Overtime Labor Standards Within The Us

Description

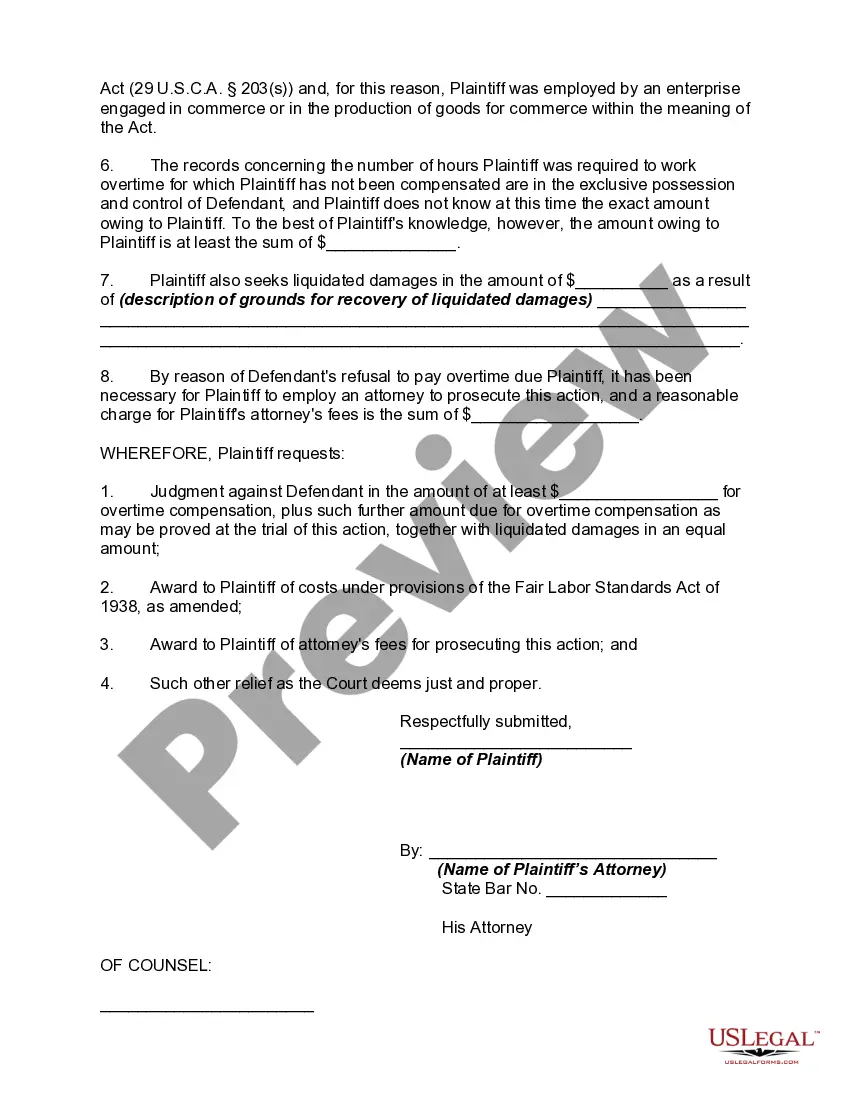

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Whether for corporate intentions or personal issues, everyone must manage legal matters at some stage in their existence.

Completing legal documents requires meticulous consideration, starting with choosing the correct form template.

With a vast US Legal Forms library available, you don't need to waste time searching for the suitable sample across the web. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- Acquire the sample you require through the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Overtime Labor Standards Within The Us sample you need.

- Download the template if it satisfies your specifications.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- In case you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the fitting pricing option.

- Complete the profile registration form.

- Select your payment method: you can utilize a bank card or PayPal account.

- Choose the file format you prefer and download the Overtime Labor Standards Within The Us.

- After saving it, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

What is the formula to calculate overtime pay? ing to the FLSA, the formula for calculating overtime pay is the nonexempt employee's regular rate of pay x 1.5 x overtime hours worked. This calculation may differ in states that have requirements, such as double time, which are more favorable to the employee.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek.

For example, if an employee is required to work extra hours during the week of Memorial Day, then any hours worked over 40 (counting the 8 hour holiday for Memorial Day) will be compensated either with compensatory time or overtime pay.

The overtime policy should include: Definition of ?standard working hours? and what qualifies as ?overtime? Classification of employees as exempt or non-exempt ing to overtime pay laws. Procedures for recording overtime and ensuring accurate compensation.