No Creditors Loans With Low Interest Rate

Description

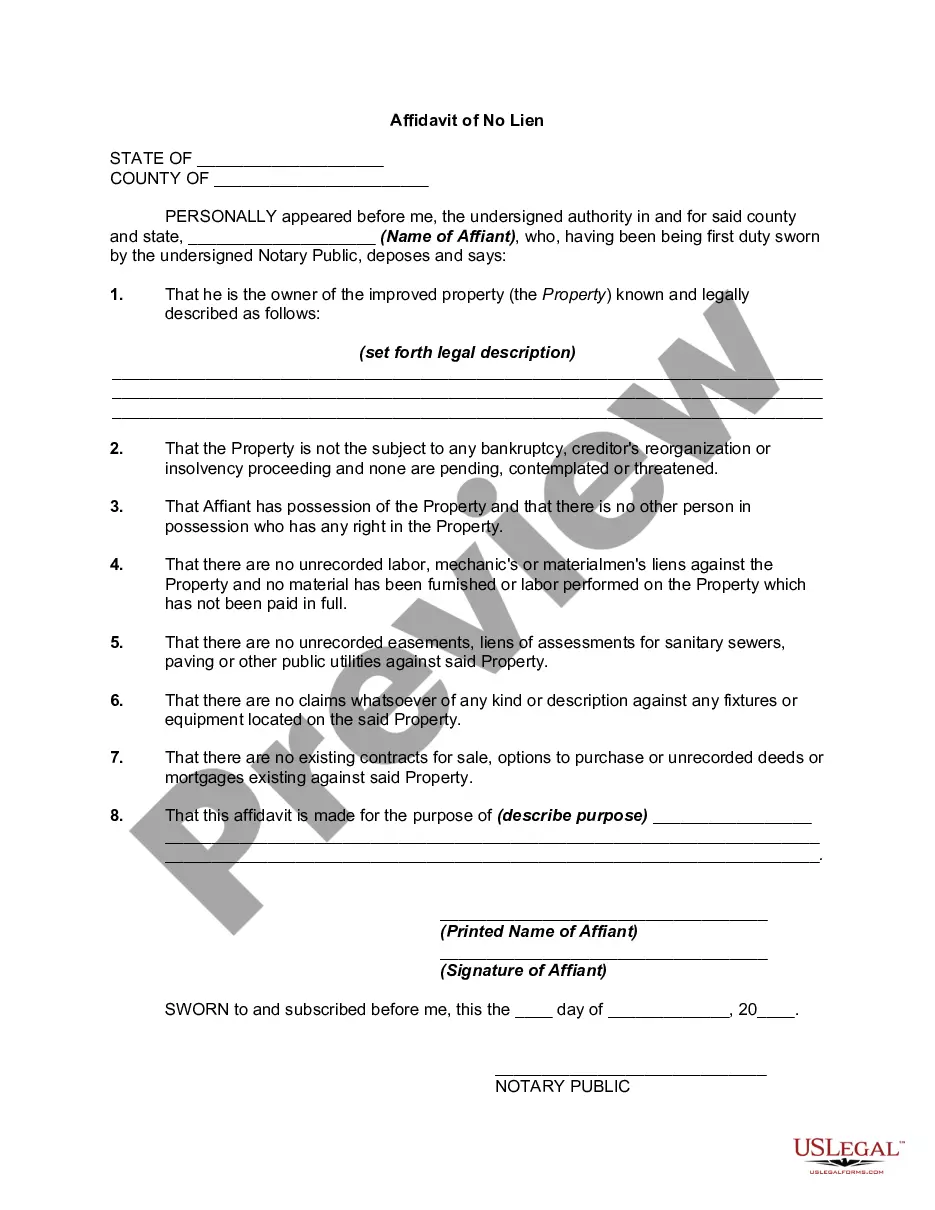

How to fill out Affidavit That There Are No Creditors?

- If you're a returning user, log in to your account and locate the desired form template. Ensure your subscription is active; if not, please renew it.

- For first-time users, start by previewing the form and reviewing the description to confirm it aligns with your legal needs and jurisdiction.

- If adjustments are needed, utilize the search feature to find the correct document that meets your criteria.

- Once you've found the suitable form, click on the Buy Now button. Select a subscription plan that fits your needs, and create an account to access your document.

- Complete your purchase using your credit card or PayPal for a hassle-free transaction.

- After your payment is confirmed, download the form directly to your device. You can access your document anytime from the My Forms section of your profile.

US Legal Forms not only provides a comprehensive library with over 85,000 fillable legal documents, but it also connects users to premium experts for guidance, ensuring that every document you complete is accurate and legally sound.

Take advantage of the extensive resources at US Legal Forms today and empower yourself to manage your legal needs efficiently!

Form popularity

FAQ

When seeking financing, consider that no creditors loans with low interest rates often include secured loans, such as home equity loans or auto loans. These loans generally have lower rates because they are backed by collateral, reducing the lender's risk. Additionally, personal loans with solid credit scores can also come with competitive rates. To find the best options for no creditors loans with low interest rate, explore platforms like US Legal Forms, where you can access comprehensive resources and tools tailored for your needs.

To ask your creditor to lower your interest rate, begin by contacting them directly, either by phone or through their online platform. Clearly explain your reasons, referencing your consistent payment history and any offers you may have found, such as no creditors loans with low interest rate options. Demonstrating your commitment to maintaining a good relationship can make your request more compelling.

To persuade your credit card companies to lower your interest rate, start by reviewing your account details and payment history. A solid track record may provide leverage during discussions. You can also mention discovering no creditors loans with low interest rate options. This shows you are proactive and ready to explore better financial solutions.

Yes, you can request a lower interest rate on your line of credit. Many lenders may be open to negotiations, especially if you have a good payment history or improved credit score. It's important to approach your lender with clear reasons, such as finding no creditors loans with low interest rate options available to you. Being informed about your financial situation can significantly help your case.

Yes, there are government programs designed to assist individuals struggling with debt. These programs can offer options such as No creditors loans with low interest rates to help ease financial burdens. They can provide support to negotiate terms with creditors, allowing you to manage your debts effectively. UsLegalForms can guide you through these options to find the right solutions for your financial situation.

Yes, there are options available for people with no credit. These loans are often referred to as no creditors loans with low interest rates. They are designed to help individuals build their credit history while providing financial support when needed. Utilizing a platform like US Legal Forms can help you find suitable lenders that offer these types of loans tailored to your needs.

While 0% interest loans may seem appealing, they are often limited to specific terms and conditions. Lenders may offer promotional loans for short durations or specific purchases. Nevertheless, exploring no creditors loans with low interest rate can be a more reliable alternative. US Legal Forms can assist you in understanding your options and navigating the application process for these loans.

Yes, there are several government debt relief programs that aim to assist individuals facing financial difficulties. These programs can provide options like reduced payments or settlements on debts. When searching for no creditors loans with low interest rate, consider exploring these programs, as they might offer solutions to help manage or eliminate your debts without excessive interest. Platforms like US Legal Forms can guide you through the necessary paperwork to apply for these programs.

To secure the lowest interest rate, start by researching various lenders that offer no creditors loans with low interest rates. Maintaining a good credit score, having stable income, and providing accurate financial information can significantly improve your chances. Additionally, consider applying with a co-signer who has better credit, as this can also lower your interest rate. Always compare multiple offers to ensure you are getting the best deal available.

Obtaining no creditors loans with low interest rate is achievable even with no credit history. Start by researching lenders that specialize in providing loans to individuals without credit. You can also improve your chances by demonstrating a steady source of income or securing a co-signer. Consider using platforms like US Legal Forms to identify options that fit your financial needs and protect your interests.