Overtime Standards Act With Karnataka

Description

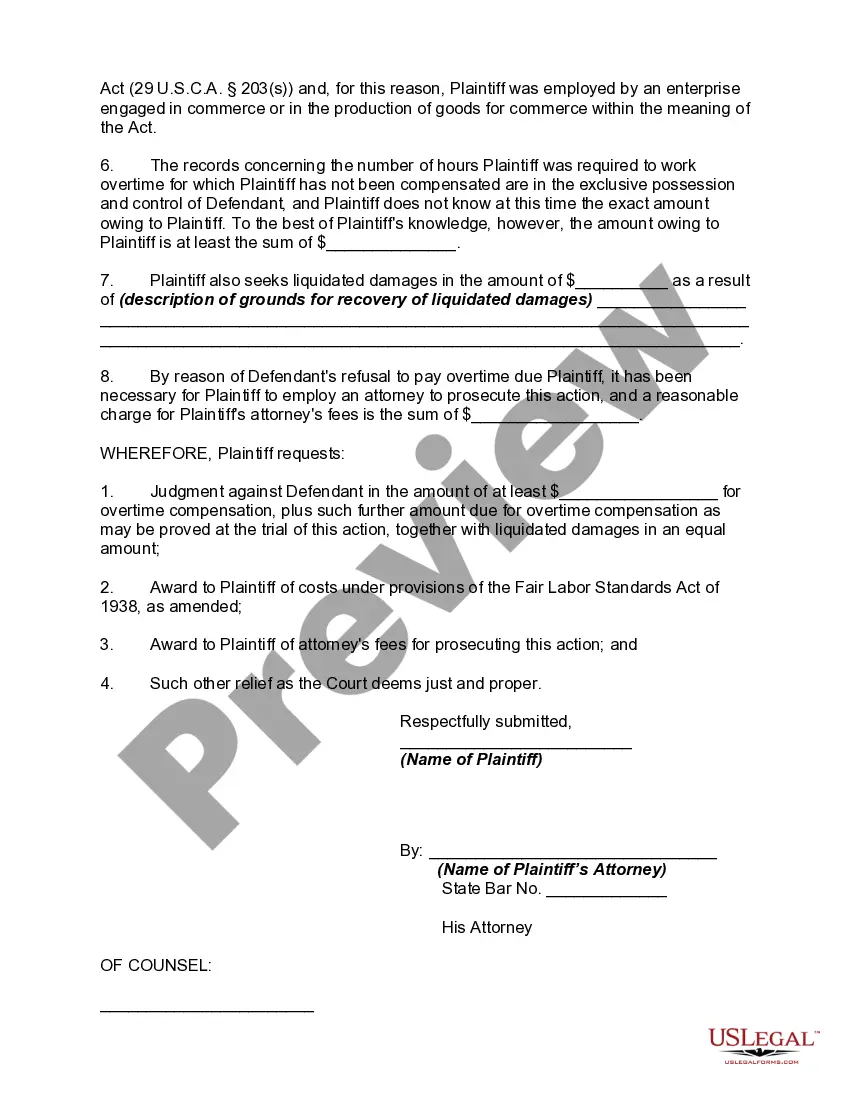

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Dealing with legal documents and processes can be a lengthy addition to your daily routine.

Overtime Standards Act With Karnataka and similar forms generally require you to look for them and figure out how to complete them accurately.

Thus, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online catalog of forms readily available will significantly help.

US Legal Forms is the premier online resource for legal templates, offering over 85,000 state-specific documents and a variety of tools to help you finish your paperwork swiftly.

Is it your first time using US Legal Forms? Sign up and create your account in a matter of minutes to access the form library and Overtime Standards Act With Karnataka. Then, follow the steps below to complete your form: Make sure you have the correct form by using the Review option and examining the form details. Choose Buy Now when ready, and select the monthly subscription that fits your needs. Click Download then finish, eSign, and print the form. US Legal Forms boasts 25 years of experience helping clients manage their legal documents. Acquire the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents accessible with just one click.

- US Legal Forms delivers state- and county-specific forms available anytime for download.

- Protect your document management processes by using a reliable service that lets you create any form within minutes without extra or concealed charges.

- Simply Log In to your account, find Overtime Standards Act With Karnataka, and download it right away from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

To calculate the overtime rate, start with your regular hourly wage. Multiply this amount by 1.5 to determine the rate for any hours exceeding the standard workweek. Make sure to follow the Overtime Standards Act with Karnataka for proper compensation related to overtime work.

Your rights are the same as if you were dealing with the original creditor. If you do not believe you should pay the debt, for example, if a debt is stature barred or prescribed, then you can dispute the debt. Find out more about disputing debts.

If you don't think you owe the debt Once you receive the validation information or notice from the debt collector during or after your initial communication with them, you have 30 days to dispute all or part of the debt, if you don't believe that you owe it.

Challenging the debt: You have a right to dispute the debt. If you challenge the debt within 30 days of first contact, the collector cannot ask for payment until the dispute is settled. After 30 days you can still challenge the debt, but the collector can seek payment while the dispute is being investigated.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

Statutes of Limitations in Kansas Code SectionKansas Statutes Annotated § 60-501 et seq.: Limitations of ActionsCollection of Debt on AccountWritten: five years (K.S.A. § 60-511(1)); oral: three years (K.S.A. § 60-512(1))JudgmentsFive years (K.S.A. § 60-2403)8 more rows

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

Kansas Legal Services gives free or low cost civil legal advice and representation for persons whose incomes make them eligible. You will find out if you are eligible for legal assistance by talking with an Intake Specialist, whether you apply online or call our intake line.

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.