Lien Made Property Form Texas

Description

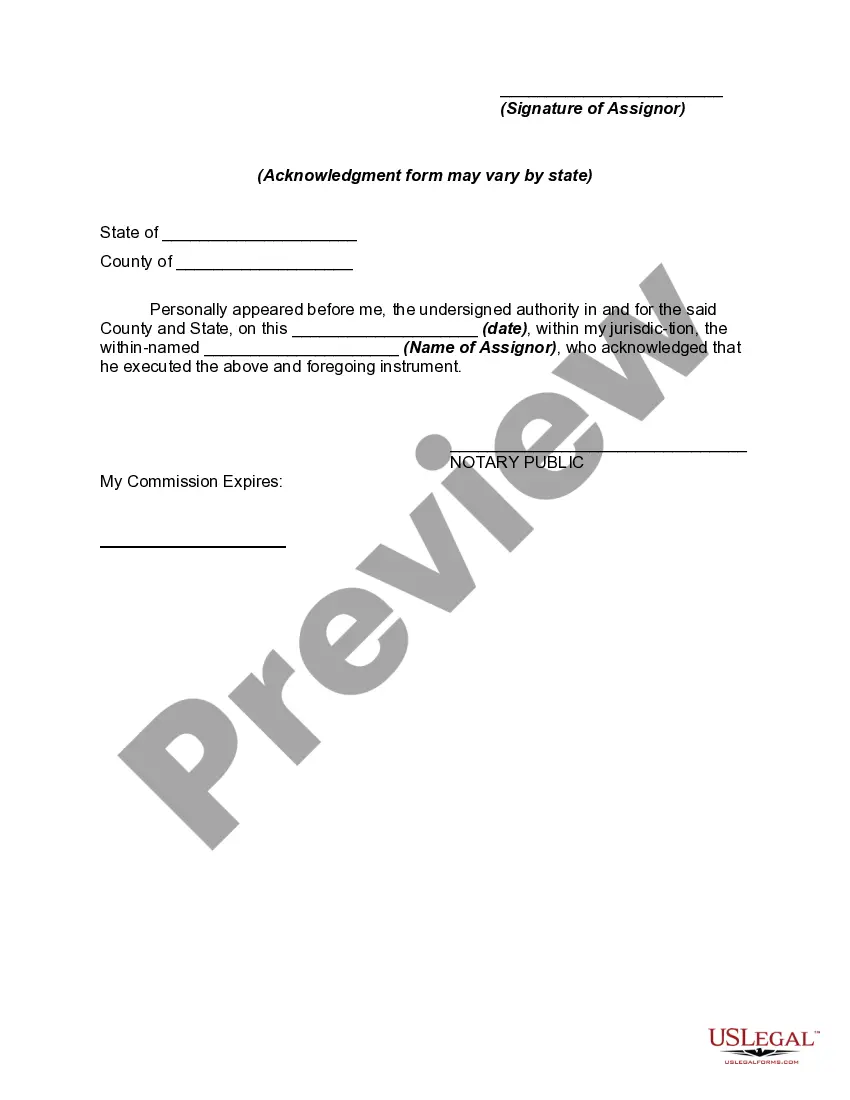

How to fill out Assignment Of Lien By General Contractor?

Acquiring legal documents that adhere to national and local regulations is essential, and the web provides numerous choices to select from.

However, what's the benefit of spending time searching for the suitable Lien Made Property Form Texas example online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the largest virtual legal repository featuring over 85,000 customizable templates crafted by attorneys for any business and personal circumstance. They are easy to navigate with all materials categorized by state and intended use. Our specialists stay informed on legislative changes, ensuring that your form remains current and compliant when obtaining a Lien Made Property Form Texas from our platform.

- Review the template using the Preview option or through the text description to ensure it satisfies your requirements.

- Search for another example using the search function at the top of the website if necessary.

- Click Buy Now once you’ve located the correct document and select a subscription plan.

- Create an account or Log In and complete your payment using PayPal or a credit card.

- Select the format for your Lien Made Property Form Texas and download it.

Form popularity

FAQ

Yes, it is possible for someone to place a lien on your property without your immediate knowledge in Texas. Typically, a lien arises when a creditor seeks to secure a debt owed by a property owner. In most cases, a property owner receives a notice when a lien is filed, but some types of liens may not require direct notification. To protect your interests, consider using a Lien Made Property Form Texas, which helps clarify issues related to property ownership and outstanding debts.

For the most part, all contractors, subcontractors, laborers, design professionals, materials suppliers, and equipment suppliers who provide labor or materials to a property in Texas are not required to have a written contract (a verbal contract is sufficient) to qualify for the right to file a lien.

Filing Lien Affidavit It must be recorded (filed) in the real property records of the County Clerk's office in the county in which the owner's property is located by personally deliver- ing or mailing the lien affidavit to the County Clerk with the required recording fee. You need only file one lien affidavit.

Information you will need Project owner's name (or company name) and last known mailing address. Project name and street address, including the county name. A legal description of the property (not always needed, but helpful if available). The amounts owed for each month you performed the work.

In order to file a Lien against a residential homestead Property, either you, or the General Contractor must: (1) have a written contract signed by the Property Owner (if they are a married couple, then both must sign the contract); (2) before the work begins; and (3) the contract must be filed with the County Clerk.

Release Of Lien Texas Form To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.