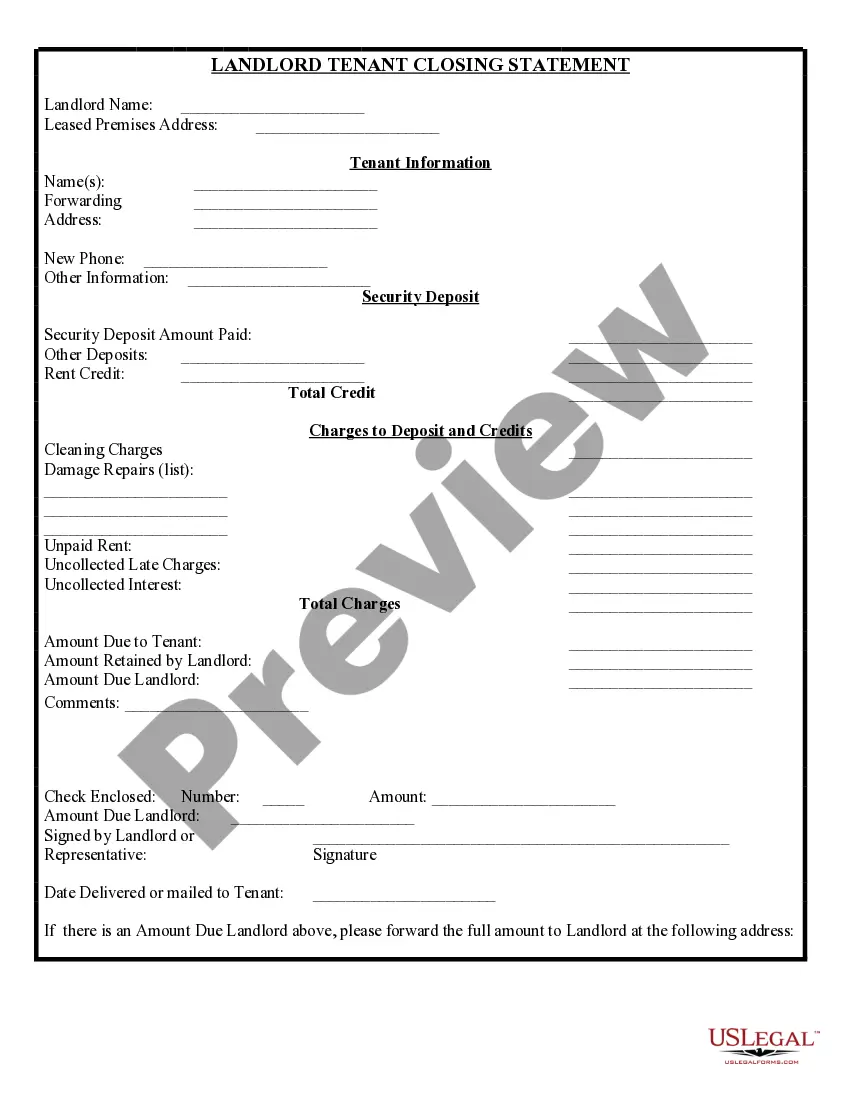

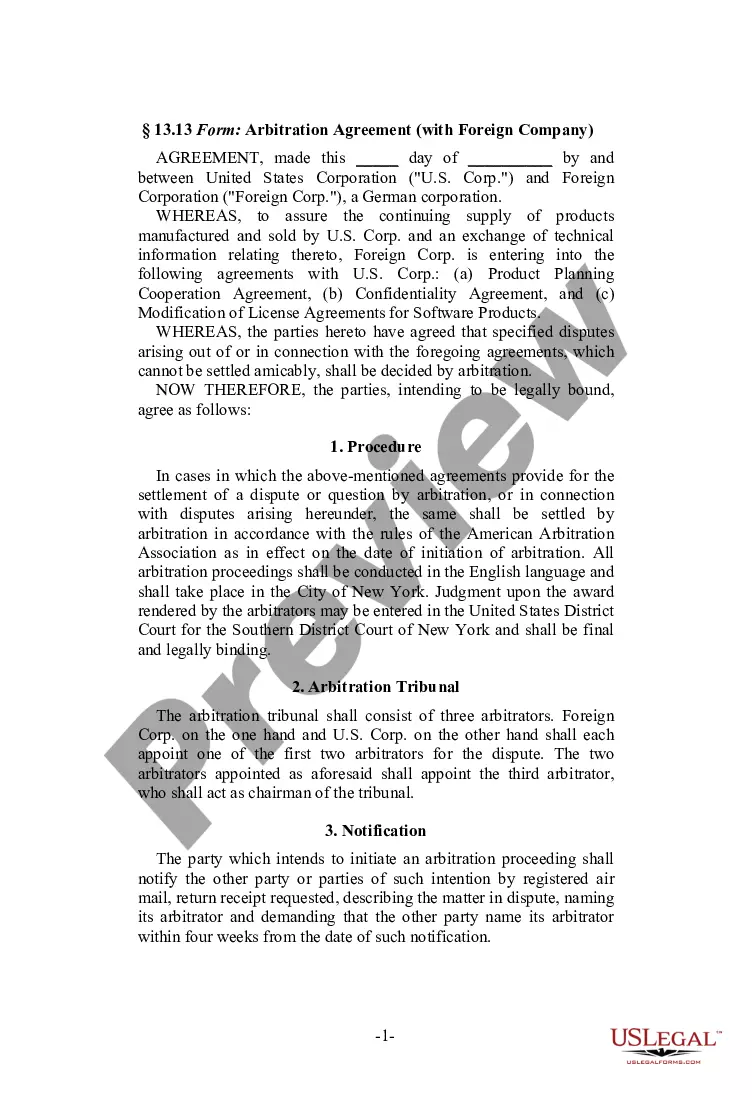

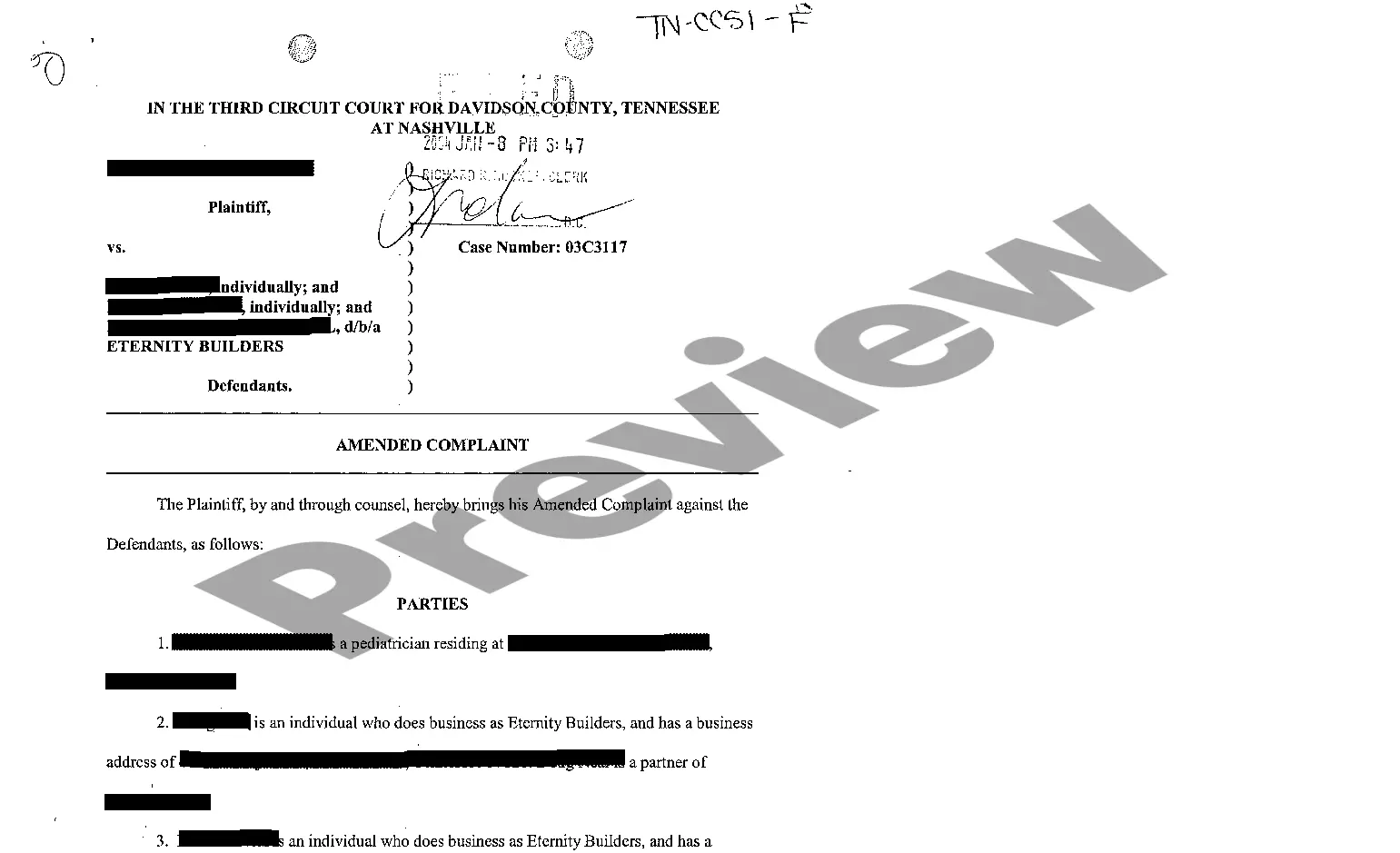

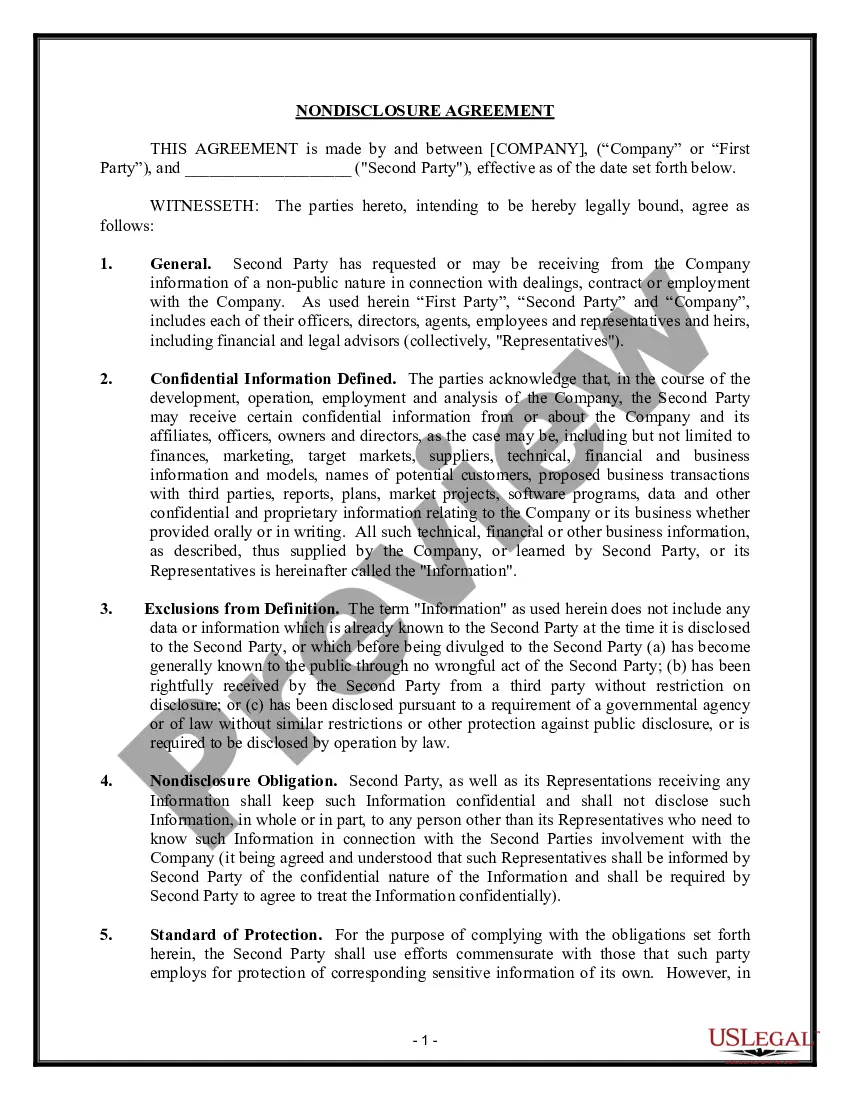

Not Profit File Withholding Tax

Description

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Creating legal documents from the beginning can frequently be overwhelming.

Certain situations may require extensive investigation and significant amounts of money spent.

If you’re seeking a simpler and more budget-friendly way of crafting Not Profit File Withholding Tax or any other documents without the hassle, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

Before proceeding with the download of Not Profit File Withholding Tax, consider these suggestions: Review the form preview and descriptions to ensure you have located the document you need. Verify that the template you select meets the requirements of your state and county. Choose the most suitable subscription plan to purchase the Not Profit File Withholding Tax. Download the file, then complete, sign, and print it. US Legal Forms has a strong reputation and over 25 years of expertise. Join us now and make document execution straightforward and efficient!

- With just a few clicks, you can swiftly access state- and county-compliant templates carefully created for you by our legal experts.

- Utilize our website whenever you require a trustworthy and reliable service from which you can easily find and download the Not Profit File Withholding Tax.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, choose the form, and download it now or re-download it later in the My documents section.

- Not a member yet? No problem. It only takes a few minutes to register and explore the library.

Form popularity

FAQ

You must make your request in writing and attach evidence to support your application. Complete the application form online (it can be saved to your computer). When you have completed the application, you can lodge it online by logging into Online services for business.

Procedure. In the Implementation Guide for Financial Accounting , choose Financial Accounting Global Settings ? Withholding Tax ? Extended Withholding Tax ? Calculation ? Withholding Tax Types ? Define Withholding Tax Type for Payment Posting .

You can file your ITR without Form 16. Compute income from salary slips, and adjust allowances like HRA, LTA, etc. Verify the TDS details on Form 26AS. Calculate income from house property. Compute income from capital gains. ... Determine income from other sources like interest on fixed deposits, savings accounts, etc.

Why is Form 16 required? Form 16 helps you easily file your income tax returns. It is proof that the employer did submit the money to the authorities that it deducted as TDS from your salary. It also details how your tax was computed based on the investment declarations you made at the beginning of the financial year.

Procedure. In the Implementation Guide for Financial Accounting , choose Financial Accounting Global Settings ? Withholding Tax ? Extended Withholding Tax ? Calculation ? Withholding Tax Types ? Define Withholding Tax Type for Payment Posting .