contact information.)

IRS Definition: A federal tax lien is the government's legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government's interest in all your property, including real estate, personal property and financial assets.