Assignment Lien Statement For Mortgage

Description

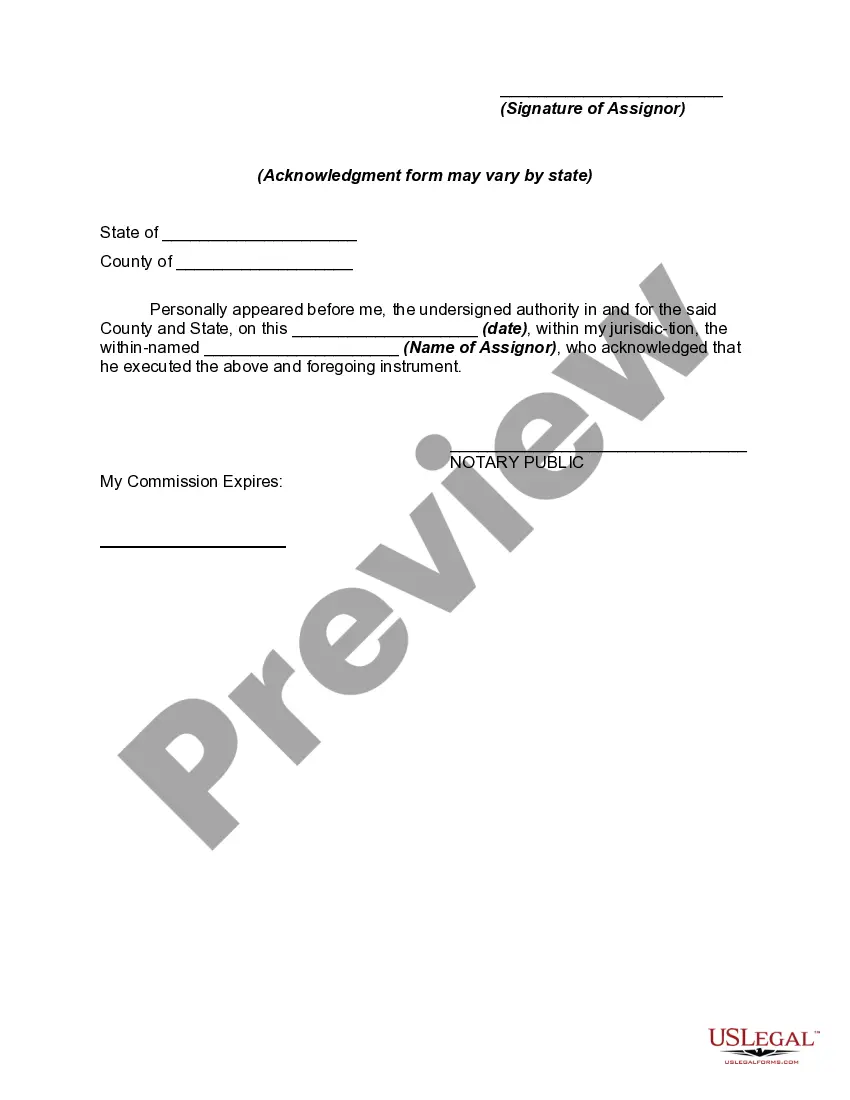

How to fill out Assignment Of Lien By General Contractor?

Managing legal documents can be daunting, even for experienced experts.

If you're looking for an Assignment Lien Statement For Mortgage and lack the time to find the appropriate and current version, the process can be overwhelming.

US Legal Forms meets all your needs, ranging from personal to commercial documentation, all in one location.

Utilize cutting-edge tools to complete and manage your Assignment Lien Statement For Mortgage.

Here are the steps to follow after obtaining the form you need: Confirm that this is the correct form by previewing it and reviewing its details. Ensure that the document is valid in your state or county. Click Buy Now when ready. Choose a monthly subscription plan. Select the format you need, and Download, fill in, sign, print, and send your document. Benefit from the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document management into a seamless and user-friendly process today.

- Access a valuable resource library of articles, guides, and materials related to your situation and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms' advanced search and Preview feature to find the Assignment Lien Statement For Mortgage and download it.

- If you have a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check the My documents section to view the documents you've downloaded previously and organize your folders as desired.

- If it’s your first experience with US Legal Forms, create a free account and gain unlimited access to all the advantages of the library.

- An extensive online form repository could be a significant advantage for anyone seeking to handle these matters effectively.

- US Legal Forms stands as a leader in the realm of online legal documents, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Once you pay off your mortgage, you will receive documentation from your lender or broker. You will then need to notify your local records office in order to receive your deed of trust.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.